The African Development Bank (AfDB) says African countries can save as much as $1 billion on a 20-year-loan from the bank instead of the Eurobond market.

Speaking on Thursday at a panel session where the bank’s financial state was discussed, Hassatou Diop N’sele, the bank’s group treasurer, said the amount of infrastructure financing covered by the private sector could double if African countries harness the full potential of their capital markets.

The group treasurer said the bank’s operating revenue has been growing since 2010 and some of its income has been reinvested to strengthen reserves and business growth capacity.

Advertisement

On debt sustainability, Simon Mizrahi, director of service delivery, performance management and results, said Africa’s debt has increased in recent years but “not to unsustainable levels”.

Pleading for caution, he said: “We need to continue to generate financing and spur growth without increasing debt”.

On the African free trade agreement, Mizrahi said: “Africa will struggle to be competitive at the global scale if it continues to operate as 54 fragmented economies. The continent needs to be more integrated, it needs larger economic spaces so that Africa can attract more investors, create more and better jobs, boost internal trade and create continent-wide value chains that are globally competitive.”

Advertisement

In recent times, the Nigerian government have been issuing Eurobonds to fund the budget deficit. The last one issued in February 2018 was worth $2.5 billion.

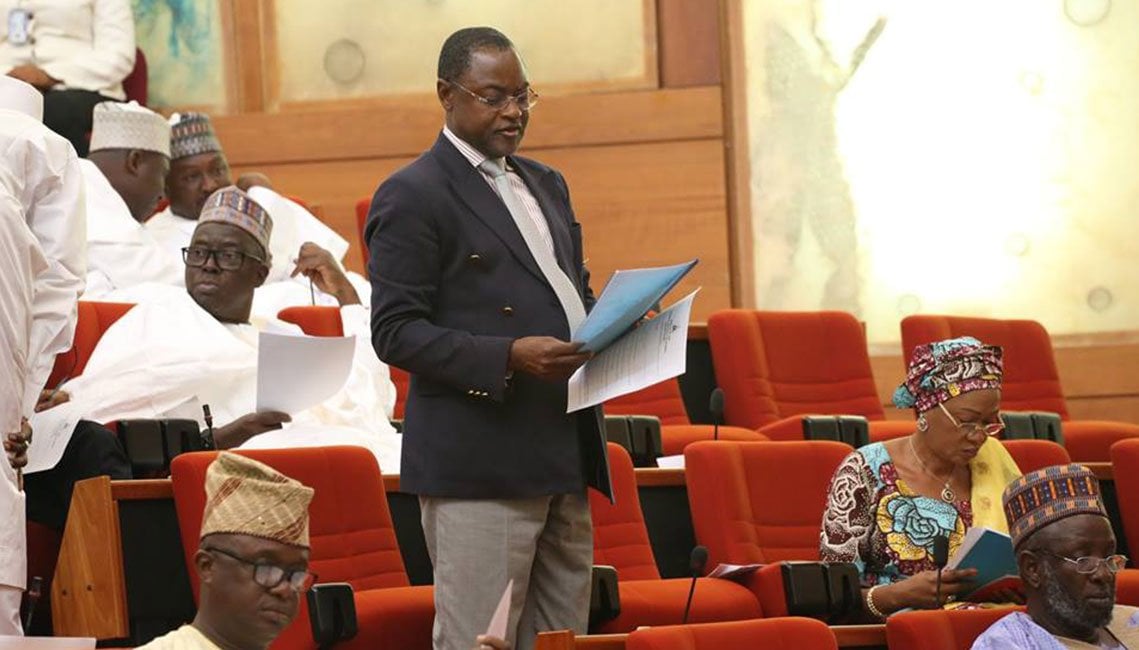

In October, the senate approved a request by the federal executive council to issue a $2.78 billion Eurobond.

Add a comment