Stock markets gradually relinquished previous gains during trading last week following the noticeable exhaustion in rising oil prices and lingering concerns over the state of the global economy that continued to weigh heavily on sentiment.

European markets were left depressed as trader’s discounted comments from Mario Draghi over further ECB stimulus measures, and this fearful contagion found its way into America in Friday’s session. Although Asian markets were offered a welcome boost from the heightened expectations that the BoJ may unleash further stimulus measures ahead of the pending BoJ meeting, the anxieties of oil prices declining further, coupled with diminishing confidence towards the economy could strengthen the Yen, consequently punishing the Asian markets.

Global stocks may be rattled this week as major central banks meet to determine the next major move in obtaining domestic stability, while quelling the concerns over the global economy. While it is expected that the Fed may remain on the bench in April, attention could be directed towards the Bank of Japan which has a talent of always surprising the financial markets with its aggressive unorthodox monetary measures. Investors should remember that depressed oil prices, concerns over the state of the global economy and central bank caution have attributed to the declines in the stock markets. With these factors unchanged and even in some cases intensifying, further declines may be pending with any rise in prices seen as a relief rally.

Yen bears reinvigorated

Advertisement

The Bank of Japan rattled the financial markets during trading on Friday with the Yen depreciating sharply following speculations that the central bank may implement negative rates on loans in a bid to bolster borrowing. Although the idea of being paid to borrow money is quite pleasant, this dangerous move signals diminishing returns of monetary policy with desperation kicking in as ammunition runs dangerously low. Japan has found itself in a painful situation as fears of a technical recession continue to heighten while the nation attempts to fan away deflationary pressures from an ever appreciating Yen. While expectations have been mounting that the central bank may induce further monetary policy measures in the coming meeting, this short term fix may only provide a foundation for the Yen bulls to dominate once more.

Sterling bulls emerge

The Sterling surged with ferocity last week as a sharply declining Brexit campaign coupled with comments from Obama against a UK exit bolstered optimism that voters could be swayed against voting for an exit from the EU. While the appreciation of the Sterling across the board was logical, this move felt quite inflated and bears could return when normality kicks in. Uncertainty over a Brexit remains rife and this continues to haunt investor attraction towards the pound while the repeatedly soft domestic economic data from the UK has provided very little incentive for the Bank of England to raise UK rates anytime soon. Sentiment remains somewhat bearish towards the Sterling and although the GBPUSD does need to technically close above 1.4500 at some point for buyers to be enticed towards pricing further gains, bears could exploit this wall of resistance for a slide back towards 1.4200.

Advertisement

Crude declines on output fears

The WTI Crude sage continues with prices meandering around $43.50 as news disperses of a possible Saudi oilfield expansion which could bolster supply, ultimately spelling more problems for a market already excessively oversupplied. It seems that the short term welcome boost the Kuwait strike offered to oil prices has concluded and with concerns over OPEC inability to cooperate in curtailing production, prices could be poised for further declines towards $40. From a technical standpoint, while the gains last week were impressive, the commodity failed to close above what is seen as a critical technical level at $44 and could be set for some profit-taking from here.

For more information please visit: ForexTime

Advertisement

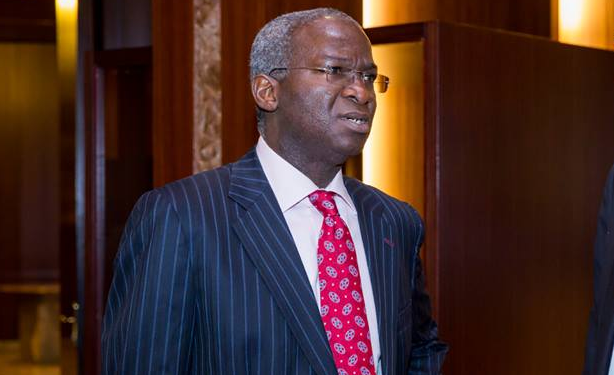

Otunuga is research analyst at FXTM

Add a comment