The naira has continued to gain momentum against the dollar after the Central Bank of Nigeria (CBN) intensified the clearance of backlog of foreign exchange forward.

An FX forward contract is a bilateral agreement where one party (the seller) agrees to sell FX to another party (the buyer) at a predetermined settlement date in the future and at a strike price, which is fixed at the time of entering into the contract.

It is also a binding contract in the FX market that locks in the exchange rate for the purchase or sale of a currency on a future date.

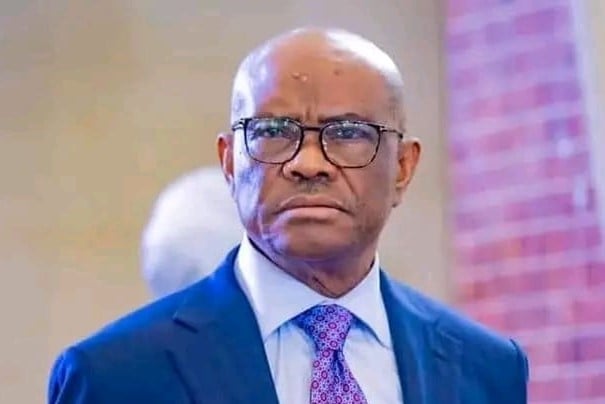

Minister of finance and coordinating minister of the economy, Olawale Edun, had disclosed that up to $6.8 billion of overdue forward payments in FX needed to be addressed before the naira could stabilise.

Advertisement

Edun noted that resolving the overdue contracts would allow the naira to strengthen and “pave the way for additional foreign exchange flows.”

He said, “The issue we have now is that the market is not liquid enough. We are committed to encouraging liquidity based on reforms that have been made at the moment, on the fiscal side and the monetary side.”

However, the chief executive officer of a new generation bank, said FX forwards have been cleared since last week, with a promise by the apex bank that before the end of the month, a substantial amount of the outstanding FX forward obligations would have been settled.

Advertisement

According to him, the latest move would usher in improved FX liquidity in the market, adding that in the coming days, the naira would rebound, but warned of currency speculators to desist from economic sabotage.

“For the smaller Nigerian banks and the foreign banks, the CBN cleared not less than 80 per cent of their FX forwards. But for the big Nigerian banks, they just started clearing ours and the central bank has cleared about five to 10 per cent of the FX forwards.

“The plan is that in the next two weeks, they would clear 30 per cent for the big banks. So, they are injecting liquidity into the system and there is a scheme of arrangement to take care of the balance.

“The banks are happy and this has certainly started driving up confidence and we are certain that in the coming days, FX speculators will lose their shirts.

Advertisement

“Realistically, the naira should be trading between N700 and N800/$ if not for the activities of those that are pushing the speculative attack on the naira. So, I am telling them to be careful and they must desist from such acts,” according to the Bank CEO who pleaded anonymity.

Add a comment