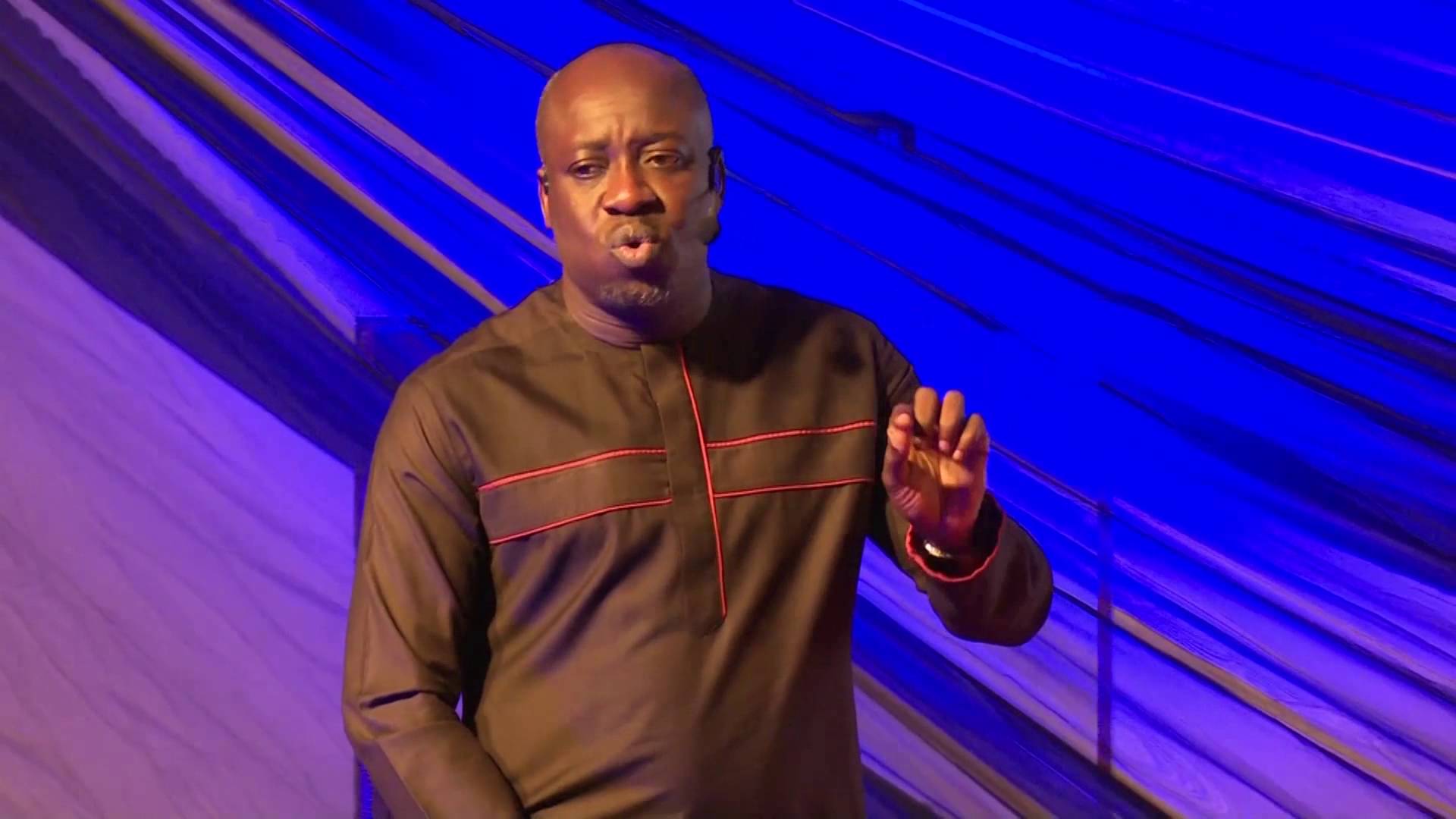

Ahead of the January 2018 deadline for Nigeria to make its financial intelligence unit autonomous, Ibrahim Magu, acting chairman of the Economic and Financial Crimes Commission (EFCC), has set up a committee to work out the process.

TheCable had reported the suspension of the Nigerian Financial Intelligence Unit (NFIU) — which is currently under the EFCC — following the country’s failure to make the unit autonomous in its operations, finance and management of intelligence.

The senate passed a resolution on Wednesday to make a law granting autonomy to the NFIU to avoid the expulsion of Nigeria from the group — a body of 154 financial intelligence units (FIUs) across the world which provides a platform for the secure exchange of expertise and financial intelligence to combat money laundering and terrorist financing.

In a statement issued on Wednesday by the EFCC, the members of the committee were named as Abdullahi Shehu, a former DG of the Inter-Governmental Action Against Money Laundering in West Africa (GIABA), who will serve as chairman, and Joke Liman, of the EFCC, who is secretary.

Advertisement

Members of the committee are: Chidi Chukwuka, from the Nigeria Deposit Insurance Corporation (NDIC); Bamanga Bello, head of EFCC’s special control unit against money laundering (SCUML); Jamila Yusuf, CBN; and Udofia Akpan Obot, a former deputy director of CBN.

Speaking at the inauguration, Magu charged the members to take a holistic look at the mandate and operations of the NFIU with a view to coming up with proposals to re-position the agency for greater efficiency, according to the statement.

He asked the committee to address the concern of the Egmont Group “by providing the necessary frameworks needed to coordinate the effective process of amendment of section 1(2)(c) of the EFCC Act to expressly reflect NFIU as an autonomous unit under EFCC so as to provide legal basis or clarity on its operational independence from the EFCC”.

Advertisement

The committee is expected to make recommendations with respect to the funding of the NFIU’s operations, develop a career path for the staff of the NFIU, develop protocol for the protection of information and confidentiality, “specifically as regards the status of STR information and information deriving from international exchange, and also develop procedure for the processing of information held by the NFIU either deriving from STR or from international exchange for legitimate purposes”.

Nigeria’s admittance into the group in 2007 is considered to be one of the biggest achievements of the President Olusegun Obasanjo administration.

The membership ensured the removal of Nigerian banks from the blacklist of international finance.

The blacklisting had prevented the banks from engaging in correspondent banking with foreign institutions and also denied Nigerians access to foreign credit cards.

Advertisement

Add a comment