The Nigerian national currency is currently trading at 197, 285 and 363 to the dollar at three different markets across the nation.

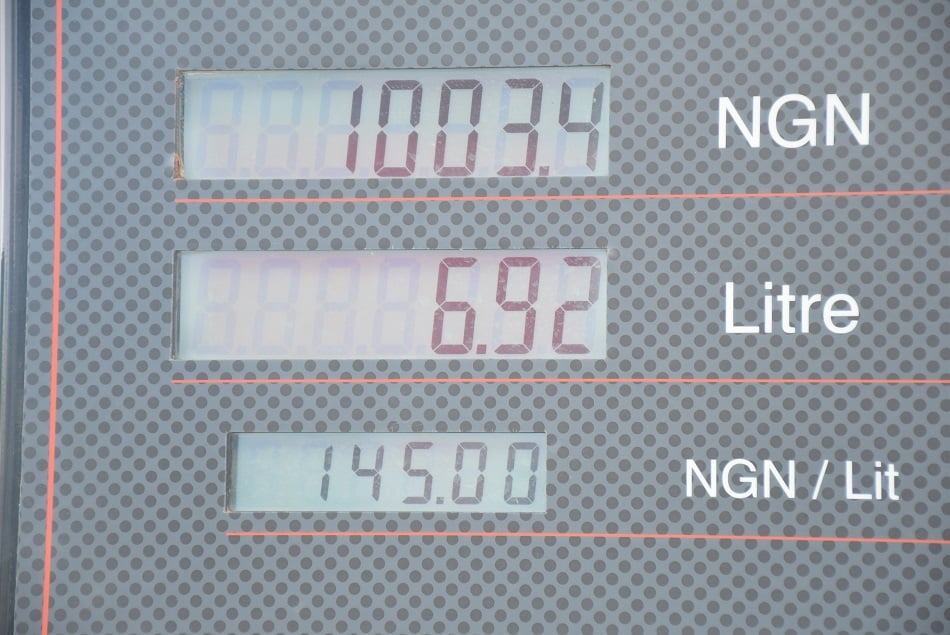

This is coming less than 72 hours after the federal government took the decision to increase petrol price to encourage marketers to import the product.

After the announcement on Wednesday, the naira crashed to 345 against the dollar at the parallel market, only to trade as high as 363 on Friday and Saturday.

BDC operators in Lagos complain that forex scarcity is biting hard at the parallel market.

Advertisement

The second market is seen as the semi-official market, which is the commercial banks’ interbank market. This market does not operate at the central bank’s official market rate.

According to Vice-President Yemi Osinbajo, the naira is currently trading at this 285 to the dollar at this market.

Speaking on the need to hike the price of petrol, Osinbajo said: “We realised that we were left with only one option. This was to allow independent marketers and any Nigerian entity to source their own foreign exchange and import fuel.

Advertisement

“We expect that foreign exchange will be sourced at an average of about N285 to the dollar, (current interbank rate).”

This interbank rate, which banks sell dollars to their customers and oil marketers, ranges from 285 and 310 depending on the bank.

The third rate, which is the CBN official rate, is currently 197 to the dollar.

A senior CBN official, who spoke to TheCable on Saturday, insisted that the bank had not devalued the naira, adding that a statement had been released to that effect, which is the stance of the bank.

Advertisement

With the existence of a three-tier foreign exchange market, the government may hold on to its plans not to devalue the naira.

This foreign exchange regime further encourages arbitrage and corruption, with customers and oil marketers being able to buy from banks at N285 and sell the same at the parallel market for N363.

The decision of the CBN is expected to be disclosed after its monetary policy meeting on May 24, 2016.

Advertisement

Add a comment