Let me begin this with a disclaimer. I am a registered card-carrying member of the New Nigerian Peoples Party (NNPP). Let me also make it abundantly clear that my party and I are not against the Naira redesign policy. In fact, no sane human will. In the 21st century, we should go the way of the world. A cashless policy is the norm and has become the mainstay of most economies, both developed and developing. I applaud President Muhammadu Buhari for his resolve, determination, and commitment to conducting a free, fair, and credible election. There is the possibility that, if conducted successfully, these might be the talk about the legacy of the president.

Having said this, let me add that for a country of almost a million square kilometres, the time allotted to the policy is not just sufficient but practically impossible to cover within the period given. And this must be appreciated from the background of the level of the general inefficiencies of our system and how such reforms can be resisted, and in some instances outrightly thwarted.

Available data from the National Bureau of Statistics show that most households have an average of a minimum of five persons. What this clearly signifies is that most people struggle daily to get by. Living in Nigeria, daily, in itself is a challenge. This is something that the various political shades seeking power acknowledge hence the litany of issues they promised to do when elected into office.

The 1999 Constitution as amended accounts for the equality of states as per federalism, but even the blind can see that Lagos State in the Southwest for instance is not equal to Yobe State in the North East, or Ebonyi in the South East to Kano in the North West. Clearly, Lagos is much more urbanised than Yobe and the same is true for Kano and Ebonyi. What this invariably means is that Lagos is more likely to have better banking services than Yobe. The same argument can be made for Kano and Ebonyi. The service penetration is not the same and the data on banking services in Nigeria clearly shows this. In a sense, the more sophisticated a banking service is the more it is urban located. This is certain of major innovations in banking services, which again follow the logic of where money is concentrated.

Advertisement

While it is true that every government policy should be made for the benefit of the people, let me now quickly examine the Central Bank of Nigeria’s cashless policy vis-à-vis the unintended negative consequences and suffering it brought to the very people it claims to serve. And it must be repeated here that this is by no means an attack on the policy itself, as some have.

The Governor of the Central Bank of Nigeria, Dr. Godwin Emefiele, on countless occasions, explained the objectives of the Naira redesign policy and on no account did he make claims that are of political or non-economic reasons. The policy was purely monetary with expected positive economic outcomes for Nigeria. However, as all policies do, particularly when not thought through, they tend to become victims of their unintended consequences. The apex bank may have had good intentions to deliver on an otherwise operable monetary policy, but has the implementation created enumerable situations and countless hardships?

The unintended consequences of the Naira redesign policy are in the numbers, but what is amazing is the “neglect” or negligence by the Central Bank officials whilst framing the policy, the list of what could go wrong. A part of the nitty-gritty of general housekeeping of public policymaking is IF. The question must, therefore, be what could go wrong if we, that is the Central Bank, did this or that. The Nigerian apex bank missed a lot of signs, innuendos, which were obvious and in the open, and more importantly its capabilities. The responsibility of the Central Bank of Nigeria, for example, does not include the assessment of possible social disorder, and the disenchantments the unintended consequences of the redesign of the Naira caused. This again, showed, that the bank was working in a silo, not reaching, consulting, or collaborating. Perhaps, what it is, is that the Central Bank sought glory but brought gory tales.

Advertisement

It remains to be seen if the Central Bank of Nigeria considered what could go wrong if the Naira was redesigned at the time, it implemented the policy. This also raises questions as to whether the three months to complete the exercise was sufficient. Three issues are clear from this. First, whether the Nigerian banking infrastructure is as big as was thought of? Secondly, Did the Central Bank of Nigeria miss an obvious challenge or opportunity that there is still work to be done, regarding the depth and breadth of the country’s banking system? The Nigerian banking system has remained largely urban-biased and has evolved very little to serve infrastructures in rural areas. Perhaps, this is why the apex bank governor persistently complains about the quantity of cash outside the banking system. This clearly shows that there are gaps in the CBN’s efforts at providing banking services across the country. The banking system must innovate a new robust financial infrastructure that not only resolves many of the problems Nigerians are currently encountering but deepen and broaden inclusiveness and participation.

The question of the timing of policy is important. As much as it can be argued, and it has been, that there is no particularly suitable time to effect a change or redesign a country’s currency, the Central Bank Act is already clear on this. Thus, in some regards the monetary authority failed in the discharge of her responsibility on time, more importantly, to anticipate when. Here in lies the basis for the political interpretation of the CBN’s decision on timing. The question has therefore become about when and over what duration, and not about what. But, more importantly, policy makers must be able to anticipate the consequences, especially the negative unintended consequences. Across the country are Nigerians standing in long queues at ATM galleries across the country tempting to access the new currency notes. We have also seen videos of Nigerians stripping naked in banking halls, shouting and crying to access their own money. The comics in these, including the number of fights breaking out in banking premises and all the attendant hardships, beg the question. The failure in the exercise can be seen in the level of exploitation of citizens who try to access their own money from POS operators and various money agents.

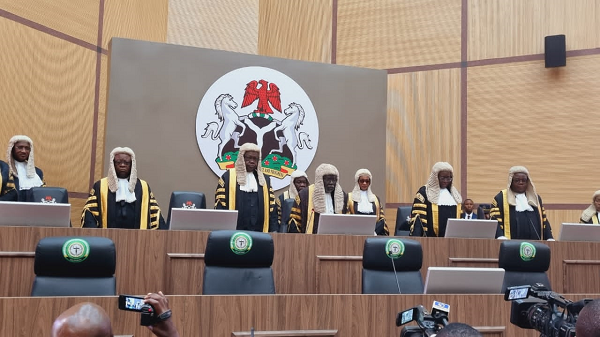

The only hope of the suffering traders, fishermen, civil servants, students and market women of Nigeria now is the Supreme Court exercising its original jurisdiction in the case of Attorneys-General of Kaduna, Kogi and Zamora States vs. Attorney General of the Federation.

Nigerians’ problems have never been the lack of brilliant ideas and plans, but the implementation of it. It is against this background that I humbly call on President Muhammad Buhari to urgently address the issues caused by the naira redesign by allowing the old notes and new ones to coexist side by side, otherwise, the very people whom you want to serve will be heading to their early graves in millions as a result of the unintended hardship. By the way, the people elected you and it is profitable to listen to their cries.

Advertisement

Vox Populi, Vox Dei!

Abdullahi II, a builder, entrepreneur and student of policy, is chief of planning & strategy, RMK Presidential Campaign Council.

Views expressed by contributors are strictly personal and not of TheCable.

Add a comment