The presidential committee on fiscal policy and tax reforms says the Nigeria Customs Service (NCS) and 62 other ministries, departments and agencies (MDAs) of the federal government should not collect revenue directly.

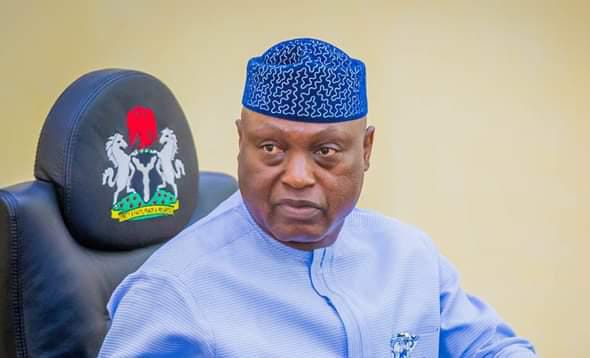

Taiwo Oyedele, chairman of the committee, spoke on Sunrise Daily, a Channels Television programme, on Wednesday.

He said the Federal Inland Revenue Service (FIRS) is best-suited to collect revenue for the MDAs.

Oyedele, a former fiscal policy partner and Africa tax leader at PriceWaterhouseCoopers (PwC), said Nigeria’s revenue collection from taxes is one of the lowest in the world but the cost of collection is high.

Advertisement

“Ironically, our cost of collection is one of the highest. And the reason for that is that we’ve got all manners of agencies. The Federal Government alone, we have 63 MDAs that were given revenue targets last year, no; actually in the 2023 budget,” he said.

“And two things that would come up from that: on one hand, these agencies are being distracted from doing their primary function which is to facilitate the economy. Number two, they were not set up to collect revenue, so, they won’t be able to collect revenue efficiently.

“So, move those revenue collection function to the FIRS. It has two advantages: the cost of collection and efficiency will improve, these guys will focus on their work, and the economy will benefit as a result.

Advertisement

“If you are Customs, focus on trade facilitation, border protection and if you are Nigerian Communications Commission (NCC), just regulate telecommunications. You are not set up to collect revenue.

“It can be your revenue and someone else can collect it for you. There will be more transparency because you see what is being collected and is accounted for properly. It is also a way of holding ourselves to account as to how we spend the money we collect from the people.”

The committee, inaugurated by President Bola Tinubu on Tuesday, is tasked with delivering tax reforms achievable in 30 days.

Advertisement

Add a comment