Abubakar Malami, attorney-general of the federation, says no state has the power to lay claim to the collection of value-added tax (VAT) in the country.

Malami said this on Friday, during an interview with Channels Television.

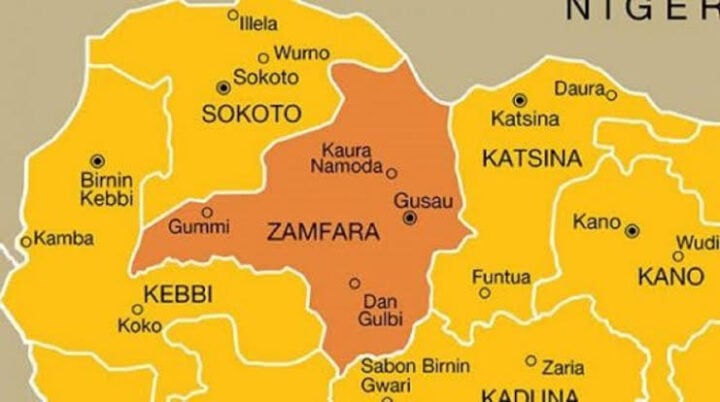

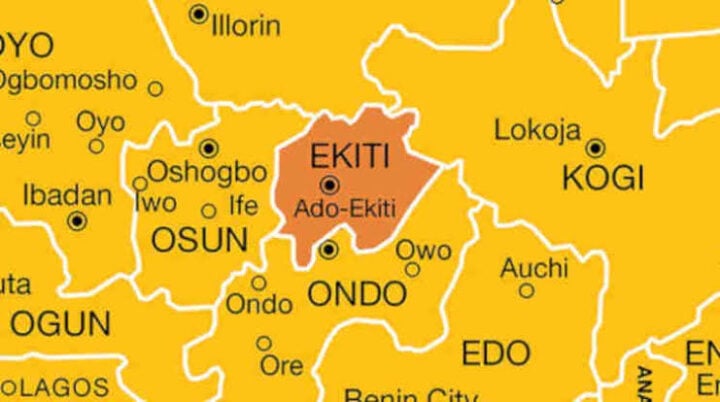

In recent weeks, the Federal Inland Revenue Service (FIRS) has been in a legal tussle over with Rivers and Lagos state governments over VAT collection.

However, some states have rallied in support of the FIRS.

Advertisement

Amid the controversy, a court of appeal in Abuja ordered both Rivers and Lagos states to maintain the status quo over the collection of VAT.

Speaking on the development, Malami said the collection of VAT in the country is under the exclusive legislative list, adding that only the national assembly has the power to make laws on VAT.

“A lot has precluded the state from collecting value-added tax. One, generally speaking, as you rightly know, the issue of the value-added tax is an issue on the exclusive legislative list,” Malami said.

Advertisement

“And the implication of being in exclusive legislative list matter is that only the national assembly can legislate on it. The question that you may perhaps wish to address your mind on is whether there exists any national legislation that has conferred the power on the state to collect VAT. And my answer is ‘no’.

“In the absence of a law passed by the national assembly in that direction, no state can have a valid claim to collection of value-added tax.

“The responsibility, right and constitutional powers to legislate on collection of VAT is exclusively and constitutionally vested in the national assembly and not in the state.

“Where the national assembly has not passed any law in that regard authorising the state to collect VAT, then it goes without saying that no state can arrogate unto itself the powers to collect VAT.”

Advertisement

Malami added that it would amount to “recklessness” for any state to go ahead to collect VAT, despite the court’s decision asking parties to maintain the status quo.

“I don’t see any state perhaps taking the law unto its hands without allowing the judicial process to take its natural course and in breach of the prevailing legislation,” he said.

“I don’t see the states acting arbitrarily and setting a very bad precedence as far as governance is concerned with particular regard to the fact that the matter is receiving judicial determination.

“I can’t understand. I can’t perhaps bring that thought into consideration that I believe it could amount to a high level of recklessness on the part of any state government to be operating in breach and to be operating a lawless governance style as far as the Nigerian state is concerned.”

Advertisement

1 comments

Let wait for the outcome of supreme Court