On February 24, MultiChoice Nigeria announced an adjustment in the cost of its subscription packages for DStv and GOtv users. The new price review came almost a year after the company last adjusted its rates for customers.

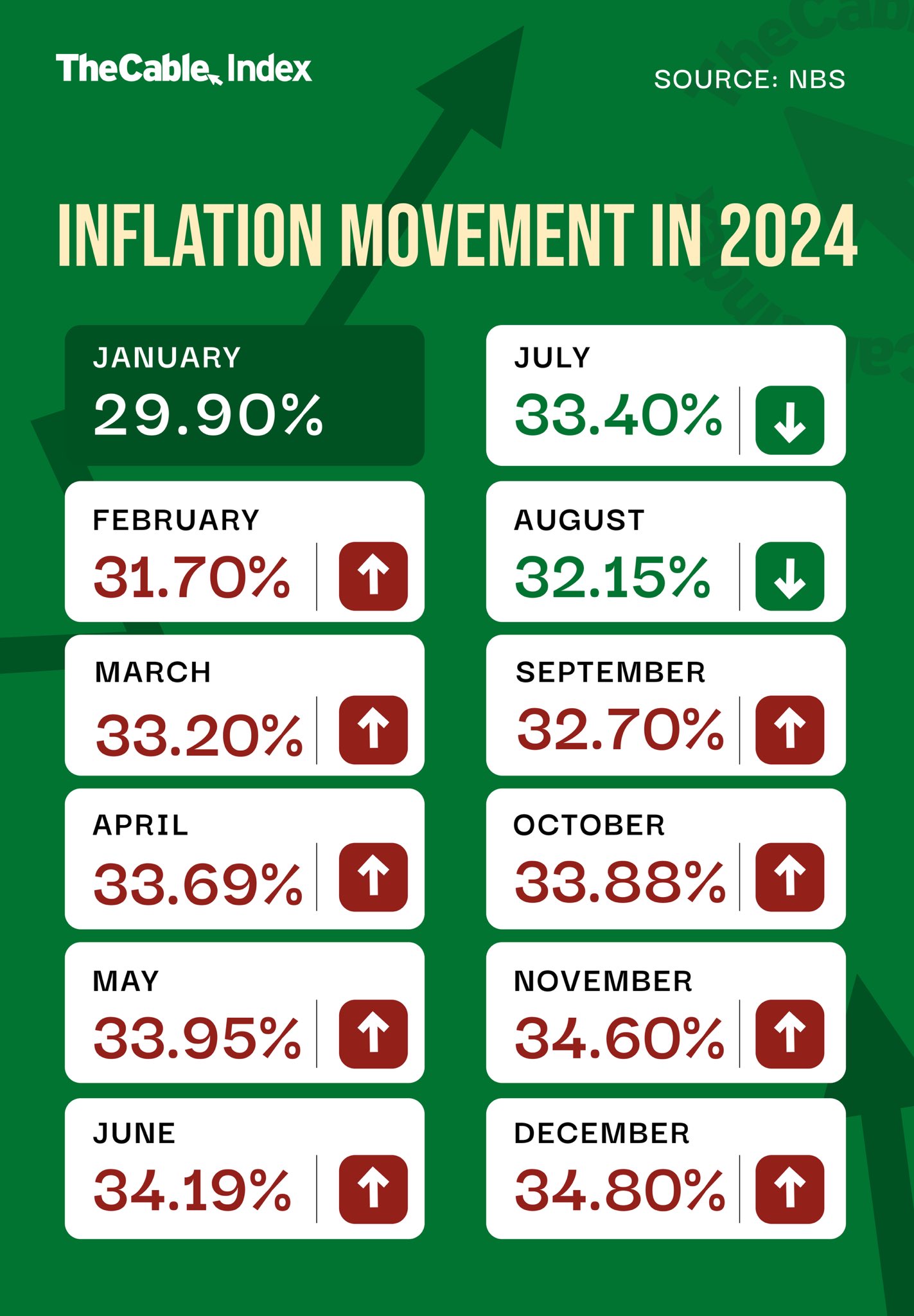

Since MultiChoice’s previous price adjustment, Nigeria’s inflation figure, according to the National Bureau of Statistics (NBS), has majorly stayed north of 30 percent, debilitating businesses and individuals. The pay-TV firm kept the subscription dial fixed despite the rising production cost nationwide. Until February 2025, nearly a year of holding the dam and painfully keeping the flood and gloom of Nigerian economic realities out of its relationship with customers.

NIGERIA’S ECONOMIC REALITIES AND ITS BURDEN ON BUSINESSES

The removal of the petrol subsidy in 2023 has left the country reeling from its impact. The increase in petrol price spilled over to other aspects of the economy.

Advertisement

A few months later, the government also floated the naira, and the currency plunged by almost 200 percent. Businesses could only count their losses as operation costs rose, coupled with other underlying economic woes. Companies were forced to review product prices to reflect economic realities.

Advertisement

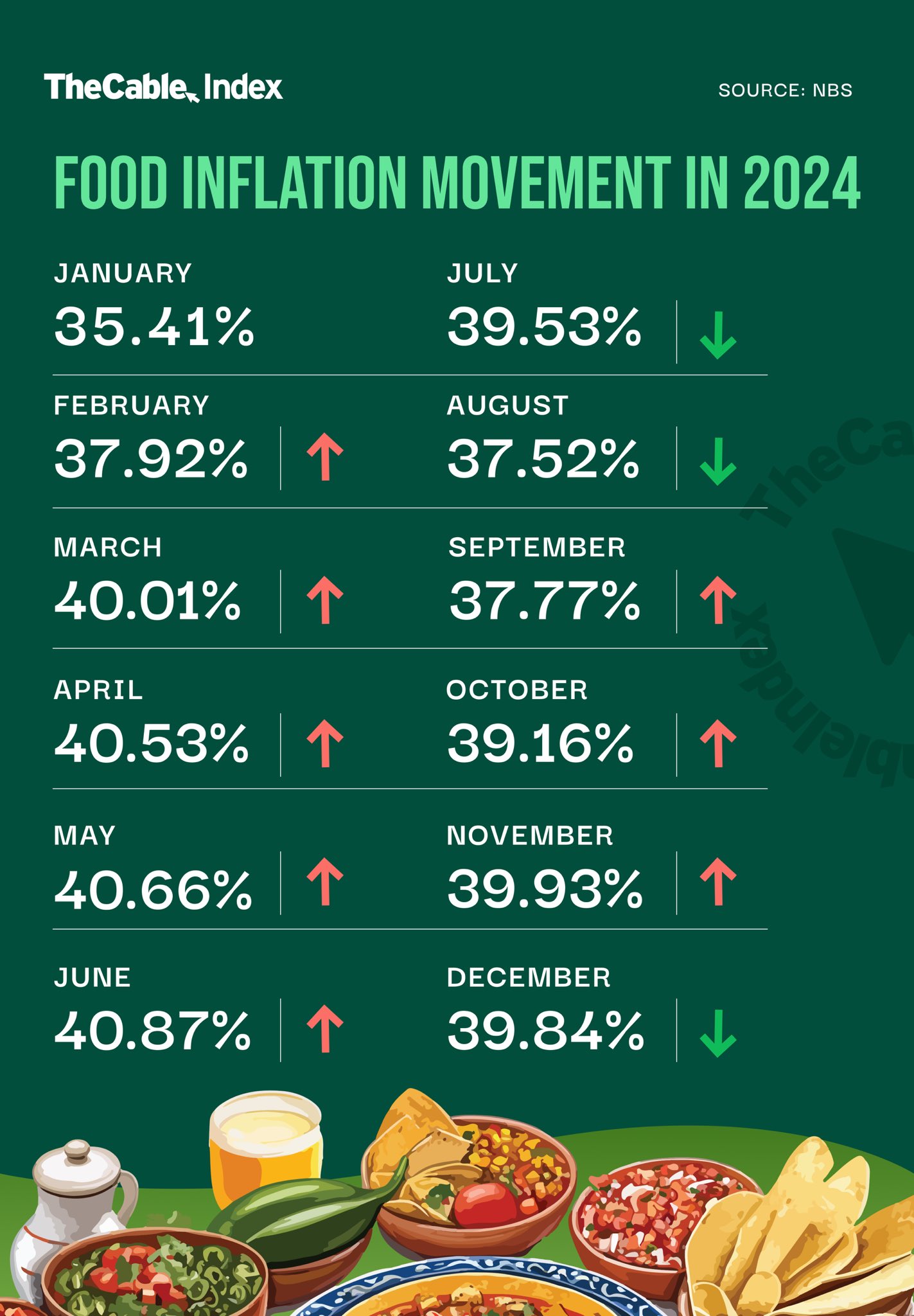

According to SB Morgen (SBM) Intelligence, a geopolitical research firm, the prices of some edible products hiked significantly in 2024. Several goods cost twice as much as they did a year before.

Between 2023 and 2024, the cost of a 50kg bag of rice soared from N33,000 to N60,000 — over 82 percent increase in the price of the staple food item. A carton of Indomie Superpack instant noodles soared by 91 percent during the same period from N7,900 to N15,000. Other household and health goods, like sanitary pads, zoomed over 100 percent.

In early 2024, Nigerian Breweries (NB) Plc increased the price of its major alcoholic products thrice. The brewer cited “rising input costs and the need to mitigate the impact” as the reason for the price adjustment.

Other brewers, such as International Breweries (IB), producer of Trophy lager, and Guinness Nigeria Plc, had to reconsider their product prices in response to economic demand.

Advertisement

In the entertainment sector, Netflix, the over-the-top (OTT) media service, also increased the prices of all streaming packages twice in 2024. One of the streamer’s bundles climbed by a whopping 83 percent.

Also, StarTimes Nigeria, the pay-TV operator in partnership with the federal government, hiked its subscription package by 15 percent.

Telecommunication companies and Internet service providers are not exempted from the struggle. Starlink, the satellite internet service, owned by Elon Musk, the world’s richest man, bumped up the monthly subscription prices in Nigeria. The lowest subscription tier increased from N38,000 to N75,000 per month – a 97.37 percent hike.

In 2025, the Nigerian Communications Commission (NCC) approved telecommunications companies’ 50 percent tariff hike.

Advertisement

Despite the inevitable factors, familiar critics protested the changes when MultiChoice eventually announced its latest rate increase.

The Federal Competition and Consumer Protection Commission (FCCPC) resumed another episode of the same old dance with MultiChoice.

Advertisement

On February 25, the FCCPC summoned the pay-TV firm to defend the price adjustments before its investigative panel and demanded that MultiChoice halt the planned adjustments.

A few days later, FCCPC filed charges against MultiChoice for not suspending the newly announced prices for its packages while waiting to appear before the commission’s panel.

Advertisement

FCCPC said MultiChoice was “violating” regulatory oversight. However, a federal high court restrained the commission from taking administrative action against the pay-TV company while the case was still in court.

Similarly, the house of representatives, the country’s lower legislative chamber, also ordered MultiChoice to halt the price adjustment.

Advertisement

Despite the objections, MultiChoice Nigeria maintained that its prices needed to be reviewed because it operates within the country’s market forces and is not immune to the economic challenges faced by several other businesses determined to navigate the dire situation.

RIPPLE EFFECT OF NAIRA’S VOLATILITY

MultiChoice’s trade is premium show business, and its live wire is high-end content and entertainment. Customers in Nigeria are billed in the local currency, which is becoming increasingly weaker against its global competitors. Foreign currencies are the determinants of licensing deals and the general production of major international programmes.

Therefore, the cost of acquiring TV rights to broadcast live top European football league matches and licensing deals to air trendy shows and films to the Nigerian audience has skyrocketed.

Since the devaluation in 2023, the naira continuously fluctuated between marks below N1,500/$. This constant bounce caused companies to suffer ruinous foreign exchange losses.

MultiChoice Nigeria was one of the victims. In 2024 the cable TV company suffered a $190.5 million foreign exchange loss due to the naira’s volatility. Between April and September of the same year, the company also lost 243,000 subscribers across its DStv and GOtv services as the currency situation forced Nigerians to tighten their shoestrings.

MultiChoice had to reevaluate its pricing structure to remain competitive in the broadcasting industry and consistently offer international events and shows to subscribers.

SOLDIERING ON AMID CHALLENGES

Despite the losses and shrinking bottom line, MultiChoice remains the largest producer of original content on the African continent.

Last year, Amazon Prime, the global streaming giant, laid off staff and scaled back its investment in African content. The platform retreated from the African market to focus on Europe.

A few months later, Kunle Afolayan, ace producer and actor, revealed that Netflix had hinted local filmmakers at a potential reduction in the volume of content licensed by the streaming service.

Contrary to its competitors’ moves, MultiChoice continued to bet on the Nigerian market.

New exciting Nigerian shows are still commissioned and funded through its African Magic channels. Evergreen TV dramas like Tinsel have been running since 2008, and over 4000 episodes have aired.

With the annual Africa Magic Viewers’ Choice Awards (AMVCA), the pay-TV company maintains its significant role in Nollywood’s growth by hosting the industry’s most recognised prize-giving ceremony.

The production of the last two seasons of the Big Brother Naija reality TV show injected at least N5.5 billion into the Nigerian economy annually.

In 2021, before it adopted a new controversial research methodology, the NBS had pegged Nigeria’s unemployment figures at 33.3 percent – the country’s highest ever.

MultiChoice directly and indirectly employs over 28,000 people across Nigeria while constantly transacting with over 20,000 small and medium enterprises.

Over the past five years, the media firm has engaged young, local filmmaking talents through the MultiChoice Talent Factory (MTF) West Africa. The fully funded academy nurtures and promotes the skills of these talented creatives and provides them with jobs and opportunities.

Due to the country’s crippling economic nosedive, several global corporations have partially shut down their Nigerian subsidiaries in the last two years. Businesses like GlaxoSmithKline (GSK) Consumer Nigeria Ltd, Procter & Gamble Nigeria, ShopRite Nigeria, among others, have all exited due to an unfavourable economic environment.

To keep the premium entertainment industry going and ensure that many Nigerian households that depend on MultiChoice for their livelihood are well paid, MultiChoice must yield to market forces and adjust the prices of its packages.

The price adjustment also gives the media firm a cushion for retaining its crown as Africa’s favourite storyteller.

CHEAPER RATES FOR NIGERIAN AUDIENCE

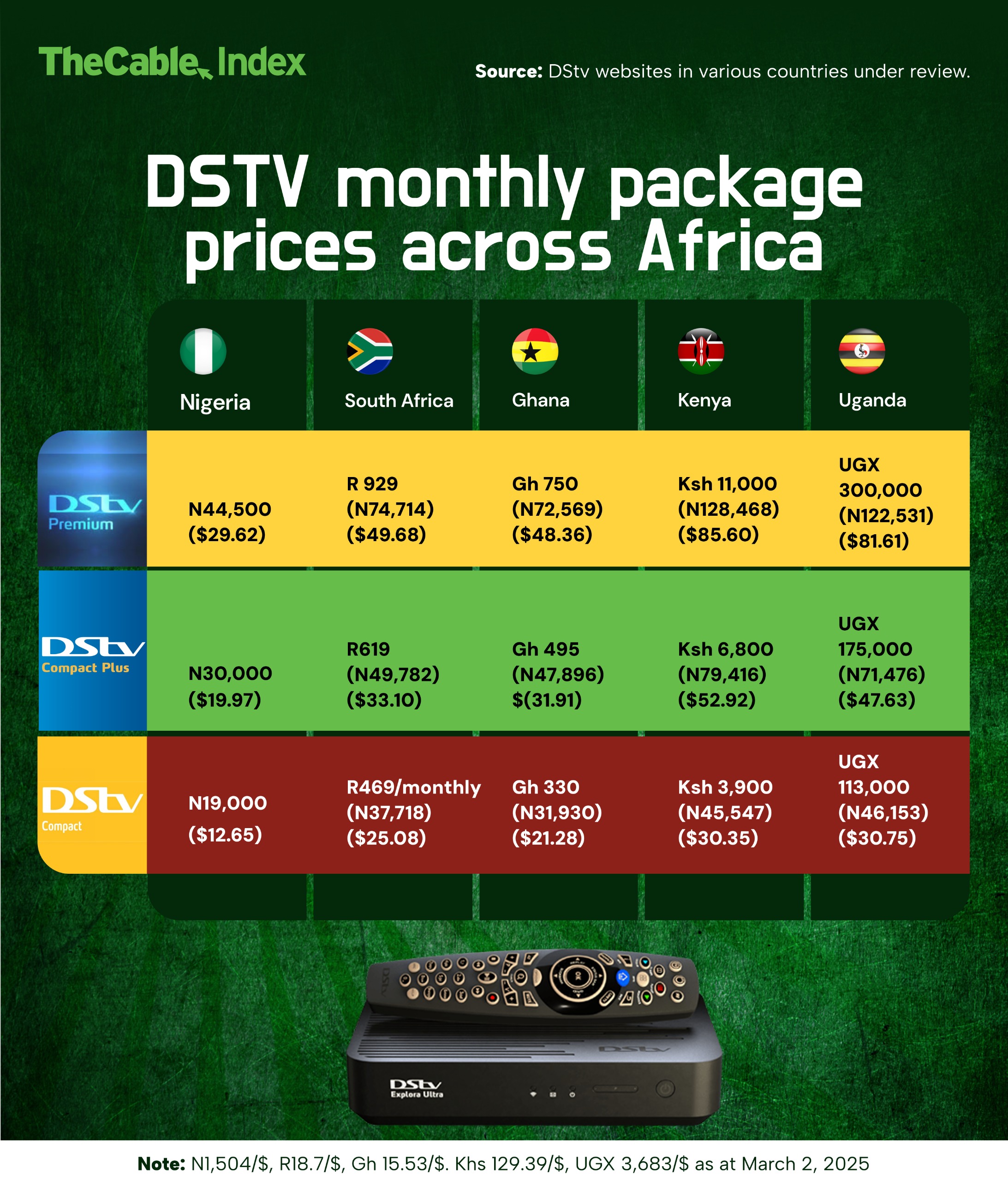

Regardless of the price readjustment, Nigerians enjoy cheaper DStv and GOtv package rates than other African countries.

The DStv Premium Package in South Africa goes for R 929 monthly ($49.68). The same package costs Gh 750 ($48.36) in Ghana, Ksh 11,ooo ($85.60) in Kenya and UGX 300,000 ($81.61) in Uganda. Nigerians pay the lowest rate of N44,500 ($29.62) monthly for the same bouquet.

The DStv Compact Plus in South Africa is R619 per month ($33.10). The bouquet costs Gh 495 ($31.91) in Ghana, Ksh 6,800 ($52.92) in Kenya and UGX 175,000 ($47.63) in Uganda. The new price review only bumped the price in Nigeria to N30,000 ($19.97).

In South Africa, a DStv Compact subscription costs R469 ($25.08) monthly. Ghanaians get the same package for Gh 330 ($21.28). Kenyans are charged Ksh 3,900 ($30.35), while Ugandans pay UGX 113,000 ($30.75). The Nigerian price has just been adjusted to N19,000 ($12.65), still lower than in every country under review.

‘STEP UP’ AND ‘PRICE LOCK’

To ease the impact of the price tariff increment on customers, MultiChoice offered subscribers on both DStv and GOtv ‘Price Lock’ which ended February 28 and ‘Step Up’ which is currently ongoing till March 31.

Subscribers who took advantage of the Price Lock offering by renewing their subscriptions before expiration were exempt from the new rates for a specified period, rewarding their loyalty.

The ‘Step Up’ offer enables subscribers to enjoy premium content beyond their current package through an automatic upgrade to a higher package upon payment for a package above their current subscription. The offer will be available for GOtv and DStv customers until March 31.

The MultiChoice price adjustment has reopened perennial issues Nigerian subscribers have always had with pay-TV companies: There have been calls for more sophisticated, well-crafted shows to justify the monthly payment all year round; a fresher, newer lineup of local and international TV dramas; and the classic poor signal accompanying rainfall or windy weather.

These are genuine concerns from subscribers, but they can only be addressed by companies that stay afloat and are not liquidated due to undercharging.

The price adjustment should give pay-TV companies the necessary buoyancy to invest in infrastructure that will improve customers’ experiences and help scale up the production and licensing of more quality shows and events for subscribers.

Add a comment