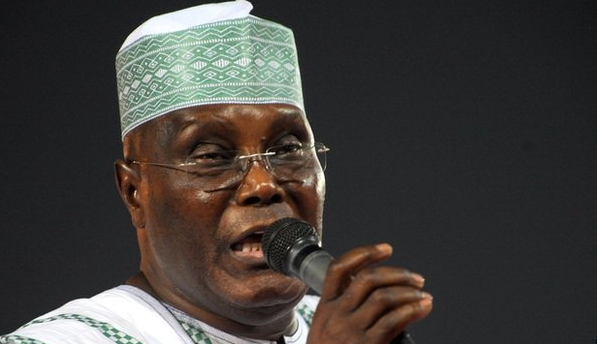

Pic.22. From Left: Chairman Senate Committee on Finance, Sen. John Enoh; Oba Riliwanu Akiolu of Lagos; Committee House Chairman on Finance, Hon Babangida Ibrahim And Executive Chairman, Federal Inland Revenue Service (FIRS) Babatunde Fowler, during a courtesy visit to

Oba Akiolu at his Palace, before the opening of FIRS 2018 on Monday (22/1/8).

00391/22/1/2018/Wasiu Zuber/JAU/NAN

The national economic council (NEC) says states are owing the Federal Inland Revenue Service (FIRS) N41 billion in value-added tax (VAT).

Badaru Abubakar, governor of Jigawa state, made this known on Thursday while briefing journalists after the NEC meeting, which was presided over by Acting President Yemi Osibajo.

He said that the council was hopeful that the indebted states would pay up, adding that there was an improvement in tax remission from states in comparison with that of last year.

“We had a briefing from the chairman of the FIRS and it dwelt on two aspects of tax issues; one is on the value-added tax(VAT) that is being collected by states,” he said.

Advertisement

“He informed the states what their positions are and the outstanding due to the states of about N41 billion.

“He believes the states have to pay; he came up also with new technique and system that will help automatic collection of taxes; both VAT and withholding tax; I think the states take and are willing to pay their outstanding.

“This is very important; when we are talking of zero oil, taxes become very important in the future prospects of this country.

Advertisement

“So far, he mentioned that from January to date, about N40 billion was remitted from the states, which has a significant increase compared to the what happened last year.”

Badaru said an audit was going on in many states on how to reconcile figures between what the states had and what the FIRS had.

According to him, with the initiative, automatically tax will be transmitted to FIRS from the states without delay.

Advertisement

Add a comment