Who is the largest single shareholder in First Bank? That question has been on the lips of many shareholders of the bank as well as other investors, analysts and members of the public for several weeks.

Since the ownership tussle between Femi Otedola and Tunde Hassan-Odukale broke out in October, market insiders are worried that the capital market regulator, the Security and Exchange Commission (SEC), is yet to utter a word.

Otedola had acquired 5.07% stake in the bank, leading to media reports that he had become the single largest shareholder and was in a pole position to take over as chairman of FBN Holdings Plc, the holding company of First Bank of Nigeria.

However, a document surfaced on social media which credited Tunde Hassan-Odukale, another shareholder, with 5.36%.

Advertisement

His shares were partitioned into two: 4.16% and 1.20%.

Before then, Hassan-Odukale’s stake was estimated at 3%.

The Nigerian Exchange Limited (NGX) then queried FBN Holdings Plc for classifying the shareholdings of Hassan-Odukale and related parties into two.

Advertisement

In response to the query, Seye Kosoko, the FBNH secretary, attributed Leadway Pensure PFA’s entire 2.11% stake in FBN Holdings to Hassan-Odukale, although they are pension funds invested by Leadway on behalf of the public.

Also listed in Hassan-Odukale’s favour by Kosoko is 1.36% of “ZPC/Leadway Assurance Prem & Inv Coll Acct” which is insurance funds invested on behalf of the public.

FBN Holdings appeared to classify both as Hassan-Odukale’s personal investments.

“The first part of the shareholding classification (4.16%), are shares held directly and indirectly by Mr. Tunde Hassan-Odukale. The second part of the shareholding classification (1.20%), are shares ascribed to Mr. Tunde Hassan-Odukale due to his influence and having significant control,” Kosoko wrote.

Advertisement

SEC STEPS IN — OR OUT?

TheCable learnt that SEC, worried by the controversy, also issued a query to FBNH requesting to be informed of the state of play.

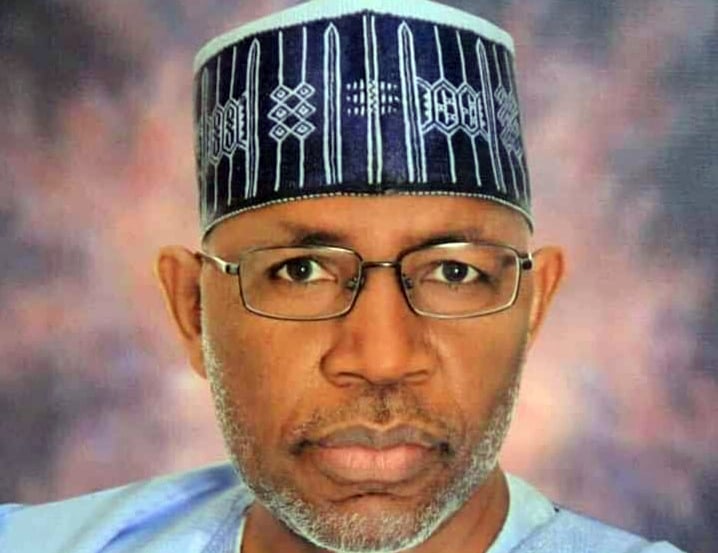

The regulatory body, under the leadership of Lamidi Yuguda (pictured), the director-general, raised questions on the attribution of the entire holdings of Leadway Pensure PFA and Leadway Assurance to Hassan-Odukale.

Weeks after the development, SEC is yet to make its position public, fuelling unease in the stock market as the board battles continue.

Advertisement

A stockbroker, who declined being named so as not to be seen as taking sides or promoting “anybody’s interest”, told TheCable on Friday that SEC is not helping matters with its silence.

“I have shares in First Bank and I would love to know the direction of things and what will happen next. These little details matter a lot in this business. SEC cannot keep us in the dark for so long,” he said.

Advertisement

Some of the questions being raised revolve around possible corporate governance issues in the reporting of shareholdings and what can be legitimately attributed to the individual shareholders and their related entities.

“First Bank is a role model in the Nigerian banking industry and the way its affairs are handled will have a big impact on the market,” another industry insider said.

Advertisement

“It would serve all of us right if SEC can do the right thing and make a public pronouncement on the tussle so we can put this behind us and face other matters. The way and promptness with which this sort of information is handled is very critical. Silence is not an option.”

TheCable has contacted SEC for comments.

Advertisement

Add a comment