Sincerely, I doubt if the average Nigerian is not getting more confused with the public debate about whether to devalue the Naira or not, which has been ongoing in the polity for quite some time now. If you ask me, I even think that rather than being enlightened with the flurry of expert opinions by economists and non-economists alike, Nigerians are only getting further perplexed by the day. This I find troubling and extremely worrisome.

Yet, the naira has been on steady decline since January 12 when the Central Bank of Nigeria (CBN) stopped weekly dollar sale to Bureaux de change operators. It went on an all-time low Tuesday, exchanging for N345 to a dollar at the parallel market. The clear pointer is that our national currency will continue to fall if things remain as they are. This is a scary situation for our economy with all its attendant troubles. In all of the confusion, however, can we try and sieve out what is really in the best interest of our country?

To be clear, the devaluation debate is one that many notable columnists have written on. Mine is another humble intervention. But this debate is not one that is about to end anytime soon. There are those who say no to devaluation. And there are those who say devaluation of the Naira is the way to go. And there are those who suggest the CBN can find a mid-point between devaluing the naira and not devaluing it.

Now, I am no economist; but as a journalist, I will attempt, in my own way, to try and dissect the issue for better public understanding especially with the colloquium organised by TheCable last Thursday in Lagos themed “Naira on Trial: To Devalue or Not?,” a topic, I believe, couldn’t have been more apt for a time like this.

Advertisement

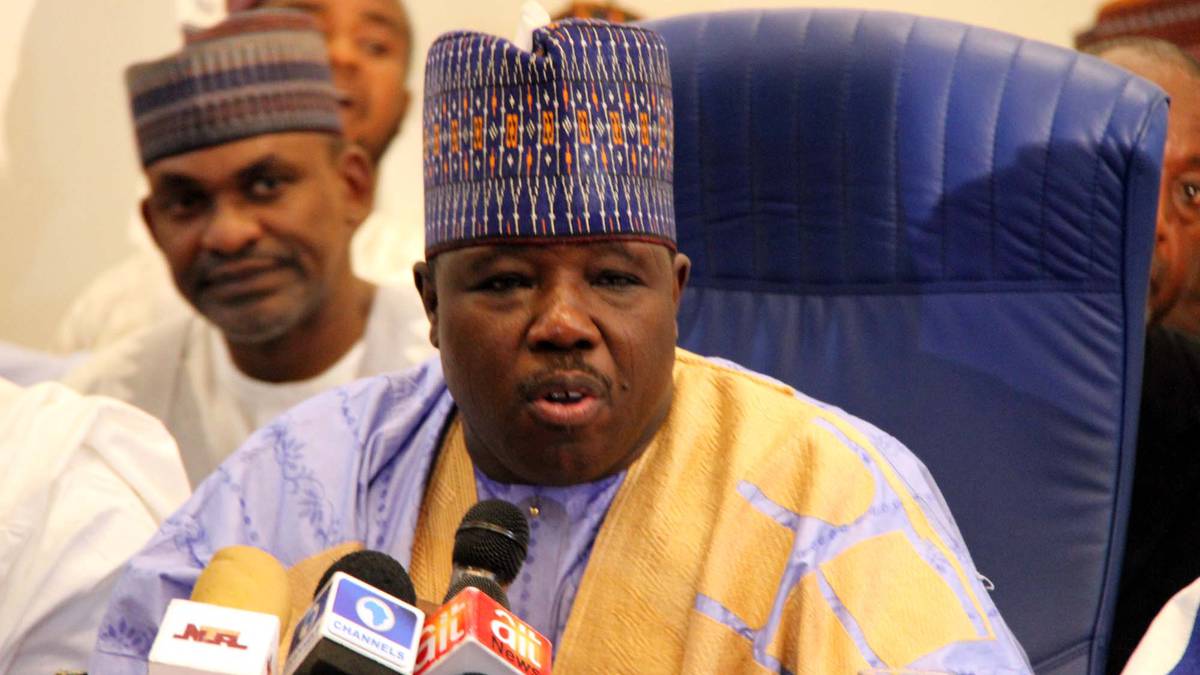

The well-attended policy dialogue on the exchange rate which had Adams Oshiomhole, Edo state Governor as Keynote speaker, with discussants like notable economist, Bismarck Rewane, Issa Aremu of the Nigeria Labour Congress, Moses Tule, Director of CBN’s Monetary Policy Department, and Dr. Vincent Nwani, Director, Research and Advocacy at the Lagos Chamber of Commerce and Industry (LCCI), was moderated by Frank Aigbogun, Publisher of BusinessDay, a veteran in such assignment.

While all the discussants tried to highlight the pros and cons of devaluation, there was a common thread uniting them. And it is that devaluation wouldn’t offer a permanent solution to the country’s economic challenges.

Oshiomhole, in his keynote address for instance, made an historical analysis of Nigeria’s exchange rate regimes over the decades and concluded that devaluation had never benefitted the nation’s economy. The comrade governor, who can be very passionate about issues close to his heart, gave the organisers a tough job keeping to his allotted speaking time. But as a former labour leader and unionist, Oshiomhole was only being himself.

Advertisement

Rewane, on his part, pointed out that the issue of whether or not the currency should be devalued should not bother Nigerians since this is primarily determined by economic factors. Rather, he said what should concern us and which should be the focus of the fiscal and monetary authorities is having a national foreign exchange policy as a strategic option of achieving naira exchange stability.

He further disclosed that devaluation is not as non-political as it is being made to seem, because the major challenge of the Nigerian foreign exchange market is that it has been consistently abused for years with many dubious folks getting forex for the purposes of round-tripping without adding any definite value to the country’s economy.

For Tule, the Director of CBN’s monetary policy department, while devaluation is sound economics, however, this would only work if the fundamentals are right. He further told the audience at the colloquium that devaluation may come someday but must be based on the right economic foundation.

Labour activist, Aremu, who spoke on behalf of the NLC, posits that devaluation has nothing good to offer the Nigerian worker as it would only further erode the value of salaries and wages. According to Aremu, the NLC might even soon submit a proposal to the federal government demanding for a new minimum wage of N48, 000 based on the impact of the devaluation of the naira on wages. It remains to be seen how the Buhari government will be able to fund such demand.

Advertisement

While Nwani noted that the Lagos Chamber of Commerce and Industry (LCCI) doesn’t subscribe to some of the items included in the list of 41 items banned by the apex bank from its official forex market, and that the forex restrictions also currently threaten about 80,000 jobs in the manufacturing sector, he believes a strong manufacturing policy addressing manufacturing key fundamentals, without recurrent uncertainties, will help the Nigerian economy and make it export dependent.

For Aigbogun, who, like I mentioned earlier, moderated the session, his concern was how to grow forex inflow to Nigeria, with or without oil. And this, for me, is the crux of the matter.

If we will tell ourselves the truth, ensuring an increased inflow of forex into Nigeria, with or without oil, should be of paramount importance for us all if we desire a better country for ourselves, if we want to demonstrate that we are true patriots, and if we aim to sustainably solve this problem for the long haul.

True, devaluation of the naira would help in reducing the pressure on forex aside boosting the inflow of capital into the country. But it would also bring with it inflation, higher cost of living apart from the fact that the purchasing power of the naira would be further eroded and weakened. Non-devaluation, or demand management being pushed by the CBN, on the other hand, will also protect certain goods and services priced at the official rates, but CBN certainly cannot cope with the current demand for forex. Even unpatriotic bankers who are involved in multi-million dollar racketeering due to forex scarcity, will also continue to take advantage of this loophole to milk the system. These bankers, especially at the branch levels, will want to continue cashing in on the situation to make illicit profits since intending importers in the country, several thousands of them who have made applications for forex, have been kept on hold by the CBN for several months now. Of course, most of the importers, desperate to sort out their businesses, usually play ball, even if grudgingly.

Advertisement

In all of these however, it is clear that the situation must not be allowed to continue. The eggheads at the CBN, as a matter of urgency, must find a way to close the huge gap that is widening between the naira-dollar exchange rate on the parallel market and the official forex market. If this is not closed, it would only encourage round-tripping and all shades of sharp practices. Frankly, for how long can the official rate of N199 to $1 be sustained?

Meanwhile, it is instructive to note that while TheCable colloquium was happening in Lagos, in Abuja, the CBN’s director of banking supervision, Tokunbo Martins, was crying out over what the bank considers an abnormal demand for foreign exchange “invisibles” like the ones for school fees and health tourism.

Advertisement

Interestingly, some notable commentators have reacted to this, arguing that it is stupid to expect that parents who are sending their children to schools abroad should be ready to pay the full dollar rate as they insist no sensible country plays politics with sound education and good health.

However, rather than continue to justify the vote-of-no-confidence on Nigeria’s educational system which is part of the reasons for why some parents send their wards to schools even to countries like Ghana and Republic of Benin like they are trying to do, is it not better to rather invest in our own educational institutions and make them world-class such that even foreign students would be attracted to want to come study in Nigeria?

Advertisement

While I also quite agree that no amount spent on education is ever wasted as a well-educated citizenry is an asset to the country even as those who school abroad especially in the greatest academic institutions in the world, often return home with bright ideas needed to add value to society and grow the economy, however, will exchange programmes and partnerships between Nigerian universities and their counterparts in the UK or USA not bring further exposure to our students if encouraged and pursued? In the same manner, is it not better to advocate and work towards having world-class hospitals here in Nigeria rather than continuing to encourage medical tourism without seeing how foolish and myopic such action is? And should we allow that category of demand to crowd out the real sector of the economy in the forex market? But again, such arguments might even be excused since successive governments in the country have left undone what they were supposed to have done over the years in providing the needed infrastructure in critical sectors of our country’s economy.

Anyways, there is no doubt that we need to curb our appetite for foreign goods and things. It is a major part of the problems bedevilling our economy especially the manufacturing sector. And that is why I wholeheartedly support and commend the Buy-Made-in-Nigeria initiative being promoted by Senator Ben Murray Bruce.

Advertisement

Like I earlier mentioned, the debate on whether to devalue or not to devalue the naira is one that isn’t going to end anytime soon. There are no easy ways out, certainly. Whichever way this mess is eventually resolved; we will surely need the Wisdom of Solomon in getting out of it. But I think our current challenge is a blessing in disguise for Nigeria. I strongly believe it should force us to look inwards and challenge ourselves to work for real economic growth. The Buhari administration must take concrete actions at diversifying Nigeria’s economy especially through agriculture, manufacturing, tourism, and entertainment. Fact is there can’t be a better time, and as a people, we must agree this is the right way for Nigeria to go.

However, in wrapping up, I believe the team at TheCable led by its Founder/CEO, Simon Kolawole, an outstanding columnist and one of our country’s most distinguished media leaders who has demonstrated uncommon passion for Nigeria’s development over the years, deserves kudos for being able to put together such a wonderful and well-attended policy dialogue on the exchange rate at a time like this. There is no doubt that this independent online newspaper is already setting itself apart as a credible and more serious platform among Nigeria’s online newspapers barely two years after it launched out in April 2014. In the days and years ahead, Nigerians and its readers around the world would certainly be holding TheCable to its lofty mission of delivering knowledge-driven journalism in the pursuit of Nigeria’s progress even as it runs with its vision of being the most respected online newspaper out of Africa!

O’Femi Kolawole, an award-winning journalist and author, is Publisher/CEO, POSTERITY MEDIA, a publishing and communication company based in Lagos. You can follow him on twitter: @ofemigan.

Views expressed by contributors are strictly personal and not of TheCable.