The Federal Inland Revenue Service (FIRS) says there is a need for collaboration between Nigeria and the Niger Republic to increase revenue collections.

Johannes Wojuola, special assistant on media and communication to the chairman of FIRS, said this in a statement released on Wednesday.

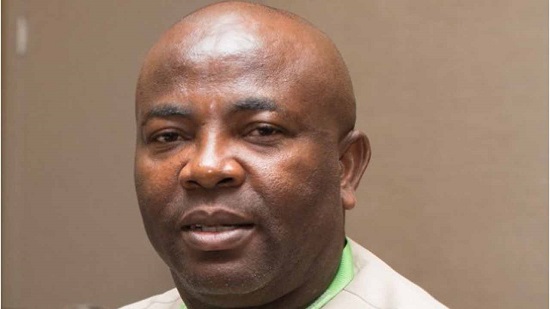

According to Wojuola, Muhammad Nami, executive chairman of FIRS, said this while receiving his Niger Republic counterpart, Mallam Mahamane, director-general of the Niger Tax Authority and his delegation in Abuja during a recent cooperation visit.

According to FIRS, recognising the long-standing relationship and shared culture and languages of the two countries is important for the agency to work with the Niger Tax Authority given the “presence of high-net-worth Nigerian individuals and companies trading in Niger with significant tax implications, which is of great interest to the FIRS”.

Advertisement

Nami also highlighted the working relationship enjoyed by the service and the Niger Tax Authority in the past, particularly on the community rule on double taxation and transfer pricing.

He said there was the need for further cooperation in the areas of sharing of tax information and mutual administrative assistance, especially in the face of an increase in trans-border tax within the context of ECOWAS and AFCFTA.

“We have focused on non-oil tax collection and indirect taxes, particularly VAT as well as on the deployment of technology for the automation of FIRS’ processes and procedures for effective tax administration and greater revenue yield,” Nami said.

Advertisement

“This technology includes e-stamping, e-registration, e-filing, e-payment, e-receipt, e-Tax Clearance Certificates, automation of Stamp Duty and VAT, deployment of VATrac—an automated VAT filing and collection system in the wholesale and retail sectors—and the deployment of a home-grown, integrated tax administration system, the TaxPro Max.

“One of the contributing factors to our improved revenue is the taxation of the digital economy through the implementation of relevant policies, legislation and administrative processes for the collection of taxes (both income taxes and VAT) from the digital economy.

“This ensures that Nigeria is able to collect taxes on non-resident companies that derive income from the Nigerian market, without physical presence. This further ensures tax equity for local businesses.”

The FIRS boss added that “the Service has evolved into a data-centric organization, leveraging data in revenue forecasting, planning, tax policy formulation and driving compliance and enforcement”.

Advertisement

He also said one of the contributors to the FIRS successes was the exchange of information it had with other tax authorities, both internally and in other countries as well as the FIRS being a customer-focused institution that has put measures in place to make voluntary compliance easier than ever for taxpayers.

Mallam Mahamane, director-general of the Niger Tax Authority, in his remarks, stated that there was an urgent need for international tax cooperation between the two institutions.

He noted that Niger’s tax authority is seeking a relationship with the FIRS that would cover cross border trade, the oil sector, the telecommunications sector.

Advertisement

Add a comment