The Nigeria Deposit Insurance Corporation has paid a sum of N6.825 billion to 528,212 insured depositors of Deposit Money Banks (DMBs) as at August 31, 2014.

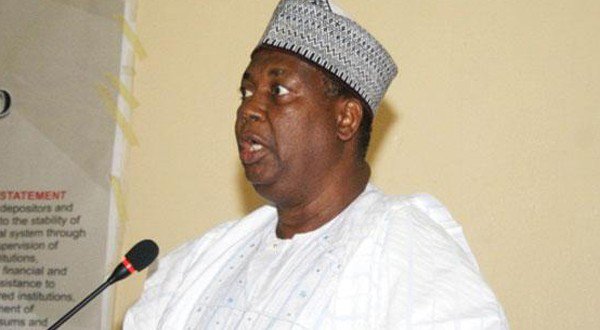

Umaru Ibrahim, chief executive officer of NDIC, said this in his keynote address during the NDIC special day at the ongoing Lagos International Trade Fair.

Similarly, a sum of N2.756 billion had been paid to 80,059 insured depositors of 186 closed Micro Finance Banks (MFBs) as at August 31, 2014.

He said the payment followed revocation of the operating licenses of about 48 insured Deposit Money Banks (DMBs) between 1994 and 2006, as well as 103 Microfinance Banks (MFBs) in 2010, 83 in 2013 and 26 Primary Mortgage Banks (PMBs) in 2014.

Advertisement

He reiterated that the core mandate of the corporation is to protect depositors, enhance confidence and foster the safety, soundness and stability in the financial system.

Ibrahim, who was represented by Kachollom Gang, head of NDIC’s strategy development department, further disclosed that a cumulative sum of N93.646 billion had been paid as liquidation dividend to 250,497 depositors with claims in excess of the insured limit as at August 31,2014.

“It is also gratifying to note that the NDIC had declared a final dividend of 100 per cent to depositors of 14 closed DMBs as at December 2013, indicating that all the depositors in those closed banks had fully recovered their deposits.” he said.

Advertisement

“I am proud to inform you that NDIC, as a deposit insurer, has also been effectively responding to all emerging issues in the global financial system, particularly financial literacy, consumer protection, financial inclusion, sustainable banking and extension of deposit insurance coverage to depositors of non-interest banks.”

Following the licensing of 24 Mobile Money Operators (MMOs) by the Central Bank of Nigeria (CBN), NDIC had considered as imperative, the extension of deposit insurance to the individual subscribers of the MMOs in the form of pass through deposit insurance, Ibrahim explained.

“The framework for making the pass-through insurance scheme operational is currently being finalised by the corporation,” he said, adding that the corporation had also created complaint units in the Bank Examination Department (BED) and Special Insured Institutions Department (SIID) to cater to the need of customers of DMBs, MFBs and PMBs who wish to lodge complaints.

Advertisement

Add a comment