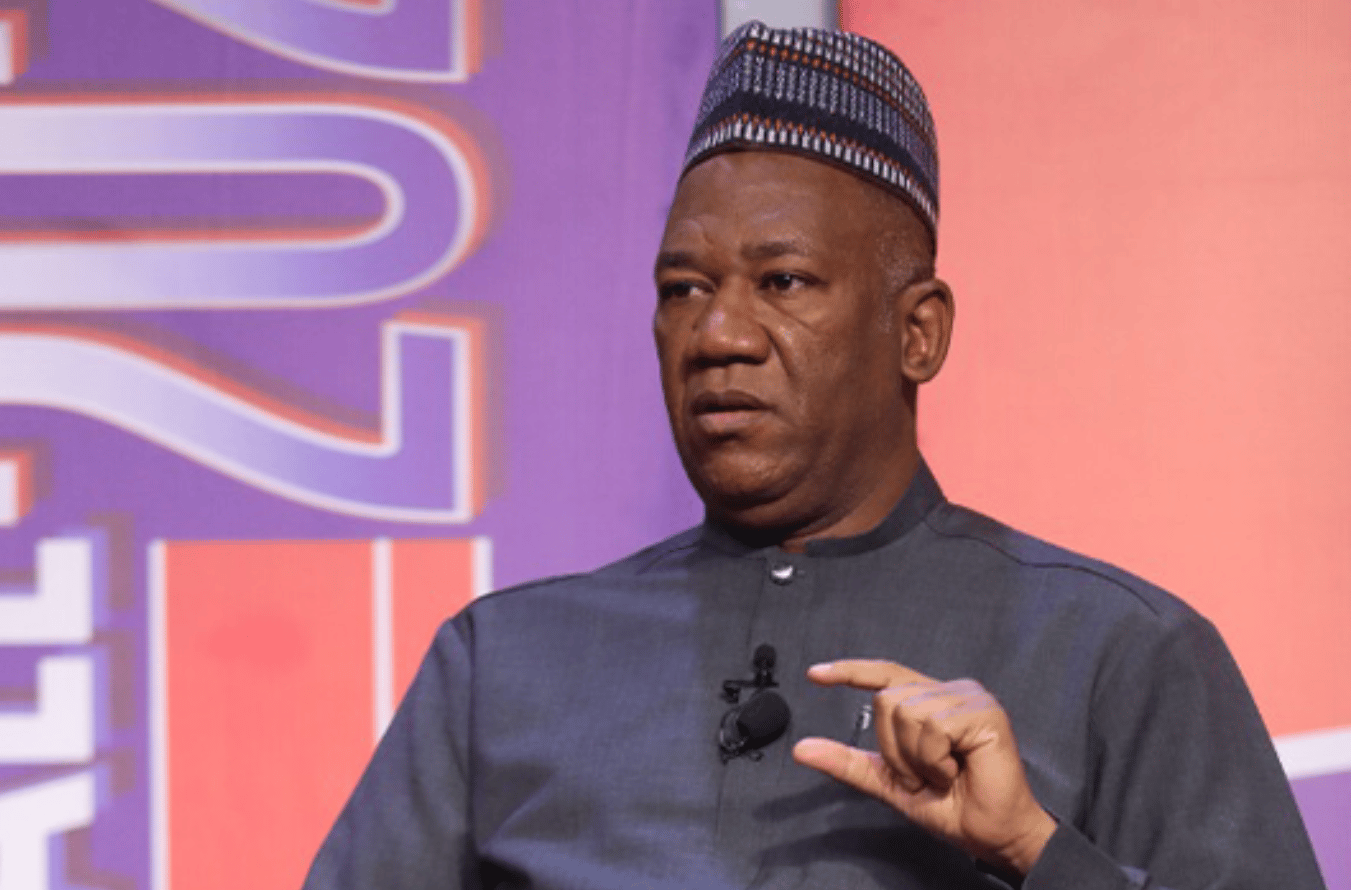

Oyeyemi Kale, partner and chief economist of KPMG Nigeria, says Nigeria’s debt is only perceived to be too much because of the country’s poor repayment ability.

In a series of tweets on Saturday, the former statistician-general of the federation said conversations on the country’s debt profile would disappear if there is an improvement in revenue generation.

The Debt Management Office (DMO) had said Nigeria’s total public debt surged to N46.25 trillion at the end of the fourth quarter (Q4) of 2022.

The 2022 figure is an increase of N6.69 trillion compared to the N39.56 trillion recorded in 2021.

Advertisement

Kale said not enough revenue is being generated in Nigeria.

“Debt has 2 issues. What it is being used for & ability to repay. Debt/GDP represents capacity to repay & is 6-8-%, so there is revenue in the system to repay. But Debt/Rev which is ability to repay is poor at about 80% so not enough revenue is being retrieved from the system,” his tweet reads.

Debt has 2 issues. What it is being used for & ability to repay.

AdvertisementDebt/GDP represents capacity to repay & is 6-8-%, so there is revenue in the system to repay.But Debt/Rev which is ability to repay is poor at about 80% so not enough revenue is being retrieved from the system1/3

— Dr Yemi Kale (@sgyemikale) April 1, 2023

“If ability is enhanced through revenue reforms so that ability is raised towards capacity then the conversation about our size of debt disappears. Nigerian debt is only perceived to be too much because ability to pay is poor despite an arguably comfortable capacity to do so.

Advertisement

“In a Nation that needs huge capital expenditure to develop, do we: 1. Curtail debt in the presence of poor revenues which slows development; 2. Borrow & focus energy on revenue reforms to repay debt; 3. Stop borrowing & generate the revenue first which also slows development.

“By the way, there are many other models to fund needed investments but my post is focusing on the particular issue of debt and its issues related to revenue and needed expenditure.”