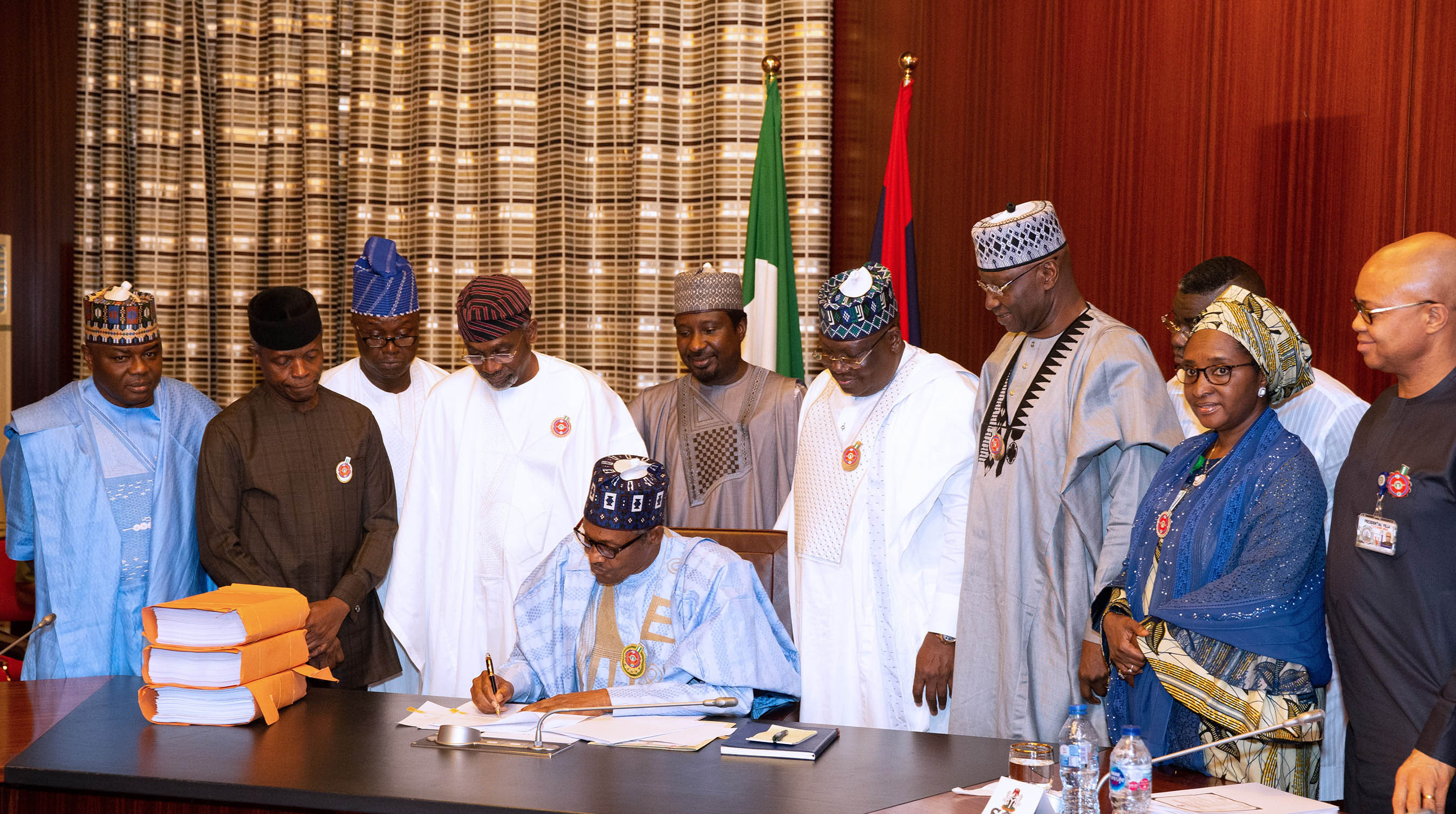

President Muhammadu Buhari Signs 2020 budget, with him are vice president Yemi Osinbajo, Ahmad Lawan, president of the senate; Femi Gbajabiamila, speaker of house of representatives; Boss Mustapha, secretary general of the federation; Zainab Ahmed, miniSter of finance; Babajide Omoworare, SSAP on senate matters and others during the signing of 2020 Budget at the State House in Abuja.

First the bad news. Expect no less than a Global Economic Depression in the realm of what happened between 1930-39. This time it may even be worse. Why? The world economy has never been more integrated. There hasn’t been so much reliance on the allocative power of markets. The fragility of world economies has never been so cheaply exposed. And never has everything come to such a sudden, shocking, screeching halt, almost worldwide. The effect of the shutdowns and lockdowns, the quarantines and curfews, is economic whiplash for many countries, businesses and peoples in the world.

The upside is that the world has, since 1939, built considerable communications infrastructure and technology, that may aid a rapid economic recovery, such that the period of global economic downturn does not have to last a decade and result in a world war (some say we are passing through one already) like the last experience. It is also important to know, that some countries learnt serious lessons from the Great Depression, while some countries were not even born then. Most of the countries this side of the world aren’t really very good in picking up these hard lessons of history by the way. But it is time to learn.

RECESSION VS DEPRESSION

The above rigmarole pops a question into mind. What is an economic depression? Economists hardly agree on anything. Some say it is a prolonged recession, recession itself being a drop in the level of a country’s Gross Domestic Product (value of goods and services produced in a country in a given year) for 2 consecutive quarters. Others say it is a drop in the GDP of a country by 10% or more over a period of time. It has been predicted by Economists at Bank of America, that global GDP will fall by 12%. That is a proper global depression for those who go by the numbers. The symptoms of an economic depression are however unmistakable; high poverty rates, high unemployment rates, high inflation rate or better still, stagflation, high crime rates, lower life expectancy as a result of broken down health systems, high illiteracy and so on. Sounds familiar right? Most sub-Saharan African countries have never known anything but economic depression, irrespective of the figures their governments post, to impress the international community. We will also find, that since 1939, no OECD (Organization for Economic Cooperation and Development) country, in other words the big Kahunas, have ever fallen into depression, even if many have dipped into recession a number of times. In fact, the terminology seems to have dropped off Economics’ lexicon. African countries who have lived in this reality have not alarmed themselves enough with such a terminology, preferring to celebrate their occasional 6-8% GDP growth as ‘Africa Rising’, even when 80% of their people roil in all of the miseries associated with economic depression (including bad or no housing, little or no electricity, little or no water, sub-human transport systems etc.), in addition to the regular symptoms listed earlier.

Advertisement

Already, with round-the-block queues to buy basic items (and others not so basic) in parts of the world, empty shelves in stores, spiking unemployment (3.3million Americans filed for unemployment benefits last week and 550,000 in the UK), it looks like a depression is afoot. Some are celebrating the takeover of Artificial Intelligence, Machine Learning, Internet of Things etc and the likelihood that these phenomena will rapidly replace human beings in the workplace. True. But these innovations will also lead to mass unemployment around the world – just as happened with the 1930s Great Depression

Will African economies, especially Nigeria, take advantage of this unique, unprecedented and profoundly destabilizing crisis to open a new chapter? Or will we generally hide away, obey toxic instruction, try some copycatting and generally waste a crisis? Has it not been said, that nations should never waste a crisis? Are great nations, just as great organizations, not forged in crises? Did Europe and the Americas not emerge as greater regions, from World Wars? In fact, did the USA not leverage on the Second World War to shove aside the United Kingdom as the world’s dominant nation? This may just be an opportunity that will not present itself to us again. I propose that we grab it with both hands.

How?

Advertisement

EXITING OUR PERENNIAL BUDGETS OF MEDIOCRITY

I have always complained about our budgeting. I see that the fiscal response to this crisis is to slash the N10trillion by N1.5trillion because the price of crude oil crashed in the global markets from about $80 as at June 2018, to around $26 today. People have supported this decision because it seems the obviously logical thing to do. But I say we should hold on a second. Is that the best we can do? We should recall that we are not our own competition. Our children are not supposed to be competing with themselves along the usual tribal and religious lines. We should be competing with other countries. We should be preparing the children of Nigeria, and provisioning for them in comparison with children of other nations. Even within Africa, we have examples we can benchmark against. Why is Nigeria cutting a $30bn budget when South Africa is working on a $130bn budget this year? And they have just 60million people there as against our own 200million! What is there to cut in a budget of $140 (barely N50,000) per person in a given year? I have asked that we open our minds to this reality; this enveloping mediocrity. Perhaps this is a good time to revisit the issue.

What to do? Rather than slash the 2020 budget, we could reorder the spending in the budget away from non-value-adding items and all those ego-boosting things into the critical sectors mentioned above that improve the human capital of the country and unleashes our productivity. The overriding assumption in our budgets is the expected (benchmark) price of crude oil and how much of it we wish to produce daily. I believe we should populate that section a bit more. Other assumptions must come in. Other sectors must feature. This involves deep thinking, a fundamental reimagining of our possibilities as a people, and honest brainstorming. I believe it is very doable. In the current budget are proposals for purchases of luxury cars for big civil servants and political appointees. The elected officials have already received their own luxury cars. There are provisions for new office complexes for a public service that should be more on the field and less in offices. There are proposals for purchase of generators. The irony of making such a budget, and within days seeing everything unravel as crude oil crashed more rapidly than ever before hasn’t shocked us. To this kind of mediocre, one-track-minded, anti-people budget that feeds the politically powerful and panders to our usual excesses and penchant for white elephant projects, we must say never again! The people of Nigeria needs to rise up this time. The political leaders are waiting to hear from us. We must reclaim our power.

A SERIOUS FISCAL STIMULUS WITH AN EYE ON THE FUTURE

Advertisement

Thus far Nigeria is slow in bringing up a fiscal emergency plan. The only near-tangible we have is from the monetary policy guys through loans to some industries, chiefly pharmaceuticals and manufacturers. The focus is for us to stay alive first since the chemist shelves as we call them here will soon be bare. That is okay, but we must think ahead. The N1.5trillion budget is regarded in economics as a procyclical policy as it deepens the problem not solve it – it intensifies our vicious cycle of poverty, want, lack of infrastructure, or investment in human capital. What we need right now is a COUNTER-CYCLICAL fiscal policy, that helps to turn back the hand of the clock by reflating and incentivizing the economy for productivity. National budgets anywhere in the world, are very critical even to business. The government is still the biggest spender in any economy too. So if we cannot increase that budget size, we should leave it alone. Or better still we need to pump in at least N10Trillion in this economy this year, and maintain that new fiscal pedestal going forward. Our budgets must begin to benchmark what obtains in other serious economies, on per capita basis and in terms of the provision for human capital development. The monetary stimulus is limited to lending to usually large companies or moratoria on loans. This leaves out majority of our people, who don’t run companies that take bank loans. This is why the Nigerian government should not sit on its hands this time. Those grassroots people are also waiting to hear from government. Direct palliatives and cash bailouts should be arranged for our most-vulnerable.

HOW DO WE FUND HIGHER BUDGETS AND A MASSIVE FISCAL STIMULUS?

We are now challenged as a people. We have no experience in managing these things but we can learn from others. The UK is intervening with GBP330bn (about 10% of its GDP), 12% of which will be given out directly in cash and transfer to people who could use some extra cash. They don’t have much reserves. So they are issuing domestic bonds. The coupon is rubbish at nearly 0% as they just crashed their reference rate to 0.25%. I read somewhere that they know that investors will not rush at the bond, so the proposal is that the Bank of England will buy up the government bonds and issue cash to banks (print money in effect). The UK will suffer some inflation as money supply rises. But though the Bank of England warehouses the bonds, the financial instruments could still be traded in the secondary market at discounted rates. This is not the time for easy economic decisions. In fact, this is time for government to take the hit, invest in the people and reap back in the future. Looking at this scenario, evidently Nigeria has an advantage. We can issue government bonds at 10% and get domestic subscribers. We can even run up to 14% and issue 5, 10, 15, 20 and 30 year bonds. The only problem is we still have corruption in the system and we cannot afford for monies so raised to be embezzled or totally mismanaged. We need to ensure monies raised are used to help our people and invest in the sectors mentioned above. Again, we should say Enough Already! to the profligacy that has come to define our nation.

Whereas I am proposing a focus on domestic bonds, something to whip up our people’s sentiments by reminding them how every country has closed its doors on everyone, foreign borrowing may come in handy too. The World Bank has positioned $8bn concessionary loans for countries like ours. That AfDB also has a much smaller plan. The suggestion of domestic borrowing is important because that is how every great country developed; local bonds, infrastructure bonds, war time bonds and so on… monies lent by the people to the state for pecuniary and/or patriotic reasons.

Advertisement

NEVER WASTE A CRISIS!

This Covid 19 pandemic and the resultant shutdowns and global panic offers us an opportunity to throw away the box in which we have imprisoned our minds for too long as a people, as it pertains to our economics that is. Why have all the indices come up short for us. No light. No water. Stinking environments. No public housing. No health systems. Nothing! Who do we think will invest in them for us and our people? We wanted to borrow $17bn out of a total of $22.7bn from China. Now they have their own problems. Still I don’t believe we should shrink the economy. I propose a more aggressive approach. I propose we look inwards, and try to raise N20trillion in domestic bonds/debts. This comes to about $65billion (roughly 15% of our GDP), with which we can prime the economy over the next two, three years. This will have impact on our banks in terms of their liquidity but only for a while as the money goes back into the banks through payment for contracts. The banks will also be involved in the money creation process that expands the economy through loan creation.

Advertisement

TARGET MARKET FOR THE N20TRILLION DOMESTIC BOND

The target for the loans could be expanded to include:

Advertisement

- Local Residents

- Nigerians abroad

- Interested foreigners and portfolio investment companies who are attracted by the yields

There is a reason the US is spending $2trillion (over 10% of its GDP), the UK 330bn GBPounds, Canada CAN$75bn etc just to tide over this season. Those countries already understand how to handle such a massive downturn and what to spend on. They know they cannot afford to see their productive sectors ruined. They know the value of keeping people at work. They learnt the lessons of the Great Depression and they swore never again! Here, we have been conditioned since independence to exist in the reality and with the symptoms of a country in economic depression. The challenge we have therefore is how to heave out of this unpalatable reality, not how to keep managing to remain in it for as far as the eyes can see. If we took my advice we can use this opportunity to launch. The domestic bond of say N20trn ($65billion) should be split over 5 to say 30 years. 10 to 13%. Focus on Nigerians. It could even be called a wartime bond.as government leverages on current sentiments. Let Nigerians know that they are all they have and as we can see there are instances that all countries shut their doors on globalization. Yes this country is all we have and it is worth investing in for the long term.

INTEREST RATES, EXCHANGE RATES AND INFLATION

Advertisement

My idea is certainly not perfect. It could do with more fine-tuning. The bond may flop. But without trying we are merely sitting waiting for a total meltdown as the Covid-19 takes a higher human toll here than elsewhere – not in terms of those who die by the disease but the upheaval that comes after the health scare subsides. The monetary authorities should also begin to reduce the Monetary Policy Rate (MPR) at the same time to boost domestic lending. Equally they should reduce the Cash Reserve Ratio and Liquidity Ratio. The should maintain the Loans-to-Deposit Ratio at the current 65%. Banks should be assisted to focus on core lending business and maintain professionalism at this tough epoch, to reduce incidences of non-performing loans. Very importantly, by beginning to reduce MPR we send a signal that rates may be lower in the future so any smart investor should lock in with the new domestic bond at 10-13% or so for 15 to 30 years. The secondary market can always rescue those who wish to get out before maturity

Nigeria will continue to battle with inflation, but I believe we should target economic growth instead. Growth is a more accurate indicator of economic development than low inflation, by all means. In the wake of the Eco currency controversy, I found out that all our Francophone brother nations have inflation in the region of 0.5% to 1%. They may be commended for managing their economies well, but they are actually stunting their economies, and France actually encouraged them along the journey. They have choked their economies and most entrepreneurial activities in those countries are run by the French and Lebanese. None of these economies can withstand Nigeria as we know, in spite of our 12.2% inflation. In this trilemma, I believe inflation is something we can let go temporarily, as we try to control it by other means e.g. preventing price gouging, better regulation of all sectors to prevent sharp practices, and enforcement of competition laws to give our people a smorgasbord of choices.

The only issue to wrestle with will be value of the Naira. What will be the effect of this approach on the Naira? Already, analysts have predicted the death of the Naira, even as the CBN swears that it will continue to defend the currency. The death of the Naira is predicted from the sharp drop in crude oil prices and the fast-eroding reserves but something can be done. I always take a cue from the 3 Generations of Currency Crisis in looking at what may happen with the Naira. A lot is still within the control of our monetary authorities in spite of the fall in the quantum of our foreign reserves (currently around $34billion). The first generation of currency crisis says speculative attacks will come when a country tries to maintain a fixed rate while the second speaks about what is called the ‘self-fulfilling prophecy’ in that when people speculate that a currency will fall, then it will. The CBN can subtly attempt to work on a reverse self-fulfilling prophecy, apart from just putting out information that it will defend the currency (a scenario that puts the CBN on the back foot).

The idea of a local bond will also see to the inflow of foreign exchange by locals who have money abroad, and Nigerians living abroad who wish to invest at home. This will help strengthen the Naira and increase our reserves. Foreign investment companies will also buy in. This strategy needs to be rolled out soon in order to ease the pressure that the Naira is presently under. As the global economy grinds to a halt, the CBN has suspended sales of currency to Bureaux de Change. We have too many of them anyway (perhaps 8,000!). People are still buying the Dollar to keep, speculatively (self-fulfilling prophecy). When the world economy resumes, a lot of business transactions will have to be concluded, leading naturally to a massive net outflow. It will be a good idea to stem the hemorrhage ahead of time.

We must never waste such a great crisis. Nigerian economy must take off finally.

Views expressed by contributors are strictly personal and not of TheCable.