The naira on Monday continued to slide at the parallel market as operators of Bureau de Change (BDC’s) suffered low patronage.

It exchanged for N232 to the dollar on Monday afternoon as against its previous value of N231.

However, it appreciated at the official interbank window as it exchanged for N196.98 to the dollar as against its previous value of N197.

Meanwhile, traders at the parallel market expressed joy that business was booming as buyers of forex invaded the market due to their inability to meet the tight conditions at the BDC’s

.

The directive of the apex bank to operators of BDC’s to demand the Bank Verification Number (BVN) from their customers was stifling business for BDC operators.

Advertisement

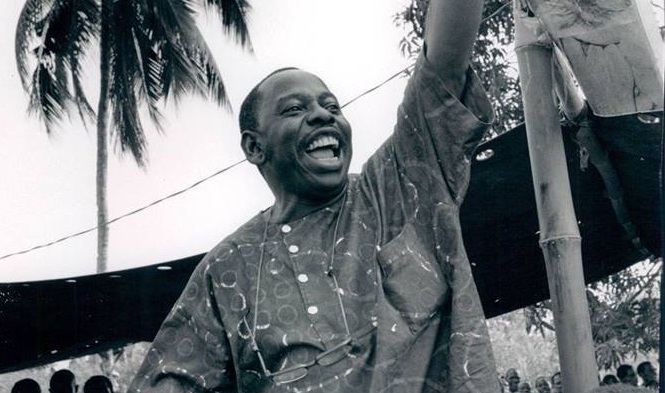

Meanwhile, Oscar Onyema, chief executive officer, Nigeria Stock Exchange (NSE), has advised investors not to panic over the current market volatility.

In an interview with NAN in Lagos, Onyema said the volatility was a “reflection of what is going on in the economy”.

He urged stakeholders to find a way to support the economy in order to revamp the market, saying the market is trying to be responsive to the economy.

Advertisement

“At every trade, we are trying to establish equilibrium in price, there is a different view to establishing that equilibrium in price,” he said.

“And an efficient market will take into consideration all available information in order to establish price.

“Given the lack of depth in our market, it’s easier for those views to show volatility in the market place. As our market becomes deeper, you are able to moderate that volatility.”

Onyema said the exchange would continue to promote price discovery, adding that market anywhere would experience volatility when there were fears.

Advertisement

“Even in a very deep market, when sentiment tends towards fear, when sentiment tend towards concern as to the growth potential of investment, you see higher volatility in the volatility measure,” Onyema added.

He called on investors to use the opportunity to increase their stake in the market, noting that “there are opportunities for investors to make money even when the market is going down.

“Higher volatility provides greater trading opportunity for the trading community. For us, the important thing is to find a way to support the growth of the economy such that the market will be a key player in driving the growth of the economy.”

Advertisement

Add a comment