A bundle of naira notes

Nigeria Deposit Insurance Corporation (NDIC) says it has paid an insured sum of over N1.7 billion to customers, following the revocation of licenses belonging to some microfinance banks (MFBs) and four primary mortgage banks (PMBs).

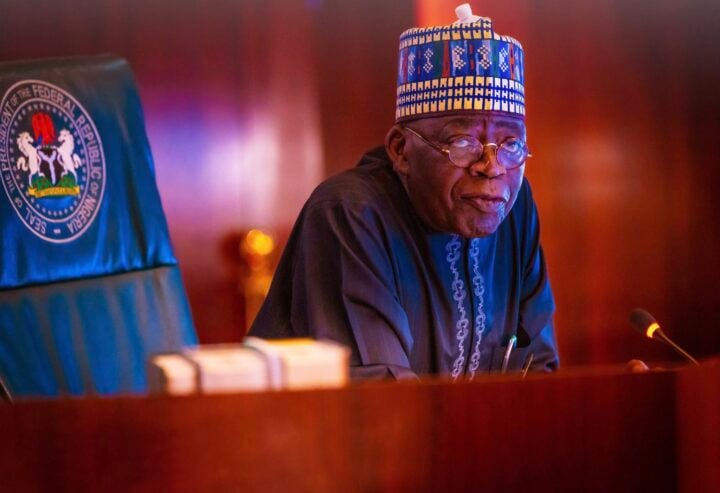

Bello Hassan, NDIC managing director made this disclosure at the 2023 NDIC editors forum, on Saturday in Lagos, NAN reported.

In May, the Central Bank of Nigeria (CBN) revoked the operating licences of some microfinance banks, finance companies, and primary mortgage banks.

Hassan highlighted NDIC’s successful efforts in compensating over 22,000 customers of closed banks.

Advertisement

“Recall earlier this year the Central Bank of Nigeria revoked the licenses of 183 institutions comprising Microfinance Banks and Primary Mortgage Banks,” Hassan said.

“And we quickly advertised and told affected depositors to get the required documents and come forward for verification so that we can pay them the insured amount.

“So, in terms of insured amount, we have paid more than 1.7 billion to more than 22,000 customers and we are calling on those customers that had no bank verification number attached to their accounts to come forward to get their claims verified so that we can pay them the insured amount.

Advertisement

“We are still on that. So, I’m using this opportunity to appeal to those depositors to come forward so that they can be verified and their claims paid.”

The MD also urged those who haven’t yet claimed their deposits to come forward and verify their details to receive their insured amounts.

He said the insured deposits represent the initial claim paid to depositors by NDIC in the event of a bank’s license revocation, with set limits of N200,000 and N500,000 per depositor per bank for the MFB and PMB sub-sectors, respectively.

Hassan said NDIC operations complement CBN efforts in maintaining a secure and stable banking system and supporting fiscal authorities in preserving stability within the broader financial system — which he said is crucial for economic growth and development.

Advertisement

Add a comment