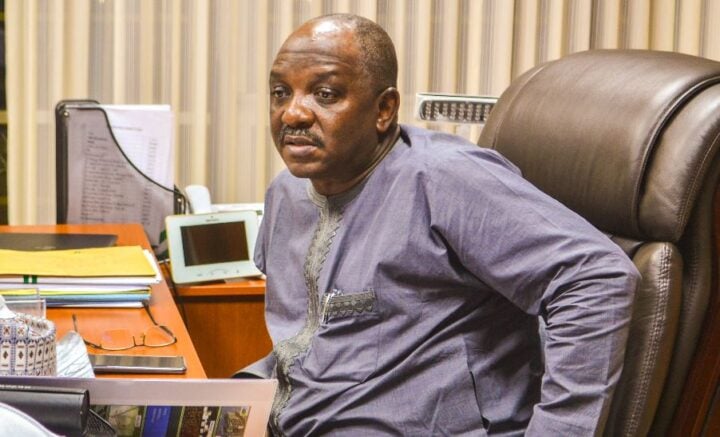

Mele Kyari, group managing director of the Nigerian National Petroleum Corporation (NNPC), has blamed the huge price differential in the pump price of petrol in Nigeria and neighbouring countries for the high rate of smuggling of the commodity across the nation’s borders.

Garba Deen Muhammad, NNPC spokesperson, quoted Kyari to have said this during a presentation at an interactive session by the joint senate committee on the 2022-2024 medium term expenditure framework and fiscal strategy paper (MTEF/FSP), on Thursday.

Kyari said that with a price difference of over N100 per litre between what is sold in Nigeria and in countries around the nation, it was difficult to curb the activities of petrol smugglers.

He explained that concerted efforts by the corporation and some federal agencies to combat the menace of smuggling of petroleum products have been largely hampered by the current arbitrage situation

Advertisement

The NNPC boss said though the corporation, working in concert with other agencies, has made noticeable progress in combating the menace, the battle was yet to be won.

“As long as there is arbitrage between the price that you sell and what is obtainable elsewhere, you can be sure that it is very difficult to contain the situation,” Kyari said.

He emphasised that the activities of smugglers had also made it difficult for the country to determine the actual consumption figures for petrol, noting that the NNPC could only know what was trucked out from loading depots across the country but could not determine how much of that was consumed in-country.

Advertisement

On the MTEF assumptions, the GMD reiterated a base oil price scenario of $57 per barrel for 2022, $61 per barrel for 2023 and $62 per barrel for 2024, predicated on a base national production of 1.883 million barrels per day in 2022, 2.234 million barrels per day in 2023 and 2.218 million barrels per day in 2024.

Kyari explained that the assumptions were arrived at after consultations with the ministry of finance and other relevant stakeholders, while also undertaking a careful appraisal of the three-year historical dated Brent oil price average of $59.07 per barrel premised on Platts spot prices among other considerations.

He added that price growth was to be moderated by the lingering concerns over COVID-19, increased energy efficiency as well as obvious switching due to increased utilisation of gas and alternatives for electricity generation.

Advertisement

Add a comment