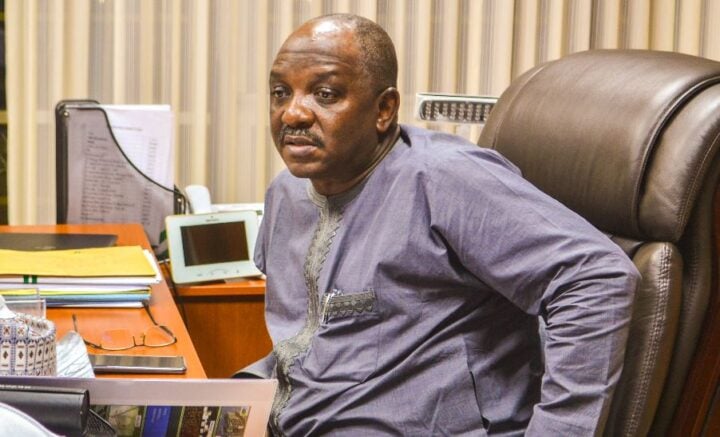

Godwin Emefiele, governor of the Central Bank of Nigeria (CBN), says the disbursement of its N500 billion facility to support non-oil export oriented companies remains minimal.

Speaking on Tuesday in Lagos at the RT200 Non-oil Export Summit 2023, Emefiele said only N243 billion worth of loans have been drawn.

This implies that the remaining N257 billion have not been given to any exporter.

Speaking at the event, the CBN governor said about 95 percent of the loans worth N243 billion were given to large companies.

Advertisement

He said that small exporters actually want to access credit but have been unable to because of the high risk acceptance criteria of banks.

“We (CBN) are ready to break our back to ensure that we provide all the resources that you need for you (exporters) to achieve your goal. That’s the reason we said when we launched this programme that we have about N500 billion available for you as an export facility for you to do whatever you want to do, whether you want to export some plants to process or export some materials,” the CBN governor said.

“I must confess that disbursement of that facility as of today is still suboptimal.

Advertisement

“We will like to encourage you and indeed, this meeting is an opportunity for you to name and shame any bank that you have spoken to and they have not responded to you. So that we can appeal to that bank to be more responsive.

“By being responsive to what you want, we are able to source export proceeds that helps our economy.

“We will also be able to generate export proceeds that weans us from depending on the Central Bank of Nigeria as a source of foreign exchange to meet our imports. It is a dream and I pray that it comes through.”

Emefiele assured that the CBN would come up with a set of guidelines that would enable small exporters to access the N500 billion export facilitation loans.

Advertisement

He said the apex bank would also bear 50 percent credit risk.

“We want to support small businesses that truly want to export and I think that an arrangement for 50:50 risk sharing, we will extend it to small exporters and we will categorise them. If it’s a large company, we’re not going to share credit with you,” the apex bank governor said.

“We will only share credit with the small borrowers just like we did for the anchor borrowers’ programme.

“We’re going to come up with some kind of guidelines for the small companies that will benefit from the risk sharing because that is the only way we can really truly support the small businesses.”

Advertisement

Add a comment