The naira, on Friday, tumbled to N775 per dollar at the parallel section of the foreign exchange market.

The figure represents an depreciation of N27 or 3.6 percent compared to the N748 it traded two weeks ago.

Bureaux De Change (BDC) operators, popularly known as ‘abokis’, who spoke to TheCable in Victoria Island, Lagos, quoted the buying rate of the greenback at N765 and the selling price at N775 per dollar, leaving a profit margin of N10.

When asked about the reason for the decline of the naira against the dollar, a currency trader in the market said, “Demand has gone up. People have been coming to buy dollars.”

Advertisement

Meanwhile, at the investors and exporters (I&E) forex window, the local currency fell by 0.07 percent to close at N463.67 on Thursday, according to details on FMDQ OTC Securities Exchange, a platform where FX is officially traded.

The data also showed that forex worth $157.56 million were transacted among market dealers.

On Wednesday, the CBN monetary policy committee (MPC) resolved to raise the benchmark interest rate by 50 basis points to 18.5 percent.

Advertisement

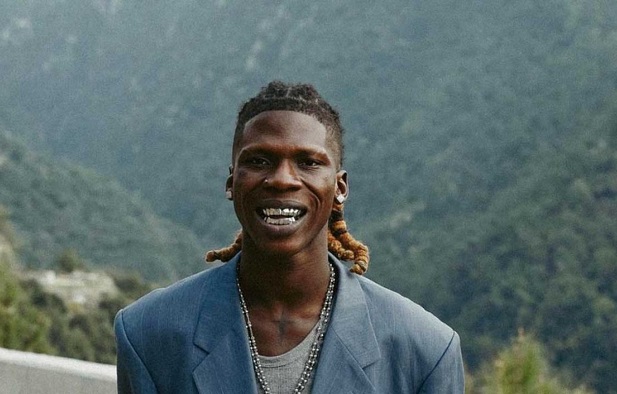

Godwin Emefiele, governor of the apex bank, who addressed journalists at the end of the MPC meeting, said the apex bank decided to further tighten monetary policy in order to “tame the rise in inflation.”

“In the opinion of the Committee, the key policy dilemma at this meeting was whether to hold or hike the policy rate marginally to offset the moderate increase in headline inflation,” Emefiele said.

“Considering the option of a hold policy, the Committee reiterated the empirical counterfactual evidence of a ‘do-nothing’ and believed that the rate hikes have indeed helped moderate the continued rise in inflation, albeit, month-on-month.

“In addition, the evidence revealed that the policy rate hikes have also moderated growth in new credit and reduced the pent-up aggregate demand contributing to the inflationary pressures.

Advertisement

“Members were unanimous in their conclusion, that the current policy stance is indeed impacting the targeted parameters and yielding the expected outcome, although slowly.”

Add a comment