Nigeria’s naira fell to a record against the dollar, stocks dropped and bond yields rose after the elections were postponed, increasing risks in an economy already under pressure from the slump in oil prices, Bloomberg reports.

The naira retreated 0.6 percent to 195.25 per dollar by 1:55 p.m. in Lagos, depreciating for a sixth day to the weakest level since Bloomberg started compiling the data in January 1999.

The 195-member Nigerian Stock Exchange All Share Index dropped 1.7 percent to 29,466.56, extending its decline this year to 15 percent, the worst performance in the world after Ukraine.

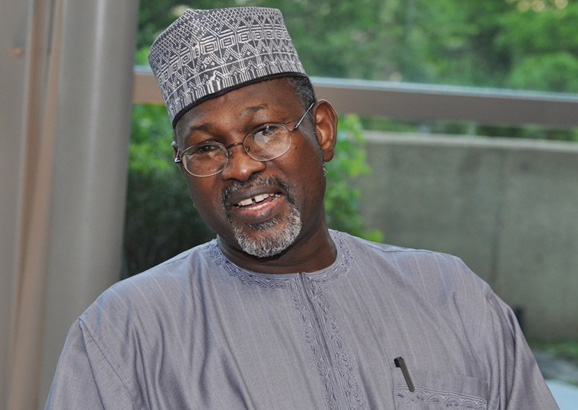

The elections were moved to March 28 and April 11 from the original dates of February 14 and 18 by the Independent National Electoral Commission (INEC) on Saturday.

Advertisement

“This is just going to increase the uncertainty in Nigerian markets,” Ridle Markus, a strategist at Barclays Plc’s South African unit, said by phone from Johannesburg.

“While the increased violence is a big concern, investors’ more immediate focus has been on the impact of lower oil prices on the currency and public finances. They need to get some sense of where this currency is heading to make a good judgment call on investments.”

Yields on Nigeria’s $500 million of Eurobonds due July 2023 climbed 23 basis points, the most since January 21, to 7.35 percent.

Advertisement

The naira has slumped 17 percent against the dollar in the past six months, the most among 24 African countries tracked by Bloomberg.

The currency could fall as low as 200 per dollar Monday, Kunle Ezun, an analyst at Ecobank Transnational Inc., said by phone from Lagos.

The Central Bank of Nigeria, which is scheduled to sell foreign currency at an auction Monday, may also sell dollars directly to lenders to support the naira, Ezun said.

Advertisement

Add a comment