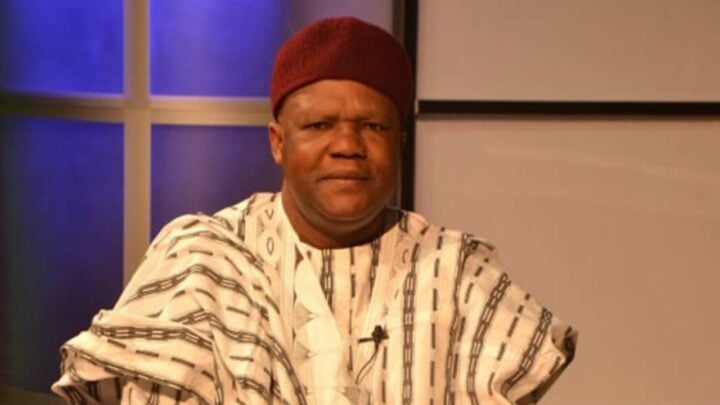

Obadiah Mailafia, a former deputy governor of the Central Bank of Nigeria (CBN), says the decision of the apex bank to stop sales of foreign exchange (FX) to Bureau De Change (BDCs) operators may worsen naira value.

At the end of the CBN monetary policy committee meeting in Abuja on Tuesday, Godwin Emefiele, governor of the apex bank, said BDC operators would no longer have access to FX.

Emefiele accused BDC operators of become a conduit for illegal financial flows working with corrupt people to conduct money laundering in Nigeria.

“They have turned themselves away from their objectives,” he had said.

Advertisement

“They are now agents that facilitate graft and corruption in the country.”

To address the gap which the decision would create, Emefiele said the CBN will henceforth channel weekly allocations of dollar sales to commercial banks to meet legitimate FX demands.

But in an interview with ThePunch on Wednesday, Mailafia said more caution is needed as the apex bank’s decision may worsen the Naira value.

Advertisement

The former CBN deputy governor warned against scarcity of foreign exchange as a result of bureaucratic processes in the commercial banks.

“If we are not careful, that decision will actually worsen the naira value because the BDCs, you could walk into any of them anywhere and within five minutes, they will attend to you but the banks, you have to drive to your nearest bank, you have to queue most of the time,” he said.

“The CBN has not told us the rate, the banks will want to make a profit over the official rate, we don’t know whether they will make a decent profit or they will profiteer.

“Bankers were the biggest experts in round-tripping. Old habits, I don’t think they change. Leopards are very unlikely to change their spots.

Advertisement

“So, we may end up in a scenario where there is scarcity and the simple economics of demand and supply tells you that where there is increase scarcity, price is likely to shoot up.

“If bank bureaucracy makes it difficult for people to access dollar, what it means is that the bureaucracies, obstacles and bottlenecks are likely to put pressure on supply and pressure on supply may mean an increase in demand for the dollar and greater fall of the naira, if we don’t play the cards well.”

Mailafia added that commercial banks in Nigeria cannot be trusted with the sales of forex.

He said the banks will prioritise their interests and only make available to the public whatever is left.

Advertisement

“How can you totally trust these commercial banks because most of them will want to corner the dollar for themselves and whatever is left, then they can now share with the market at a rate they want?” he queried.

“On the naira, it is not just the underlying economic fundamentals that matters like interest rate, inflation and so on, these things matter and the level of debt affect it but there are the non-quantifiable elements like violence, instability, rural banditry and terrorism, those things undermine the productive capacity of the economy.

Advertisement

“They also destroy social capital, the trust that holds the community together to do businesses together.”

Advertisement

Add a comment