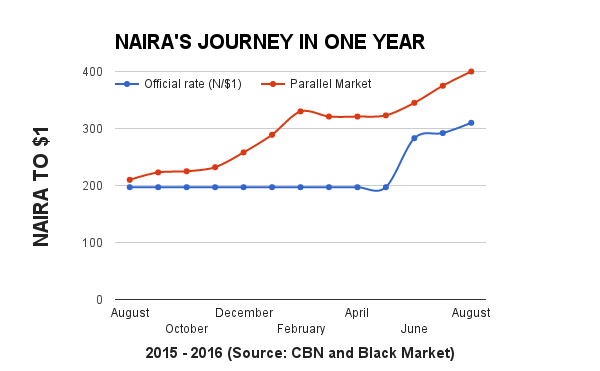

The naira has depreciated by over 91 percent at the parallel market in the past one year, TheCable can report.

On the official market side of the market, however, the currency fell by 57.4 percent within the same people.

The local currency traded for 209 against the dollar on August 3, 2015, while the official Central Bank of Nigeria (CBN) window traded the naira at 197 to the greenback.

Over the period of one year, the naira has seen a number of policy changes and plunge in oil prices, the mainstay of the economy, causing a summersault for the 42-year-old currency.

Advertisement

The naira, which was introduced by the Central Bank of Nigeria (CBN) on January 1,1973, fell to a 42-year low on December 11, 2015, trading at 260 to the greenback on the parallel market.

Since then, the local currency has been on a free fall, sinking to 400 against the dollar on Thursday.

Advertisement

Speaking to TheCable by phone from Abuja, Baba Ibrahim, a bureau de change (BDC) operator, said the local currency has been taking a downward swing on the black market, in the nation’s capital.

Ibrahim disclosed that the naira was selling at 505 to the British pound, while the Euro went for N415.

In Lagos, Nigeria’s commercial capital, the rates were significantly higher, owing to dollar scarcity at the parallel market.

In Lagos, a single dollar was trading as high as 400, while the British pound is going for 510.

Advertisement

The CBN quote for the official side of the market stood at N310, N414 and N347 to the dollar, pound and Euro respectively.

Over the past one year, President Muhammadu Buhari has shown that he remains opposed to the devaluation of the local currency, but eventually bowed to the CBN’s decision to let go of a 16-month old peg.

The CBN defended the naira at 197 to the dollar for 16 months, in what The Economist, a British newspaper, described as disastrous.

The apex bank initiated the floating foreign exchange in June, seeing the naira plunge by over 42 percent in less than two months.

Advertisement

United Capital, a financial banking firm in Nigeria, says the naira would settle at about 360 to the dollar by December 2016, while the parallel market will trade less than 400 to the greenback.

This is against the CBN’s “reasonably optimistic” N250/$1 settling point.

Advertisement

1 comments

The free fall on the Naira would have been worse if it is being traded on the Forex Market.

Fortunately, you too can earn in dollars:

http://Fans2Earn.com/?ref=41595