The Federal Inland Revenue Service (FIRS) says it collected a total of N1.782 trillion as tax revenue between January and July 2017.

This is even as it has projected a total of N1.8 trillion value added tax (VAT) collection for the 2017 fiscal year.

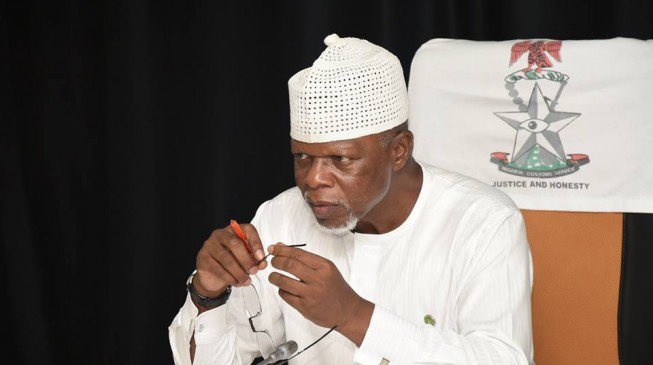

Tunde Fowler, FIRS executive chairman, made this known on Tuesday while presenting the agency’s budget before the senate committee on finance.

He said the revenue from the first half of 2017 represents an increase of N224.140 billion in tax revenue when compared to the N1.558 trillion collected within the same period in 2016.

Advertisement

The revenue consists of N636 billion from petroleum profits tax (PPT) and N1.146 trillion from non-oil taxes companies income tax (CIT), value added tax (VAT), stamp duties among others.

This is bigger than the N504,834 billion recorded from PPT and the N1.053 trillion from the non-oil sector within the period under review in the preceding year, Fowler also said.

A breakdown of the revenue showed the FIRS collected N551.690 billion in CIT as against 514.840 billion in 2016, N467.710 billion from VAT as against N396.510 billion in 2016, N58.936 billion in education tax (EDT) as against N34.817 billion in the preceding year.

Advertisement

Further breakdown showed the service also collected N4.841 billion from stamp duty (SD) as against N2.701 billion in 2016. N936,300 million in capital gains tax (CGT) as against N72,821 billion in 2016.

The service said it remitted the sum of N54,226 billion to the consolidated account within the period while it remitted N26.145 billion in the preceding year.

Fowler also told the committee that the service’ budget is focused on capacity to increase VAT and other non-oil revenue areas.

“The Service in realization of this responsibility and challenges of doing manual collection, have automated VAT collection for the critical sectors of the economy notably telecommunications, airlines and financial institutions,” he added.

Advertisement

1 comments

Thank you Mr.Fowler for your wonderful achievement.