Financial markets displayed high levels of sensitivity during trading this week as a combination of Brexit anxieties and mounting uncertainty weighed heavily on investor sentiment. With the EU referendum polling commencing on Thursday, market volatility may be set to amplify to untold levels as speculation heightens over the United Kingdom’s future in the European Union.

Although stock markets were offered a lifeline this week amid the “Bremain” optimism, most major stocks could be poised to decline lower if risk aversion and a potential “Brexit” encourages investors to scatter away from riskier assets. In Asia, equities received an uplift from both “Bremain” hopes and Yen weakness, but most Asian stocks could be set for a slippery decline with the Nikkei edging lower when risk aversion empowers the Yen. While there may be a possibility that the domino from Asia encourages European and American markets to trade slightly higher, gains should be capped as uncertainty and caution keep investors on edge.

The Final Countdown – Bremain or Brexit

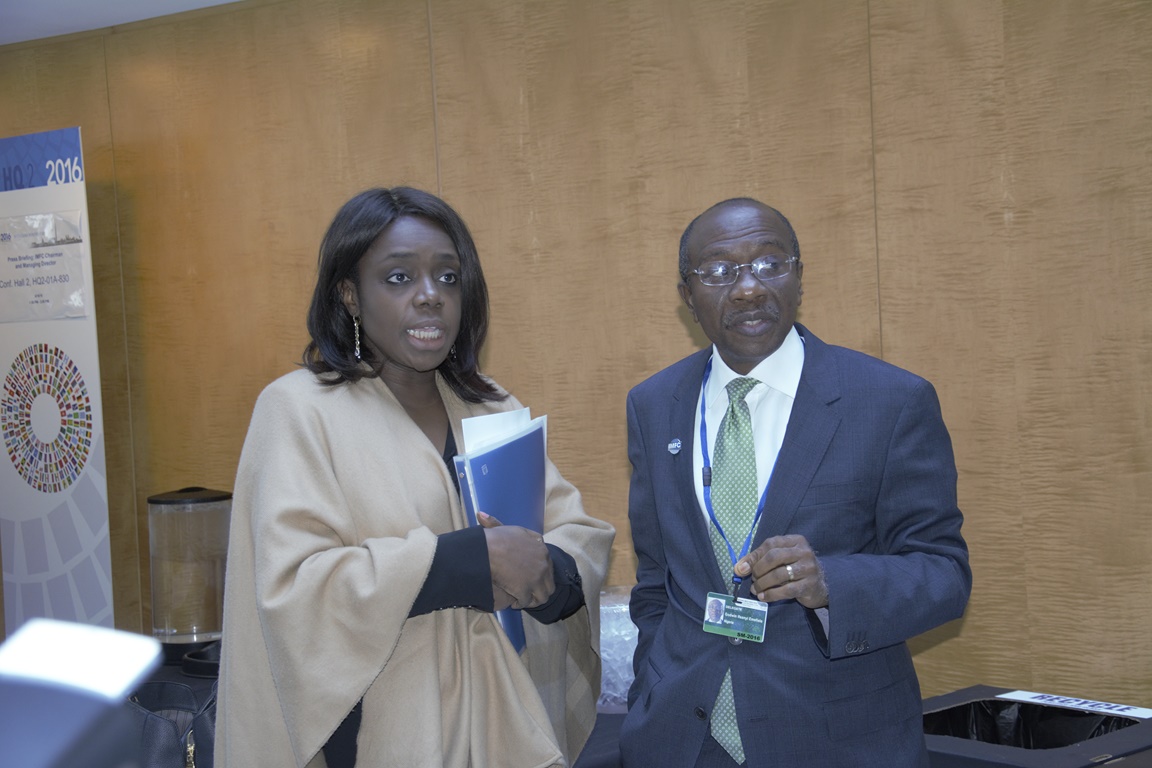

The final countdown determining the United Kingdom’s future in the European Union commences and Sterling volatility has already hit shocking levels with the GBPUSD spiking to fresh 2016 highs at 1.4840. With the polls engaged in a fierce tug of war, uncertainty may mount in the next 24 hours which could generate even more explosive levels of volatility for the Sterling. The bookmakers are notorious for their accurate predictions and with most highly favoring the “Bremain” camp; expectations have risen of a potential “Bremain” victory. Although it remains uncertain which camp will claim victory, a “Brexit” could have a deeper impact on the global markets with the Sterling and Euro left vulnerable to major losses. It should be understood that the United Kingdom leaving the European Union may have a knock on effect that encourages other countries to leave consequently reducing confidence in the Euro project.

Advertisement

The GBPUSD sprung to fresh 2016 highs during trading on Thursday as a combination of “Bremain” optimism and Dollar weakness offered a foundation for bulls to attack. Although this pair remains technically bullish on the daily timeframe, prices may be open to very wild swings as the day progresses. A “Bremain” victory could propel the GBPUSD towards 1.500 while a “Brexit” should trigger a violent selloff back towards the lows of 2016 around the 1.3850 regions.

Dollar under pressure

Dollar bears were installed with inspiration during trading on Wednesday following Janet Yellen’s cautionary stance on future US rate hikes which dimmed expectations over the Federal Reserve taking action in July. Yellen wasted no time in voicing her concerns over the impacts of a Brexit to the US economy while suggesting that the prerequisites for another US rate hike were for an increase in hiring numbers. Although it was suggested that US rates could be increased if there was an improvement in hiring, the potential Brexit could force the Federal Reserve to remain on standby potentially leaving the Dollar open to more losses.

Advertisement

The Dollar Index remains bearish and could decline lower as US rate hike expectations diminish. From a technical standpoint, prices are trading below the daily 20 SMA while the MACD has crossed to the downside. Previous support at 94.00 should act as a dynamic resistance that could encourage sellers to send the Dollar Index towards 93.00.

Commodity spotlight – Gold

Gold prices slightly stumbled during trading on Wednesday as the “Bremain” hopes bolstered risk appetite which consequently punished safe-have assets. While bears may be commended on their ability to sending Gold prices lower, the mounting uncertainty and anxiety ahead of the E.U referendum results should breed a wave of risk aversion that may renew Gold’s allure. With concerns over the state of the Global economy already providing a firm foundation for bulls to attack, a potential Brexit may be the catalyst that sends Gold prices towards $1300 and potentially higher. From a technical standpoint, prices are trading above the daily 20 SMA while the MACD trades to the upside. Gold may be in the process of creating a new higher lower around the 50% Fibonacci retracement regions of $1250 before rising back higher.

For more information please visit: ForexTime

Advertisement

Add a comment