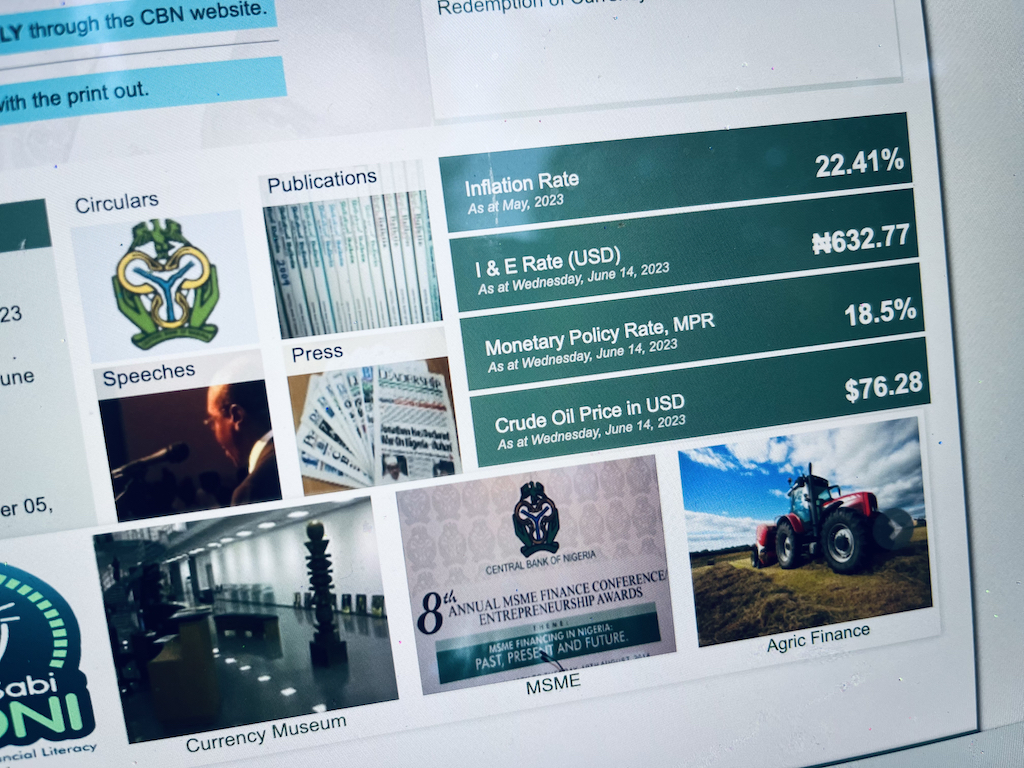

The Nigerian naira traded as high as 790 to the dollar at the investors and exporters (I&E) window on Thursday — about 24 hours after the float of the local currency.

However, the naira appreciated after hitting a record low at the FMDQ trading platform to close at 702 to the dollar.

On Wednesday, the Central Bank of Nigeria announced the unification of all exchange rate markets in the country, stating that every rate quoted will be decided by the forces of demand and supply.

Following the instruction of the bank, the naira depreciated to 755 per dollar but later appreciated to close at 664 to the greenback.

Advertisement

The market rate is expected to maintain a “willing buyer, willing seller” arrangement forthwith.

In a circular stating that the I&E foreign exchange (FX) window is now the country’s official exchange rate window, the CBN said the “operational hours of trades shall be from 9am to 4pm, Nigeria time.”

“Re-introduction of the “Willing Buyer, Willing Seller” model at the I&E Window. Operations in this window shall be guided by the extant circular on the establishment of the window, dated 21 April 2017 and referenced FM/DIR/CIR/GEN/08/007. All eligible transactions are permitted to access foreign exchange at this window,” the bank added.

Advertisement

“The operational rate for all government-related transactions shall be the weighted average rate of the preceding day’s executed transactions at the I&E window, calculated to two (2) decimal places.

“Proscription of trading limits on oversold FX positions with permission to hedge short positions with OTC futures. Limits on overbought positions shall be zero.”

Add a comment