The Nigerian Exchange Limited (NGX) says strengthening the development of the derivatives markets on the African continent requires accelerated investor education and capacity building.

Exchange-traded derivatives (ETDs) are standardised, highly regulated, and transparent financial contracts listed and traded on a securities exchange, and guaranteed against default through the clearinghouse of the derivatives exchange.

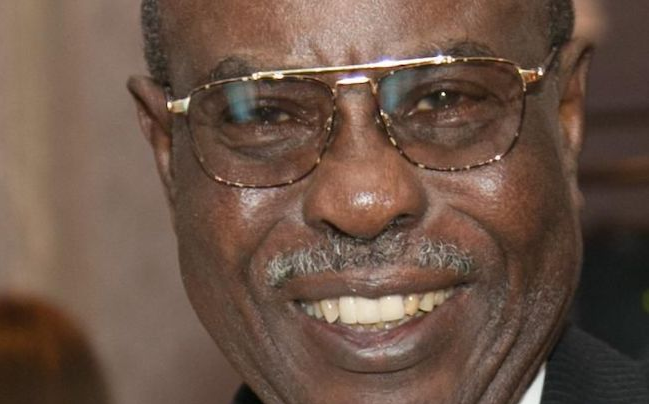

Speaking at a virtual capacity building workshop of the CFA Society, South Africa, Jude Chiemeka, the divisional head, capital markets at NGX, said the exchange firmly believes that the derivatives market will be deepened by introducing a broader range of product classes and intensifying investor education efforts.

The event was themed, ‘Building and Scaling Derivatives Markets in Africa’.

Advertisement

“Enabling the development of the derivatives markets on the African continent requires more investor education and capacity building,” Chiemeka said.

“Our markets are still in the nascent stages and investors need to be aware of the risks and opportunities that are inherent to derivatives. Stakeholder engagement and collaboration are also needed to catalyse growth.

“At NGX, we have organised various capacity-building sessions in partnership with major stakeholders in the capital market to educate investors on the intricacies of ETDs market.

Advertisement

“We also continue to drive conversations and engage regularly through forums and other marketplace development initiatives.”

Chiemeka said the exchange is assiduously working on the technology implementation and systems integration that will allow for seamless trading and clearing of the contracts.

“NGX is poised to accelerate the development of ETDs market in Nigeria and is committed to rolling out other derivatives contracts based on market appetites including single stock futures, interest rate futures, bond futures, currency futures, etc. The SEC has approved five NGX single stock futures contracts, the selection of these contracts were based on their market capitalisation and turnover within the last few years,” he said.

“We are confident that the introduction of single stock futures contracts will drive the desired liquidity in this market segment as seen in other derivatives market jurisdictions including Kenya, Thailand, India, South Africa, etc.”

Advertisement

On April 14, 2022, NGX introduced West Africa’s first exchange-traded derivatives market, commencing with equity index futures contracts based on the NGX 30 index and NGX pension index.

As of May 2023, the exchange said it has already listed ten contracts, with a trading volume of nine contracts valued at N16.48 million.

Add a comment