Activities on the Nigerian Stock Exchange (NSE) remained on a bullish trend on Friday with the All-Share Index crossing the 33,000 mark for the first time since June 2015.

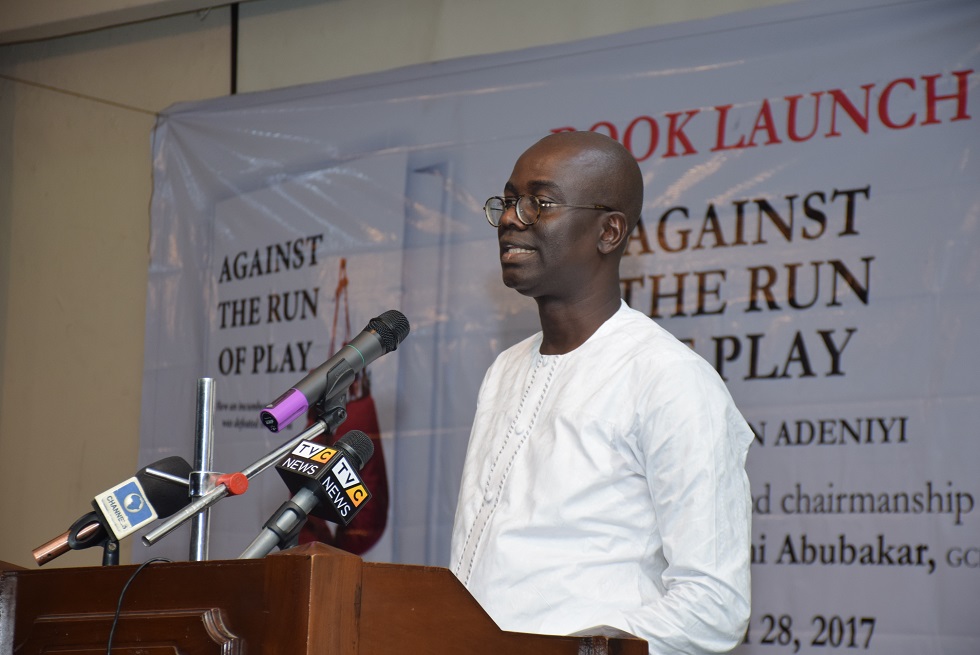

NAN reports that the index, being led by Oscar Onyema (pictured), grew by 338.70 points or 1.03 per cent to close at 33,276.68 against 32,937.98 achieved on Thursday.

Similarly, the market capitalisation inched N117 billion or 1.03 per cent to close at N11.503 trillion compared with N11.386 trillion posted on Thursday due to huge gains by some blue chips.

A breakdown of the price movement chart indicated that Seplat led the gainers’ table, growing by N43.56 to close at N468.56 per share.

Advertisement

Market analysts attributed Seplat’s steady price appreciation to recovering of lost crude output after force majeure was lifted on the Forcados export terminal.

Seplat said in a statement that the lifting of the force majeure helped it to successfully reinstate gross production at its oil mining licences (OMLs) 4, 38 and 41 to levels last seen before the terminal’s closure.

Further analysis of the price movement table showed that Forte oil followed with N5.97 to close at N64.30 and International Breweries increased by N2.99 to close at N32.23 per share.

Advertisement

Presco gained N2.97 to close at N62.50, while Total N2.50 to close at N282 per share.

On the other hand, Flour Mills topped the losers’ pack with a loss of N1.20 to close at N27.60 pet share.

Mobil trailed with a loss of N1.14 to close at N285.86, while Nigerian Breweries shed 50k to close at N156 per share.

Unilever declined by 45k to close at N35.55, while UPL depreciated by 37k to close at N3.46 per share.

Advertisement

NAN also reports that Access Bank was the toast of investors in volume terms, accounting for 125.01 million shares valued at N1.29 billion.

It was trailed by FCMB Group with 105. 75 million shares worth N147.48 million, while Diamond Bank sold 72.96 million shares valued at N108.26 million.

FBN Holdings traded 71.99 million shares worth N504.32 million and Fidelity Bank exchanged 55.78 million shares valued at N80.12 million.

In all, a total of 686.30 million shares worth N6.07 billion were exchanged by investors in 6,785 deals against 528.69 million shares valued at N4.84 billion in 5,603 on Thursday

Advertisement

1 comments

The good of the NSE is appreciated but the Exchange must flush out bad brokers . Personally I seem not to like the lukewarm attitudes of cardinal stone registrars . All my due process transactions are handled with poor attendance even when they were city registrars .