BY TUNJI ANDREWS

Friday welcomed more bad news for the Nigerian economy, as news filtered in that, MSCI (a US-based provider of equity, fixed income, and hedge fund stock market indexes, and equity portfolio analysis tools), had announced that they were considering removing Nigeria from their MSCI Frontier Markets Index.

MSCI also went ahead to give its reasons for the considerations, citing restrictions on currency trading and the resulting deterioration of FX liquidity impacting investors’ ability to repatriate capital. Not that this really comes as a surprise seeing that this had been rumored for the last six months, plus the fact that industry colleagues JPMorgan and Barclays had already removed Nigeria from their respective local currency emerging market bond indices.

This removal however, would hurt more, as although JPMorgan and Barclays track government bonds (which arguably would still find a market with Nigerian banks and PFAs), MSCI tracks equities; $480m worth of equities. To put that into perspective, that’s about N144bn’s worth of equities and about 2% of the already depressed Market capitalisation of the Nigerian stock exchange, put at risk.

Advertisement

You may then ask, what’s the big deal? Indications remain that international frontier investors still see Nigeria as a fantastic investment destination, but the continuous and persistent bad news coming out of its shores do not speak much confidence that this is the right time to come in. Much of the goodwill that was gained by the emergence of President Buhari has since been squandered, while investors have already begun to look to the future, when a reformist government can take the reins and create a more realistic currency regime that reflects current oil prices, while allowing the central bank to ease capital restrictions and gradually ease policy on the banks over time.

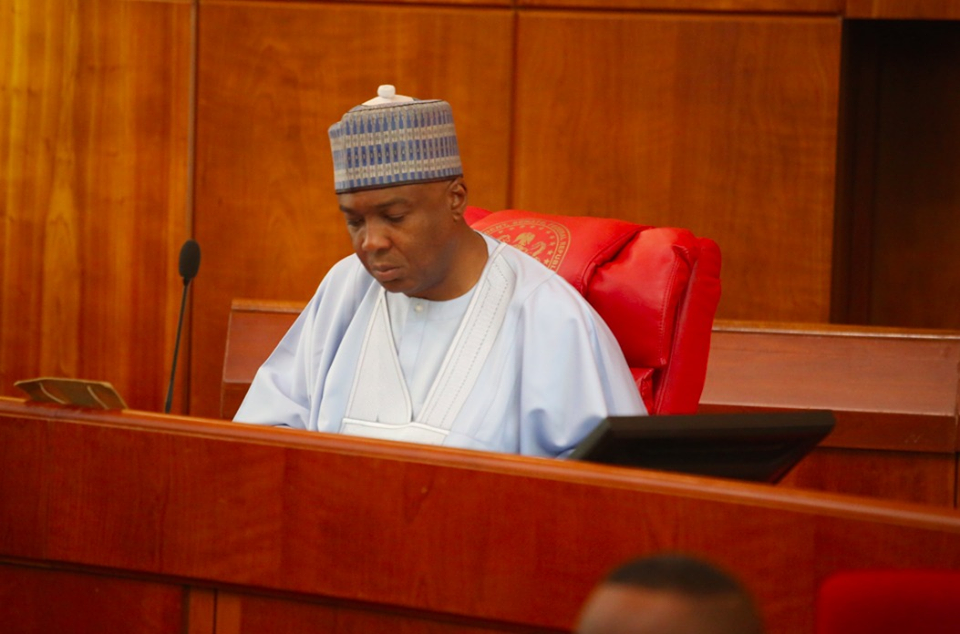

But, can the present government be 100% to blame for the inefficiencies of the Nigerian structural make up? Absolutely not, as Nigeria is a sum total of decades of making wrong decisions backed by greed and ethnic sentiments. Previous governments have failed repeatedly at taking the bull by the horn to fix what has now become a monster. The country’s lawmakers also can’t be exonerated, as having powers to create laws that can put Nigeria on the right path, have rather chosen to seat in their chambers, while stretching their necks into issues of the executive; even where they have zero jurisdictions.

Case in point would be the Senate ordering the Federal Ministry of Power, Works and Housing, NERC and the electricity distribution companies not to go ahead with the about 45 per cent increase in tariffs, but should revert to the former rates, a move that the Association of Nigerian Electricity Distributors stated was capable of crumbling the power industry, arguing that the country risked future blackouts if it was forced to go back to the old tariff regime.

Advertisement

Another example is the House of Representatives ordering that the N1.4trillion fine imposed on MTN by the Nigerian Communications Commission “must” be fully paid as against the N780billion the Federal Government negotiated with the telecommunications service provider. With the House expressing an unhappiness over the role played by the Minister of Justice and Attorney-General of the Federation, Mr. Abubakar Malami, in the negotiations leading to a reduction in the $5.2billion fine. The question to be asked is, to what end?

While speaking at the hearing, Vice- Chairman of Senate Committee on Communications, Senator Adeola Olamilekan (Lagos West) came with a document from the Office of the Solicitor- General of the Federation which detailed the commitment of MTN towards the settlement of the fine. According to the document, MTN committed that it will pay only N300 billion. A breakdown of the payment showed that, apart from the N50 billion already paid by the network provider into a recovery account of the CBN, MTN committed that it would pay another N100 billion via electronic transfers between December 31, 2016 and December 31, 2020. The proposal also includes another N80 billion proposed payment by MTN as a demonstration of its commitment to and confidence in the Nigerian economy, which would be subject to necessary regulatory approvals.

Should the National Assembly continue to push this cause, to which it has no jurisdiction to, it would amount to bullying and as the case is, send a fresh message to the global business community that Nigeria isn’t ready for business.

Ayo Bello, a Lagos-based business analyst and consultant, expressed sadness at the fact that the managers of the nation were doing a successful job at scaring away foreign investors. He said: “I wonder why we love shortcuts to success in Nigeria. The N1.4tn fine was announced and the National Assembly had already projected that amount as part of FG revenue. So now, the easiest way for the government to make money is to look for one scapegoat multinational that will commit a heinous crime and we slam a huge fine on it? While I do not support any act of criminality on the part of our multinationals, we should be careful not to scare away new investors and at the same time focus on how we can develop other areas of our economy to make things work.”.

Advertisement

The issue of the fine was raised by Jacob Zuma, South African president, when he visited Nigeria recently, a fact which shows that a lot of eyes globally are tuned unto the resolution of this issue; a resolution that would graphically paint Nigeria’s stance to business and foreign investors.

Andrews @TunjiAndrews, an economist, writes from Lagos

Advertisement

Views expressed by contributors are strictly personal and not of TheCable.

Add a comment