A bank chairman backing a windfall tax that may affect his own bank?

Welcome to the world of Femi Otedola, the “strong man” of Nigeria’s money and capital markets who is causing ripples in the sector.

Speaking on the new windfall tax on Wednesday, Otedola, chairman of FBN Holdings Plc, owners of First Bank Plc, said it was long overdue — even criticising the banks for “the culture of flamboyance, especially the ownership and operation of private jets”.

This is something Nigerians have known and discussed in a muted tone for years, but now an insider is spilling the beans.

Advertisement

He went on to give editors a very good piece of headline.

“Nigerian banks are spending an estimated $50 million annually just on maintaining private jets, with over $500 million gone into purchasing nine private jets by four banks,” he said.

The #OccupyWallStreet protests of 2011 in the United States easily come to mind.

Advertisement

For 59 days, activists gathered at the Zuccotti Park, in New York City’s Wall Street financial district, to protest corporate greed, among other things.

The global corporate big boys did not enjoy the protest as governments in many Western countries began to crack down on their humongous benefits and bonuses.

Is Otedola about to start a corporate revolution in Nigeria?

“A concerning trend has emerged where some bank chief executives prioritize personal gain over their duty to shareholders and customers. The core values of banking—trust, integrity, and service—must be upheld,” he said in the widely shared statement.

Advertisement

FROM DIESEL TO DEBT

In 2009, he became the second Nigerian to be named in Forbes billionaires list. With rising wealth, he was on the list again in 2014 and, most recently, in January 2024. This was after surviving the toughest period of his life — going into debt after a turbulence in the international crude oil market sent his diesel business tumbling down in 2009.

To entities like Forbes, Otedola may just be another billionaire indexed among 19 others in Africa in 2024, but the mogul is part of the few elites who have conquered Nigeria’s back-breaking business climate and risen as a symbol of inspiration, grit, and the burning desires of many.

Born into the family of late Michael Otedola, a former Lagos governor, in Ibadan, the entrepreneur sits atop many businesses across diverse sectors including shipping, real estate, and finance.

But the root of his wealth can be traced to his interest in the core of Nigeria’s economy, oil. After his short teaching career in England, Otedola’s father ventured into journalism and rose to leadership positions in London’s newsrooms.

Advertisement

Two years after returning to Nigeria in 1959, he moved into public relations, working for Mobil Oil Group of Companies between 1964 and 1977, and continued as a consultant after leaving the company. Today, Nigeria’s oil and gas industry development cannot be documented without the contributions of his son, Femi.

Otedola’s name garnered steam in Nigeria when he entered the energy sector with Zenon Petroleum and Gas Limited, a procurement, storage, marketing, and petroleum products distribution company. The firm’s initial assets were diesel trucks “bought from the sale” of his first house.

Advertisement

From acquiring depots to cargo vessels, Zenon took hold of the largest chunk of the Nigerian diesel market, becoming the major supplier of most conglomerates in the country. Zenon also became a critical stakeholder in the kerosene segment.

THE FBN HOLDINGS TAKE-OVER

Advertisement

His accomplishments in the energy sector do not entirely define the enigma that Otedola is. Recent developments in the Nigerian bourse have shown him to be a grandmaster in the money and capital markets. While the billionaire may have stepped into the precinct of finance, investment, and trading with the establishment of Centreforce Limited in 1994, Zenon was a battle axe through which he became a major shareholder in Zenith Bank and the United Bank for Africa (UBA).

But Otedola wanted more and Nigeria’s oldest financial institution — First Bank of Nigeria (FBN) — became the target. The battle for control in the company began when the bank ran into a problem of who would become the managing director. In April 2021, the bank’s board, led by Ibukun Awosika, sacked Adesola Adeduntan as its managing director.

Advertisement

Angered by the move, Nigeria’s central bank, under Godwin Emefiele, the embattled ex-governor, dissolved the board of directors, and reinstated Adeduntan.

While the reinstated MD was getting comfortable in office, Otedola, six months later, acquired a 5.07 percent stake in the company, making him the largest shareholder. Prior to this, no one held up to 5 percent of shares in FBN Holdings Plc.

The acquisition stoked fresh conflicts about who has the largest shares in the holding company. A letter that went viral during the period attributed a 5.36 percent holding to Tunde Hassan-Odukale, ex-CEO of Leadway Assurance. This was after FBN Holdings said it was not aware of Otedola’s shares in a corporate filing — but later backtracked, acknowledging the buy.

Two months later, the investor bought additional 2.5 percent in FBN Holdings Plc, cementing his position as the single largest shareholder in the company. At this point, it was clear to market watchers what the goal was, but Otedola, on December 10, 2021, said he was not interested in any position in the bank or the holding company. “I am simply an investor,” he had said.

In 2023, the billionaire was displaced by another fierce investor, Oba Otudeko, chairman of Honeywell Group. Otudeko became the largest shareholder in FBN Holdings when he purchased 4.7 billion shares.

That same year, the organisation named Otedola as a non-executive director, and subsequently appointed him as the new chairman of its board of directors in January 2024.

Otedola was displaced again in February when the financial institution named Barbican Capital Limited, Otudeko’s firm, as its majority shareholder. But showing his dislike for the second spot, Otedola made a comeback in June — splashing a total of N18.9 billion on shares to up his stakes to 9.41 percent.

He aggressively delivered the final blow, raising his stake twice in June this year, to tighten his grip on FBN Holdings. Otedola’s total shares (direct and indirect) in FBN Holdings as at June 24 stood at 4,187,602,704.

Within six months of being appointed chairman of the company’s board of directors, he acquired more shares than Barbican Capital Limited, to be the largest shareholder in the company.

STRONG MAN OF FINANCIAL MARKETS

Some capital markets analysts often describe Otedola as Nigeria’s Elon Musk because of the impact his investment moves often have on the local bourse. When the philanthropist entered the defunct Africa Petroleum in 2007 and became chairman, its share price rose sharply, increasing the market capitalisation from N36 billion to N217 billion in six months.

Nigeria’s stock exchange has witnessed a similar trend recently.

FBN Holdings had appointed Otedola as a non-executive director in August 2023. By December of that year, the company’s market capitalisation crossed the N1 trillion mark buoyed by a 9.9 percent appreciation in share value. With a N1.05 trillion market cap, FBN Holdings joined the trillion-naira stock list on the Nigerian Exchange Limited (NGX).

The company became the most capitalised bank in the Nigerian bourse with a valuation of N1.22 trillion as at February 26, after FBN Holdings’ share gained a leap. This happened in less than a month Otedola was announced as the firm’s board chairman.

Otedola’s acquisition of shares in Dangote Cement made the manufacturer the most capitalised firm on the NGX and the first Nigerian organisation to cross the N10 trillion market cap. Within the same period, Aliko Dangote, its majority shareholder, returned to the list of the world’s top 100 billionaires.

GEREGU EMPOWERED

Like Zenon, Geregu was the billionaire’s entry route into the power sector. Geregu Power Plc was incorporated in November 2006 as one of the unbundled companies from the defunct Power Holding Company of Nigeria (PHCN).

Otedola financed the acquisition of the 414MW Power Plant by Amperion Power Distribution Company Limited, a subsidiary of Forte Oil, in 2013. The company invested $94 million in the power plant at the time.

In 2019, Otedola sold Forte Oil Plc and announced plans to focus on power with Geregu and pledged to invest $1 billion. The billionaire had pumped $350 million into the plant in 2018.

Since then, the company has recorded notable milestones under his leadership. For instance, Geregu Power Plc became the first electricity generation company (GenCo) to be listed on the NGX main board in 2022.

The businessman has also steered the company on a path of profitability as seen here and here. The organisation’s 2024 half-year profit before tax was N30.15 billion — rising from the N12.29 billion posted in the corresponding period in 2023.

The firm entered the trillionaire club list on NGX after its market capitalisation jumped to N1.07 trillion in January and was also named among the companies with high corporate governance practices by NGX Regulation Limited (NGX RegCo).

The growth of the company has also drawn the interest of organisations like Afreximbank which acquired a 5 percent stake in Geregu last year through the Fund for Export Development in Africa (FEDA), its impact development unit.

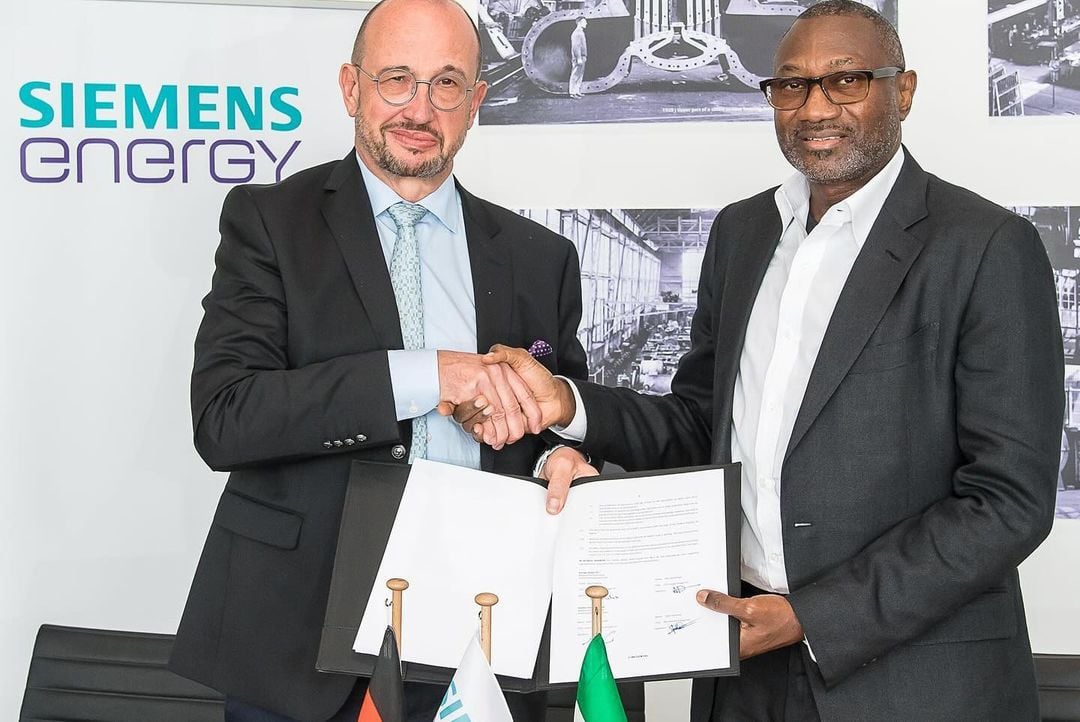

The GenCo recently signed a deal with Siemens Energy AG to raise power generation in Nigeria to 1,200MW.

EYES ON REFINING?

When Otedola sold his stake in Forte Oil to Prudente Energy, he said the reason was because he wanted to “explore and maximise business opportunities in refining and petrochemicals”.

It is uncertain if he still intends to do so as he has remained silent on it since then and also given his public declaration to focus on power.

A good guess would be that he would not go into the same business with Dangote, his best friend, who he has fully supported in his face-off with key petroleum sector figures over the lack of crude oil for the refinery.

Whatever he decides in the future, he is, for now, stamping his authority majestically on the financial markets.

Add a comment