The Nigerian Stock Exchange (NSE) for the very first time since the Goodluck Jonathan administration, crossed the N12 trillion market capitalisation mark.

This occured on Tuesday after the Central Bank of Nigeria monetary policy committee voted to hold key interest rates at 14 percent for 12 months consecutively.

The MPC also decided to hold cash reserve ratio (CRR) and liquidity ratio be maintained at 22.5 percent and 30 percent respectively.

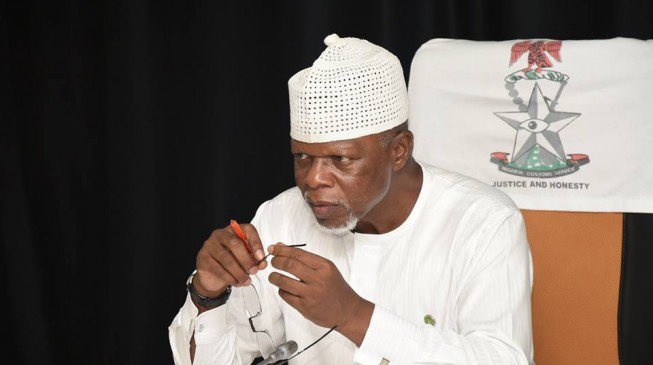

After the decisions were annouced on Tuesday by Godwim Emefiele, the central bank governor, the NSE market cap crossed over to N12,085,339,769,999.12 from N11,943,016,727,794.88 at the close of trading on Monday.

Advertisement

All share index (ASI) also rose to 35,065.47 from 34,652.52 hitting another all-year high.

Ambrose Omordion, the chief operating officer, InvestData Ltd., also linked the growth to impressive half year report and interim dividends declared by some quoted companies.

Omordion said that investors anticipation of more improved half year earnings contributed to the current price rally.

Advertisement

NAN reports that Nestle recorded the highest gain for the day, increasing by N8 to close at N910 per share.

Forte Oil followed with gain of N5.40 to close at N62.90 and Okomu Oil appreciated by N3 to close at N67 per share.

United Bank for Africa (UBA) increased by 65k to close N10.10, while Zenith International Bank grew by 60k to close at N23.85 per share.

On the other hand, Nigerian Breweries recorded the highest price loss, leading the losers’ table with a loss of N3.40 to close at N155.60 per share.

Advertisement

UACN trailed with a loss of 71k to close at N16.68 and Dangote Sugar dipped 42k to close at N8.71 per share.

NASCON dropped by 15k to close at N9.15 , while Lafarge Africa also lost

15k to close at N60.05 per share.

In spite of the hike in market indices, the volume of shares traded dropped marginally to 288.58 million shares valued at N2.46 billion exchanged in 2,578 deals.

This was in contrast to a total of 293.75 million shares worth N3.95 billion transacted in 3,712 deals on Monday.

Advertisement

UBA recorded the highest volume of activities, exchanging 118.45 million shares valued at N1.20 billion.

Transcorp followed with an account of 38.31 million shares worth N63.19 million and Fidelity Bank traded 25.64 million shares valued at N33.01 million.

Advertisement

Access Bank exchanged 21.40 million shares worth N216.77 million, while Fidson Healthcare sold 12.61 million shares valued at N38.84 million.

Advertisement

Add a comment