Coke, Fanta prices to rise as FG imposes N10/liter excise duty on carbonated drinks

The Nigeria-British Chamber of Commerce (NBCC) has expressed concern over plans by the federal ministry of finance, budget and financial planning to effect a hike in the specific excise component of some products, including alcoholic and non-alcoholic beverages and tobacco.

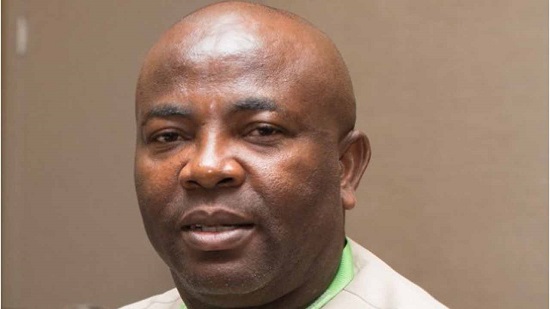

In a statement issued over the weekend, Bisi Adeyemi, NBCC president, said the move is a significant digression from the recently adopted 2022 fiscal policy measures and tariffs amendments (FPM 2022) roadmap, which covers the excise expansion from 2022-2024.

The NBCC called for a thorough review of the policy, considering its impact on the Nigerian business environment.

“While we understand and appreciate the need to improve federal government income, a holistic review of the peculiarities of Nigeria’s current micro and macroeconomic realities, as well as the impact of these on businesses and Nigerians specifically, should be undertaken,” Adeyemi said.

Advertisement

“This is to ensure sustainability and minimise the negative impact on the affected sectors, including the value chain, who will be the hardest hit.

“Long and medium-term plans and policies that will allow for the engagement and input of all stakeholders usually yield optimal outcomes.”

Adeyemi said the manufacturing sector is currently contending with sundry issues, which include skyrocketing energy costs, rising inflation, foreign exchange scarcity, poor and inadequate infrastructure, increasing difficulties associated with ease of doing business, and other headwinds that increasingly challenge competitiveness in the global market.

Advertisement

Quoting a recent report by the National Bureau of Statistics (NBS), she said that the value of manufactured goods traded for the second quarter of 2022 fell by 36% compared to the same period in 2021.

“Even as manufacturers adjust to the approved excise increase in the FPM 2022, the aforementioned conditions are being exacerbated by the fragile state of the country’s economy,” she added.

Adeyemi implored the federal government to retain the approved excise regime, as contained in the approved FPM 2022, covering the period from 2022 to 2024, and to urgently engage with the affected sectors, chambers of commerce, the organised private sector and other stakeholders.

According to her, any sudden hike in excise would be counterproductive.

Advertisement

“The benefits of the retention cannot be overemphasised, some of which include a steadily increasing tax contribution from the affected sectors which will be delivered by the 2022 FPM; these sectors are able to support the government’s objective of reducing the high rate of unemployment reported to be at about 33.3%, and improve the inflow of foreign direct investment as investors’ confidence is strengthened by government’s continuous demonstration of its willingness to create an enabling environment through stable and consistent policies,” she said.

“Insights from these discussions with the affected sectors, chambers of commerce, the organised private sector and other stakeholders should form the basis of well-rounded policies.

“Finally, we also implore the government to institute measures to plug current sources of revenue loss such as oil theft as this will reduce the over-reliance on taxes from a struggling manufacturing sector in the short term.”

Advertisement

Add a comment