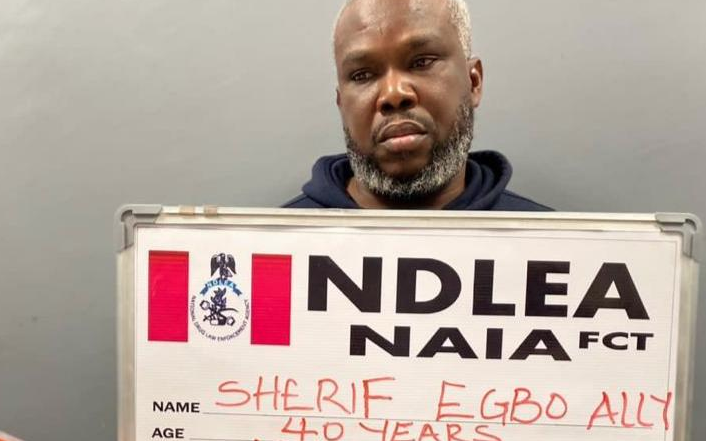

Tete stares at the wall in his shop hoping for some financial miracle. Photo credit: Claire Mom/TheCable

Worries cast long shadows on Tete’s face as he furiously punched figures into his calculator, desperately hoping to reassure himself that the palpitations he was experiencing were because of a wrong figure somewhere.

But there was no wrong figure and his fears of plunging into a financial ditch was a nightmare that soon began to look real.

Seated in a moment of stillness on a plastic chair that seemed like it would soon give way with the slightest addition of weight, 26-year-old Tete stared at the pile of bills in front of him.

Hunched over packs of water in plastic bottles which doubled as a desk, he felt a knot of fear in his stomach and buried his face in his hands. He had been trying to figure out how to make his finances work for weeks.

Advertisement

Like many young people in Nigeria, Tete dreamed of carving his path to success in Abuja, the country’s capital.

Back in Benue, his state of origin, he had heard stories of how the federal capital territory (FCT) was a fertile ground for young hardworking people like himself who were willing to do whatever it took to have their names pop up in one Google search.

Lagos was too far. Abuja was only about five hours away by road and it would be just the perfect place, an ambitious Tete had thought.

Advertisement

Immediately after secondary school, with nothing to his name but a bag full of clothes and dreams, he came to the FCT to start life, working as a house help for a high-ranking female government official whose identity he refused to disclose.

Soon, his diligence paid off and he started a small store in Gwarimpa’s first avenue – selling drinks to customers who frequently ply the popular route.

But the journey to success was not as easy as he thought. In no time, he found himself grappling with keeping his business afloat while wrestling with an unseen adversary – multiple taxes.

MERRIMENT TAX: SMALL BUSINESSES STRUGGLING TO STAY AFLOAT

Advertisement

According to a PricewaterhouseCoopers Inc (PwC) report, small and medium-scale enterprises (SMEs) account for 96 per cent of businesses and 84 per cent of employment in Nigeria. In Abuja, thousands of SMEs operate under harsh conditions.

SMEs in the country’s capital are expected to pay the mandatory personal income tax, value-added tax (VAT), and withholding tax. But that is not all. They also pay other taxes, including environmental sanitation fees, fire service fees, emblem levies, retail permits, trade permits, development tax, market taxes, merriment tax and revenue tax. These are among the taxations imposed by the Abuja Municipal Area Council (AMAC). AMAC is the local government administration overseeing Abuja’s main city – five others around the suburbs.

More of these taxes include radio and TV license, signposts, liquor license, mobile advert, food handlers test, food handling inspection and certification, and premises inspection among others.

For Tete, trying to make ends meet no matter the cost is the only way forward.

Advertisement

“If your business is located in a good place, then you can cope with the tax. It is affecting me but what can I do? It’s something I’m used to,” he said while showing off his certificate of fitness tax to TheCable.

“People only close their shops when they have other sources of income, but this is my only income. So, I just have to suffer and smile.”

Advertisement

When asked if he had enjoyed any benefits of the taxes he paid, Tete paused to ponder, stroking his beard while staring as cars raced by.

“I don’t see any benefit,” he said after a long hard thought.

Advertisement

“You need to see the benefit and be motivated to pay. Taxes are like an investment; you need to see the returns.”

Another tax imposed by AMAC on business is the merriment levy.

Advertisement

Kingsley Madaki, AMAC spokesperson, said “It is a levy being charged for entertainment areas” like nightclubs, but restaurants have also been mandated to pay this type of tax.

In a demand notice for payment seen by TheCable, Maubby’s Express, a restaurant and cafe in Wuse 2, was mandated to pay N250,000 for “merriment taxes”.

Lucy Julius, manager of the cafe, said the council officials have visited the business centre twice this year for the same levy.

“They brought it twice this year, first as a notice before coming again and asking us to pay,” she said.

“The other day, they spoke to my boss about it and she was even confused. She said ‘which one is merriment tax again’ and they had to settle it.”

Julius said the different taxes imposed on SMEs, coupled with the state of the economy, have affected businesses with the decline in the number of customers that patronise the restaurant.

“The AMAC tax is too much. Sometimes, they will bring this document today; tomorrow, it will be a food handler. The other one, they will say they have to run tests for the staff in the organisation. It is too much,” she said.

NO RECEIPT FOR ‘TAXES’

Like Tete, the pressure of the multiple taxation in Abuja has forced Jerry Ofo, an entrepreneur, to close down his barber’s shop.

Through gritted teeth, Ofo told TheCable that he pays over 20 different kinds of AMAC taxes to strangers who wear “polo shirts” claiming to be from the council.

“FIRS will come with their own. AMAC will come and say ‘No, it is supposed to be them’. You’ll still pay for the billboard and after paying for the billboard, another set of people will come and tell you that the person you paid to is no longer with them and you have to pay another one,” he said angrily.

“In a set, one person is collecting fumigation, another person is collecting liquor license and another person is collecting approval for a permit. In our own country, they’re treating us like slaves.”

In a restaurant tucked behind a row of shops in Gwarimpa’s First Avenue, Ofo recalled that he has paid fumigation taxes twice this year but there has been no evidence of his payment.

He told TheCable he does not see the benefit of the taxes he pays. Hence, he was forced to shut down the business. Now, he is struggling to keep up with the cost of trying to run another business within the municipal area.

“I don’t see the benefit of the tax. Payment of tax is good only if they are using it well. With this fumigation tax, for example, come here in the evening, mosquitoes will bite you, and you will see rats. So, what is the essence?” Ofo asked while waving off a fly buzzing around his nostrils.

“All the shops here pay for fumigation and they only use one chemical for us. The only reason I’m going against it (taxes) is that when you pay for something, let’s see it working. Not when you pay, another person will pocket the money.

“We are not fools. We don’t pluck money from the trees. We work for it. So, if we are dishing it out, we should get value for it.

“They came today and called another name (for a tax). The month is ending and we will not be able to pay our staff with the way everything is going.”

But not everyone can afford to set up another business like Ofo.

AMAC REACTS, SAYS CENTRALISED TAX SYSTEM NOW IN PLACE

Speaking with TheCable, Madaki said the council is deeply concerned about the stumbling blocks in raising the much-needed revenue for accelerated development activities in the FCT.

The AMAC spokesperson said the council is aware of the ghost partners swindling business owners and how it has affected the ease of business in Abuja which is why “we have now initiated a centralised tax payment system”.

“All taxes are now unified and will be paid to the FCT-FIRS,” he added.

Madaki said the goal was to harmonise revenue collection. Although AMAC recognises that challenges lie ahead, “we are committed to overcoming these obstacles and transforming our collective vision into a reality”.

But AMAC’s promise is one Ofo is not willing to hold his breath for. He said this is not the first time he has heard that something will be done about the problem.

“I will only be convinced when I see true change,” he added.

Add a comment