Brokers and dealers hail the President during his visit to the Nigerian Stock Exchange in Lagos, March 12

The Nigerian Stock Exchange (NSE) started the year 2019 on the red side, as the market shed N134 billion on Wednesday.

As at the last trading day of 2018, the market capitalisation stood N11.7207 trillion, only to fall by N134 billion to N11.5863 trillion on the first trading day of 2019.

The all share index (ASI) also fell from 31,430.50 on the last trading day of 2018 to 31,070.06 on January 3, 2019.

Diamond Bank came in as the biggest trader for the day, with 111.995 million in trades on Wednesday, ahead of Access Bank, Zenith Bank and First Bank Nigeria Holdings (FBNH), which were all well traded.

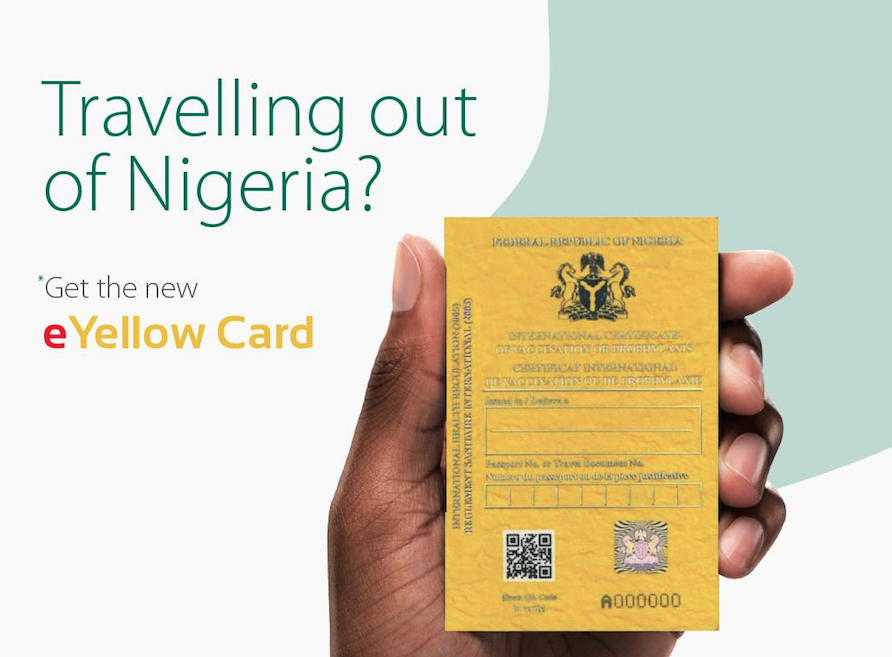

Advertisement

The top losers for the day are; Nestle, Nigerian Breweries, Dangote Cement, Flour Mills, and Forte Oil.

Julius Berger, International Brewery, Custodian, Vitafoam, and Ecobank led the top gainers at the bourse.

Economic analysts have predicted a withdrawal of portfolio investors from Nigeria in 2019 — in anticipation of the 2019 general elections, and expected economic uncertainty.

Advertisement

Oscar Onyema, chief executive officer of the Nigerian bourse, said the exchange hoped to achieve a market cap of about N200 trillion at the end of 2015 and the opening of 2016, but reviewed the plans for 2019.

“The targeted 2016 capitalisation was set across five asset classes and would not be possible to achieve considering present realities. We no longer believe that it is possible to meet the target, given where we are today,” he said.

“But we believe that our new strategy up to 2019 has more realistic targets and we are approaching it now in a different perspective.”

It is clear today that the market cap of the Nigerian exchange will not be anywhere near the $1 trillion target set a few years ago.

Advertisement

Add a comment