To the surprise of a large percentage of even the best of analysts, the federal government finally “liberalised” the pricing of petrol on Wednesday. It will now sell for N145 per litre to encourage marketers to resume importation.

This is coming four years after former president Goodluck Jonathan tried the same policy but was vehemently opposed by protesters, leading to the “Occupy Nigeria” rally of January 2012.

Here are the things to expect if the federal government is to follow through with comprehensive reforms.

“OCCUPY NIGERIA”

We certainly expected that pump price would surge after the liberalisation of the market, but we didn’t expect a ceiling of N145, since the Petroleum Products Pricing Regulation Agency (PPPRA) template said only a few days ago, that the actual cost is N99.38 per litre.

Advertisement

However, that seems to be the case. If the official ceiling is N145 per litre, one can imagine how much petrol would be sold by oil marketers. Inflation is inevitable.

Less than three hours after the announcement was made, #OccupyNigeria started trending on Twitter, and may trend in the country over the next few days or weeks – across the country.

The labour unions are gearing up already…

Advertisement

INCREASE IN MINIMUM WAGE

After back-and-forth discussions between the government and the labour unions, to dissuade them from embarking on a nationwide industrial action, the government may offer to lift the minimum wage to cater current economic realities.

The N56,000 demand by the Nigerian Labour Congress (NLC) may not be met, but the government would most likely pacify workers with better pay.

But since many states are owing workers, how will a wage increase work out?

SALE OR CONCESSIONING OF REFINERIES

Advertisement

Ibe Kachikwu, minister of state for petroleum, says Nigeria is currently speaking with Total, Chevron and Agip on a partnership deal to ensure Nigerian refineries function optimally.

With current realities however, Nigeria may sell the refineries to these companies or strike a deal with them as concessionaires to turn the refineries around.

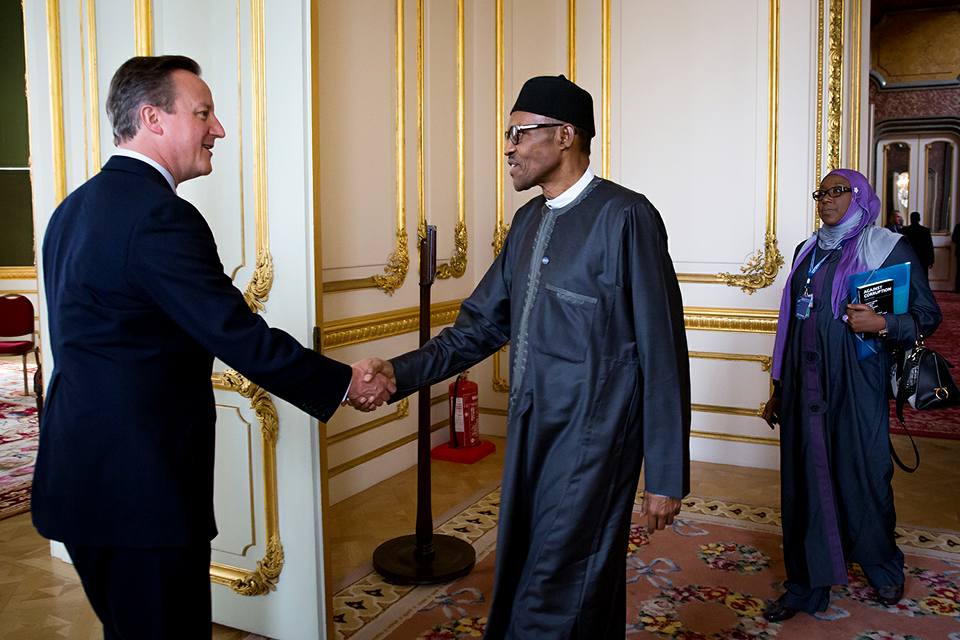

Kachikwu has always expressed his opinion to sell, but Buhari thinks otherwise. However, with Kachikwu’s school of thought prevailing, the president may let go of his staunch support for state-run refineries.

“Personally, I will have chosen to sell the refineries, but President Buhari has instructed that they should be fixed,” Kachikwu said in September 2015.

Advertisement

TOTAL DOWNSTREAM DEREGULATION

The timing may not be right, considering economic hardship in Nigeria, but liberalising the market is a smart move for the total deregulation of the downstream sector.

The senate may now be forced to pass the Petroleum Industry Bill (PIB) to allow for total deregulation of the downstream oil sector. This move is de-facto deregulation.

Advertisement

APPLAUSE FROM IMF, WORLD BANK

The International Monetary Fund (IMF) and the World Bank will literally pat Nigeria at the back and say, yes, you took the right decision.

Both bodies have always called on Nigeria to liberalise the market and encourage carbon pricing.

Advertisement

“A vibrant economy still has to deal with a lot of poor people with a lot of inequality and those two components should always be the driver of reforms, whether it is looking at subsidies and how they are structured and how they can be phased out,” Christine Lagarde, IMF MD said while visiting in January.

The World Bank corroborated the IMF by saying low oil prices should encourage the president to liberalise the market. Both financial institutions would definitely applaud the government for this move.

Advertisement

DEVALUATION OF THE NAIRA

This is not to take anything away from President Muhammadu Buhari and his economic team, but to prepare for the days ahead. The president has said time and again that poor Nigerians will not have to pay for more until palliatives are in place, adding that pump price will not be increased, as it would hurt Nigerians and the economy.

When asked to remove subsidy, the president said: “I have received many literature on the need to remove subsidies, but much of it has no depth”.

“When you touch the price of petroleum products, that has the effect of triggering price rises on transportation, food and rents. That is for those who earn salaries, but there are many who are jobless and will be affected by it,” Buhari said in 2015.

In the same manner, the president has said time and again that the naira will not be devalued.

Perhaps if superior argument is presented or straining economic situations prevail, like in the case of fuel scarcity and subsidy debate, the president may change his mind on devaluation of the naira.

Moreso, with minimum wage up for increment, the easiest way government can get more money with same resources is via devaluation. With devaluation, $1 billion from the federation account, becomes N300 billion, rather than N197 billion.

LONG-TERM ECONOMIC RECOVERY AND BOOM

The times may be hard now, but with deregulation of the downstream sector, the future is bright. First, Nigeria will stop spending 40 percent of its scarce foreign exchange on importation of fuel if refineries spring up in record time. Dangote refinery may be forced to come on stream earlier than the projected 2018 to keep up with competitors who will come in record time.

The competition will be stiff, jobs would spring up, government revenue from oil taxes will increase, Nigeria may actually shift focus from oil, if the president remains true to his resolve to diversify the economy.

Competition will set in. Just like no one would have believed in 2003 that SIM cards will sell for free, 1 gigabyte of data will sell for N900. The parrallels may not follow in the same manner, but the principles are the same.

When competition sets in, supply rises, demand falls, and the pump price of petrol may fall below N100 (without subsidy) before you get to say Muhammadu Buhari.

All is well that ends well.

1 comments

Na una talk so o!