Markets are calmer today after a steep selloff on Monday driven by concerns that Friday’s decision to cancel voting on Obamacare bill might lead to difficulties to push through other US pro-growth plans. Asian equities are back to green territory, oil prices recovered slightly, fixed income markets are steady, and similarly currency markets are moving in narrow trading ranges.

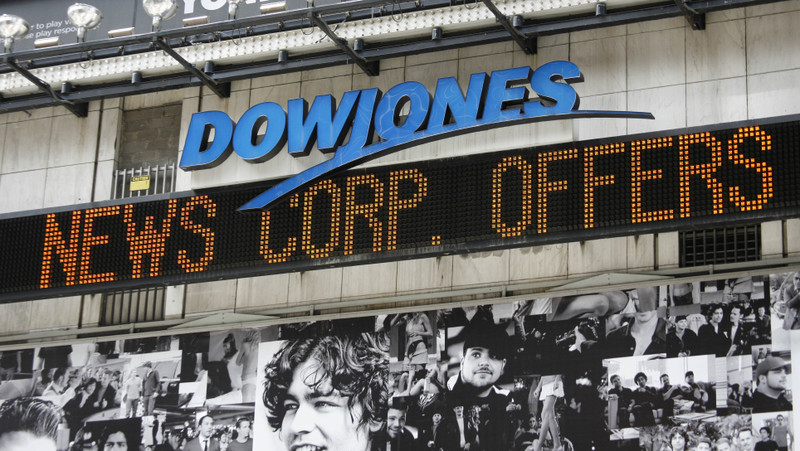

At this stage, U.S. markets will remain the key driver for global investors. The Dow Jones industrial average dropped for eight consecutive days heading into Monday; the longest losing streak since 2011, but nothing dramatic here given that the total declines are less than 2%. This selloff is obviously not a good sign, but it shows that investors are not yet in a stage of fear, but are somewhat on the defensive side.

Tax reforms, infrastructure spending, and deregulation. this is what’s next on Trump’s administration agenda. The success of execution on any of these legislations is probably lower now than it was just last week, but investors are still giving President Trump the benefit of the doubt. However, if they see that these plans will face the same destiny as the Health Care Act, markets will soon turn to aggressive selling as the expected companies’ earnings growth and pace of economic recovery are not enough to support currently overstretched valuations.

The fixed income markets are not showing signs of enthusiasm either. US Treasury bonds yield curve is flattening again with U.S. 10-year yields down more than 9% from March highs, and 30-year yields fell below 3%. This explains why the dollar lost much of its value, but more importantly, it indicates that fixed income investors do not see real signs of acceleration in inflation and economic growth.

Advertisement

Investors will turn their attention to Europe this week as U.K.’s Prime Minister Theresa May will officially trigger article 50 on Wednesday and start the two-year journey into the unknown. Meanwhile, Scottish Parliament is set to vote today on whether to hold another independence referendum.

Interestingly, the pound was the best major performing currency yesterday rising 0.7% against the dollar. While the sterling strength was more of a USD weakness story, I believe any approach towards 1.27 will be a selling opportunity. The BoE seemed somehow hawkish when Kristin Forbes voted to raise rates on March 16, but I don’t think this will be enough to overcome the challenges awaiting the U.K. when negotiations kick off with the E.U.

Advertisement

Add a comment