I got what was perhaps my first baptism of fire in politics when at the 2018 Osasu Symposium organized by Osasu Igbinedion at the NAF Centre, Abuja early December of that year, I was brutally taken down by Mrs Oby Ezekwesili. In my usually effusive and if you like, self-deprecating style, I had rushed to greet upon sighting her. I also made references to her in my opening speech, wherein I also tried to push some of my more radical ideas that prompted me to run for President of Nigeria in 2019. One of them was that Nigeria’s economy should be growing much faster. I believed – and still do – that ours is a toddler economy in terms of achievement and experience, and if this is so, a toddler should grow much faster than adults. The US economy was then growing at 4% under Donald Trump and I didn’t see why we cannot do much better. That was my sin.

Mrs Ezekwesili in her own first speech (I think she was then running on the platform of ACPN), layered into me and, casting a glance leftwards to where I sat, stated ‘Tope, you should not come here and sell people koolaid! You cannot sell koolaid here!’. My mouth went dry and anger welled up in my brains. What the blazing hell! Who was selling Koolaid? And is this the lady I had and showed so much respect for? The reference to Koolaid itself was derogatory for it is what poor black Americans are usually described with. Koolaid is also the sugary drink which Jim Jones in 1978 asked his followers in Guyana to drink after they had poisoned it with cyanide. He said they will all meet in heaven as the authorities closed in on his cult. Koolaid is associated with mass hypnotism and mass suicide! And I wouldn’t take any of that. Anyhow she went on to state that achieving double digit growth rate was the stuff of Lalaland and that if Nigeria could achieve 6% to 8% that would be an achievement. So I didn’t take it likely as I told her off in my later response – for the fact that she also served in Obasanjo’s government of little achievements, and that she must be in some mental block thinking we cannot do much better than what had happened in the past perhaps because she had worked with the World Bank. I am extremely humble, almost gushingly so, but my madness gets unleashed when I sense bullying. Apologies to the lady and anyone who may have felt offended by my offensive that day. I noticed she refused my handshake when we were done.

But that is not my concern today even though there is a nexus somewhere. I must warn, that there will be some name-calling in this article, mostly for the right reasons. I hardly write about people, but this time, I am adopting a down-to-earth style while looking at policy issues as I am wont to do. The story came back to mind when I listened to Mr Mustafa Chike-Obi’s recent interview on AriseTV. He answered sundry questions on fuel price deregulation, liberalization in general, and of course the country’s management of our currency the Naira. I was so enamoured of some of his ideas, and he happens to be the only person in the space, talking about the need for Nigerian to target double-digit rate, despite some of his other ideas that I disagree with. For this reason, I decided to build today’s article around Chike-Obi.

MY AGREEMENTS AND DISAGREEMENTS WITH CHIKE-OBI

Advertisement

I believe that the fact that this ex-Goldman Sachs/Bear Stearns man is speaking about double-digit growth for Nigeria’s GDP should be amplified. I have found a single companion who seems to understand that mindset. In the first place, the big economies developed much faster than they do today, when they were just coming up, especially when they were driven by discoveries and inventions. The 4 Industrial Revolutions (driven by Steam, Electricity, the Internet and now Robotization and AI), or the 5 waves of innovative entrepreneurship as propounded by Joseph Schumpeter, saw those economies leaping in bounds, even in the times when nations kept not much coherent records. So why would the USA economy grow at 4% pre-COVID, the Chinese economy slowed to 6.5%, India grew at 5.5%, and even Ghana, Ethiopia and Cote D’Ivoire leaped on at 8% and here was Nigeria being very mediocre at barely 2% until Covid-19 struck? Sometimes these things are in the mindset. You achieve because you think you can. An economy like Nigeria has great space to grow. There are too many things yet undone. Infrastructure does not exist in many places where they should. Too many Nigerian are jobless or underemployed when they shouldn’t be. There are many things we should be able to do for ourselves that we aren’t presently. All I see is space, space, space.

If we were thinking right and had courage, Nigeria should be a huge construction site, not necessarily for foreigners to come and do the work, but for our youths to get really busy. I agree so much on this with Chike-Obi. I also agree with him that we need to get out of the fuel market as a country because this was just one product out of so many. I even agree with him that for now, Nigeria needs to borrow money from wherever it can find some, especially to develop her infrastructure. What is more? I was flabbergasted at his thoughts that the CBN should not be struggling to finance BDCs because Nigerians want to travel abroad at this time. I absolutely agree on this. Nigeria has probably close to 10,000 Bureaux de Change. Many people carry 5 in their briefcases. The Central Bank of Nigeria sells dollars to these guys, presently at N386 to the dollar, and somehow, they offload to the market at the going rate at say N460. When the CBN indicated that now that Nigeria was exiting lockdown and international travel will commence it will start selling to BDCs, the Naira firmed a bit from N480 to N440, but soon enough – as I had warned my friend Paul Alaje who hailed the policy – the Naira slipped again to around N465 presently. I have been disappointed way too often by promises of ‘we will defend the Naira!’ that I know that we are currently toying with a Zimbabwe situation and anchoring a currency on weekly sales of Dollars to BDCs just won’t cut it. More on that later.

I disagree with Chike-Obi on several issues, especially his all-out liberal policy prescriptions. I could even see a contradiction in his position. Whereas he believes that proper deregulation is a scenario where government has absolutely no hand in a market, he is willing to allow government go gradual on fuel price deregulation. Whereas I am a bit left of centre, I believe government should not be subsidizing fuel at all, and if it doesn’t quit the market fully, we will just keep deceiving ourselves. Nigeria has deregulated several times now, but the Minister of State for Petroleum, Timipre Silva, recently announced that this last action government took, was merely a partial deregulation! We are expecting to see ‘subsidy’ return to our national account books, perhaps in a different moniker soon. If we don’t quit subsidy, we will never quit subsidy. For petrol, until government agrees that fuel should sell at varying prices all over the country, no deal. PEF should be scrapped, simple. But once you are thinking of what ‘your people’ will say, you are mixing liberal economics with politics and that doesn’t work.

Advertisement

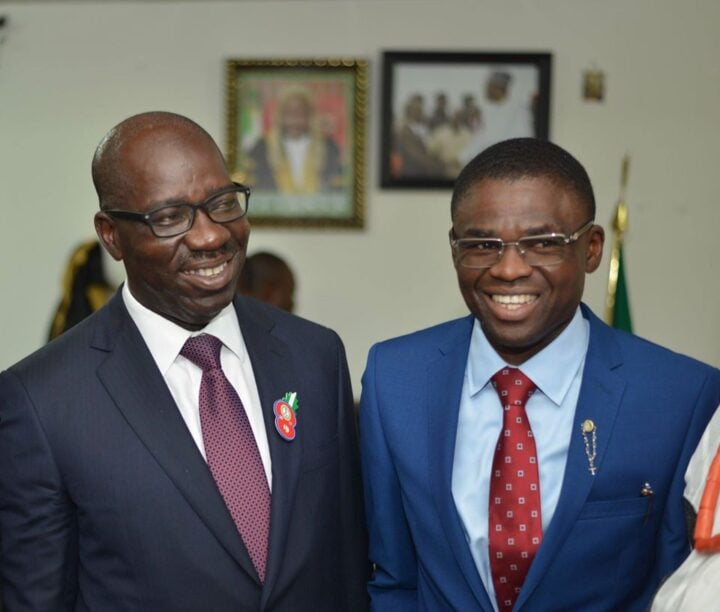

I further disagree with Chike-Obi in his comparison of Nigeria’s debt to her GDP. This is the typical hideout of serving Ministers of Finance. The GDP is indeed an almost meaningless figure, given its many faults (it can be skewed to a few industries or a few players, and we in sub-Saharan Africa as a whole can hardly calculate correct figures of it. I only posit that we set higher targets on GDP growth because it is an approach that people in government can understand, and the idea can get everyone of us into a high-productivity mindset. Otherwise, setting GDP targets is a hit-and-miss. It is even possible for a fair portion of a nation’s GDP to end up in another country (via book-cooking and large dividend payouts by conglomerates). For example, MTN once got into trouble with Nigerian authorities for this reason. Nigeria should remain mindful of her Debt-to-revenue ratio, and indeed our almost total reliance on debt at this point. I just believe that at moments of global recession, a nation has to keep moving and deficit should not be an issue, hence my support for debts at this point. I had written much earlier, calling the attention of the Minister of Finance that we have the trio of a debt, revenue, and expenditure problem, not just a revenue problem; something Chike-Obi alluded to in his interview. Even if government personnel are now ‘trying’ to cut down on much excesses because of covid, whatever came upon them since 2015 that they frittered away the hopes of the people by being worse than PDP? Thankfully, the APC government is now getting some feedback. Edo State of mind.

MANAGEMENT OF THE NAIRA

So naturally, and for good reasons, I disagree that the Naira should be left to float ‘freely’. If we do, the Naira will float to Mugabe’s Zimbabwe, because we have nothing to anchor the Naira upon apart from sheer luck. Luck, and prayers, that crude oil will not permanently tank and become near worthless. Not much else. We produce nothing. Yes, we agree. But more important is the fact that to start to produce anything tangible and worth placing on international markets asides from Okra, Cassava, Beans, Goat, Cocoa, Sorghum, Yam, and Sesame Seed (where we ran among top 5 exporters in the world), it will take time, concentration, education, sheer force of will, stability, resolve, seriousness of mind, national unity, courage, and I may be wrong, but I think we may need some secrecy as we have too many local and foreign detractors who are there to ensure this country never succeeds. This also reminds me of a WhatsApp arguement I had this morning with a Nigerian in diaspora. A short writeup on WhatsApp had gone viral wherein the life of Muhammad Okoro Gbenga, a fictional Nigerian, was examined. His entire life revolves around foreign products (and that is all of us). My diasporan Nigerian friend tried to say it was okay so long as he bought Garri and Melon in Nigeria. I had to painfully retort that it was not okay, and David Ricardo’s 1817 concept of Comparative Cost Advantage was indeed quite expired. Nigeria has to start producing complex product, the emphasis being on START! Otherwise even our tenth generation from today will remain slaves to the world.

The quest for double-digit GDP growth rate for Nigeria is also supported by economic theory. The Phillips Curve and the underlying theory says that there is an inverse relationship between unemployment and inflation rate because the more the unemployed people a country has on the streets, the less money they have in their hands to spend, and so inflation tumbles, and vice versa. Okun’s Law also states that 1% reduction in unemployment rate can generate 4% growth in GDP. Whereas there are contentions to these two theories, they hold a lot of truth for a less-sophisticated economy like ours.

Advertisement

FLOATING TO ZIMBABWE

So, I want readers to have the imagery of one of those kites we used to be so delighted to fly as kids. If your kite gains altitude and you lose your thread, forget it. That is what will happen if we float the Naira and this is why: 1. No anchor – no products as I had discussed above. Nigeria is NOT China. Not in history, not in discipline. Not in deeds. Not in culture. Not in tastes. So pulling up the example of China as a country that deliberately depresses its Yuan so as to export more, will not work. We have nothing to sell. We haven’t started to produce that which we could export competitively.

2. Historically, there is no backup for the idea of a country like Nigeria floating her currency. Meaning that speculators home and abroad will know that the Naira will first float to at least N1,000 to the dollar for starters, and that we have started a game we cannot finish. George Soros’ cleaning out of the British Pounds in 1992 will be a child’s play.

3. By the time it hits like N1,000, or even before, all hell will be let loose as even mai-barrow or Alaarus in the market, who help offload stuff, will demand for dollar

Advertisement

4. In a small space of time, once total confidence is lost, Naira can exchange for N5,000 to the dollar and we will not remember where we started. It could exchange for even N50,000 to the dollar.

5. Maybe that is when we will realise that currency management is really such a fragile affair, largely dependent on perception. Yessir. For currencies, perception is indeed reality.

Advertisement

ERUOBODO’S MESMERIZING TAKE ON PURCHASING POWER PARITY

Another personality who captured public imagination about the value of the Naira, and whose take merits an economic policy consideration is a gentleman who signs off as Eruobodo (which in Yoruba means a river is never afraid – you know, it just keeps on flowing). Lanre Oyenuga Eruobodo (a senior friend) penned a pensive article lately wherein he compared the values of what we buy in Naira with what one can buy with the US dollar. This is called Purchasing Power Parity in Economics. I have seen professors argue that all we need to do to set a value on the Naira is look at PPP. However the PPP is also flawed because people in two different countries do not place same value on same things (like food, clothing etc), and so you cannot compare like for like. Therefore Eruobodo should understand, that the reason why a can of Coke is $1 in the USA and N150 (or a third the price here) is because of the cost of factor inputs largely. If we had to import the Coke, we will have to buy at best at wholesale price in the USA and not be able to sell less than N450 per can. I have seen a few government officials use Eruobodo’s analysis to justify the fall in the value of the Naira. No, no, no! That is dangerous. There are many things that are cheaper to get even in the USA than here in Nigeria. It is a confusing labyrinth to contemplate. I remember that there was a time when a one litre bottle of water sold at 1.5 dirhams in the UAE and Naira then exchanged for N40 to the Dirham. Water was more expensive then in Nigeria than in UAE, a desert country. N60 water in Dubai was N100 in Nigeria

Advertisement

MOGHALU’S TAKE ON NAIRA DEVALUATION

I also read Prof. Kingsley Moghalu’s take on the Naira value in his article titled “How Subsidizing the Naira Blocks Nigeria’s Economic Takeoff”. His views are also liberal and he believes we should float the Naira freely. I disagree for reasons stated above, but I need to point out the fact that contrary to Moghalu’s views, exports may not grow as a result of allowing the Naira float or devaluing the currency. In fact, that was what they told Nigerians in 1986. I recall that a number of my Uncles went into the export business and many got their fingers burnt. What they weren’t told was that we were a little short on international standards. Many of the crops they exported were discounted or outrightly dumped and discarded for failing ‘phytosanitary conditions’. They also missed it in the area of measurements. Since 1986, the world has evolved and I doubt if there is much Nigerians can export from here that will command more demand as a result of a cheaper Naira. There is also what is called the Marshall-Lerner Condition. The theorist propounded that for devaluation to work, a country’s exports MUST be price elastic i.e. that the world should want to buy more than one unit as a result of say a 1% reduction in the price. Our main export is crude oil, which price is set by traders in futures market and everything else – including production quota – is controlled by OPEC. Crude oil is certainly not price elastic and will not benefit from a naira devaluation. There is also this assumption that if we allow anyone bring in any good, our Customs will collect more tariffs. The reality however, is that as we know, our Customs is one of the most corrupt entities ever. As we speak, they have rackets which change the HS Codes on high quality VSOP Whiskies to that of fruit juice. They undercut the country and smile to the bank. Any aspect of the policy we propose, that expects the government and its agencies to sit up and do right, is dead on arrival.

Advertisement

WHAT THE CBN SHOULD DO?

So, the CBN should understand that any market will have end users, speculators, day-traders, hedgers, arbitrageurs and long-and-short-term investors. There is no point fighting arbitrageurs and speculators openly. In fact, the CBN should act as if they don’t exist, while devising ways of clipping their wings underneath. In advising the CBN, I always pull out the 3 Generations of Currency Crisis as taught in International Finance.

Generation 1 crisis basically says if you fix your currency, speculators will attack and make you shift your position. Nigeria has not fixed her currency, BUT the pronouncements by the CBN is akin to doing so. The CBN governor should never assure the market that we will defend our currency. It should be a subtle given. Even the USA has ways of defending the dollar. Yes, they do. The USA will never sit by and watch the dollar fall to levels unknown. The Dollar is a global reserve currency. When people like Saddam and Gaddafi wanted to start selling their oil in other currencies, the USA took them out. Call it conspiracy theory. You are on your own. No one jokes with their currency. Margaret Thatcher in 1990 once addressed a bunch of British businessmen, and echoed Stalin by saying, “to destroy a country, first debauch their currency”. No one could be more liberal than Thatcher.

Generation 2 crisis is about ‘Self-fulfilling prophecy’. It says that when there is rumour that a currency will be devalued, it will end up being devalued. This is where perception management comes in. in the case of Nigeria the rumour has always been that the Naira will be devalued. From N1 = $2 in the early 1980s see where we are today? All we have ever done is go down, down, down. The CBN, being the custodian of the Naira should not openly try and influence the perception as that shows a sign of weakness and defeat. Also, the CBN can work on psychology. When the economy is going great, it can decide to revalue the Naira by strengthening the currency a bit. This tells speculators that it is not a one-way devaluation street. A lot of subtle engagements is required on the part of CBN.

Generation 3 crisis is not very important for our analysis as it pertains to when countries borrow short term money from abroad and lend for long-term projects as it happened in Thailand in 1984, thereby causing the Asian Currency and Economic crisis of that period. But perhaps it is an indication that we must be careful of our foreign borrowing as we may be needing a whole lot more Naira when they are due. These guys running the economy today will be dead and/or gone. Someone should write down their addresses in the villages they hail from.

WHY DID THE BRITISH SET THE NIGERIAN POUND/NAIRA AT PAR?

I have been asking my liberal friends; apart from the usual allusion to wickedness – which may not be true – why do we think the British upon departure set the value of our Nigerian Pounds at par with the British Pound? Note that we relied very much on not only Britain’s economic expertise, but also on their engineering and administrative prowess. Our first bridges and roads were constructed by them, and of we had to repay, we paid back Nigerian Pound – and later Naira – for Pound. I recall a World Bank document for the first Nigerian road project financed by their loan, in 1965. The Nigerian Pound was equivalent to $2.80! Our currency was almost thrice the value of the US Dollar (see attached)! By all means it would have been a bit easier to repay such loans. What happened later? When did the Brits and Americans start getting the idea that our currency was overvalued and needed to be constantly devalued? Is there an end in sight?

NIGERIANS, NOT ONLY THE NAIRA, HAVE BEEN DEVALUED

Somehow, the straight-line devaluation of the Naira seemed to have coincided with a devaluation of the Nigerian people. At the end, for a country that does not produce even the basics, devaluation means that more and more of our children will be deprived of milk, sugar, and cereal, and basic hygiene. More of them will get stunted and their brains, underdeveloped. It means a bleak future for them, and for the country. So, don’t jubilate because your children are well-fed. At the end of the day, devaluation means that options for the people are daily more limited. It means that more of our people will wear rags, or at best, clothes and underwear abandoned by dead people in other countries and pushed into Nigeria as ‘Okrika’. It means our people will be shut out from the rest of the world, and live a substandard existence, because their currency can buy nothing. A lesser proportion of Nigerians can travel abroad today, compared with those who could ten, twenty years ago. Devaluation is meant to anger a people until they protest and change government. Devaluation is a painful trajectory. Are we ready?

I started to ruminate about what countries like ours should do. If every country starts out on a tabular rasa, with not much to export to the comity of nations, what does she do? If you set your currency strong from get-go, maybe in order to get equipment and machinery to kickstart your development, at what point do you embark on a quest to find the true value, basically weighing your economy, historical, present, and future prospects, against those established and deep economies? Our people say until the hand of the child grips the handle of a sword, he shouldn’t start inquiring about what kind of death killed his father. Even if his hands were firmly on the hilt, or shaft of that sword, I think he needs to be vigilant lest his opponents have bigger, better swords or are so many as can overwhelm him. This I believe, is the situation that Nigeria and many developing economies, especially in Africa, find themselves.

My advise is that we continue managing our currency, howbeit very subtly with the CBN saying very little, while we stop our unnecessary ego-driven spending, and get on a program whereby we can bring serious productivity to this economy, encouraging our youths, innovating what we have, moving on to more complex production, and hopefully, one day we will float the currency but like the good old kite, we keep a hand on the thread. This is why I support CBN’s curb on the 43 products like rice, maize, milk, fish, Indian candle, toothpicks, etc, that it had decided not to support. We must jumpstart our economic complexity for crying out loud! I know that our sincerity is in question, and a country with no unity among its people will only work to destroy itself from within as we are presently doing. Still there is hope. The alternatives proposed by my egbon Mustafa Chike-Obi on Naira management, may however see our kite landing all the way in Mugabe’s Zimbabwe, once we snooze. Still I thank him for that take on double-digit GDP growth.

Views expressed by contributors are strictly personal and not of TheCable.

2 comments

Frankly, you are not that smart and too different from the current mismanaged of our fx policy Emefiele.

You claim the naira will experience a free fall if floated, whereas historically, countries who experienced severe currency crisis often did so because they tried to artificially prop their currency, Venezuela is a case in point.

In proving your points, you had to rubbish age old concepts like GDP and PPP, to show your lack of understanding of the subject matter.

You should have stuck to writing about politics.

Frankly, unimpressive write up

Perhaps it made no sense to you but it does to me and maybe a number of other readers. I also disagree with the idea of totally floating the naira. A very precarious move as we hardly have any export of significant volume and depend on imports for so many other things.

Can you imagine the number of our populace that will be able to avoid say a month supply of diabetic drugs if it goes for 100,000 naira for each month supply. Floating the naira — the classic textbook recommendation you are all spouting fails to take into cognisance the poverty level of Nigerians presently. Floating the naira is death.