When Nigeria announced its plan to rebase the Consumer Price Index (CPI), I previously argued that while the methodology would change, the fundamental economic realities would remain the same. I noted that the rebasing would moderate food inflation’s dominance in the overall index while highlighting other inflationary pressures such as housing, transportation, and healthcare costs.

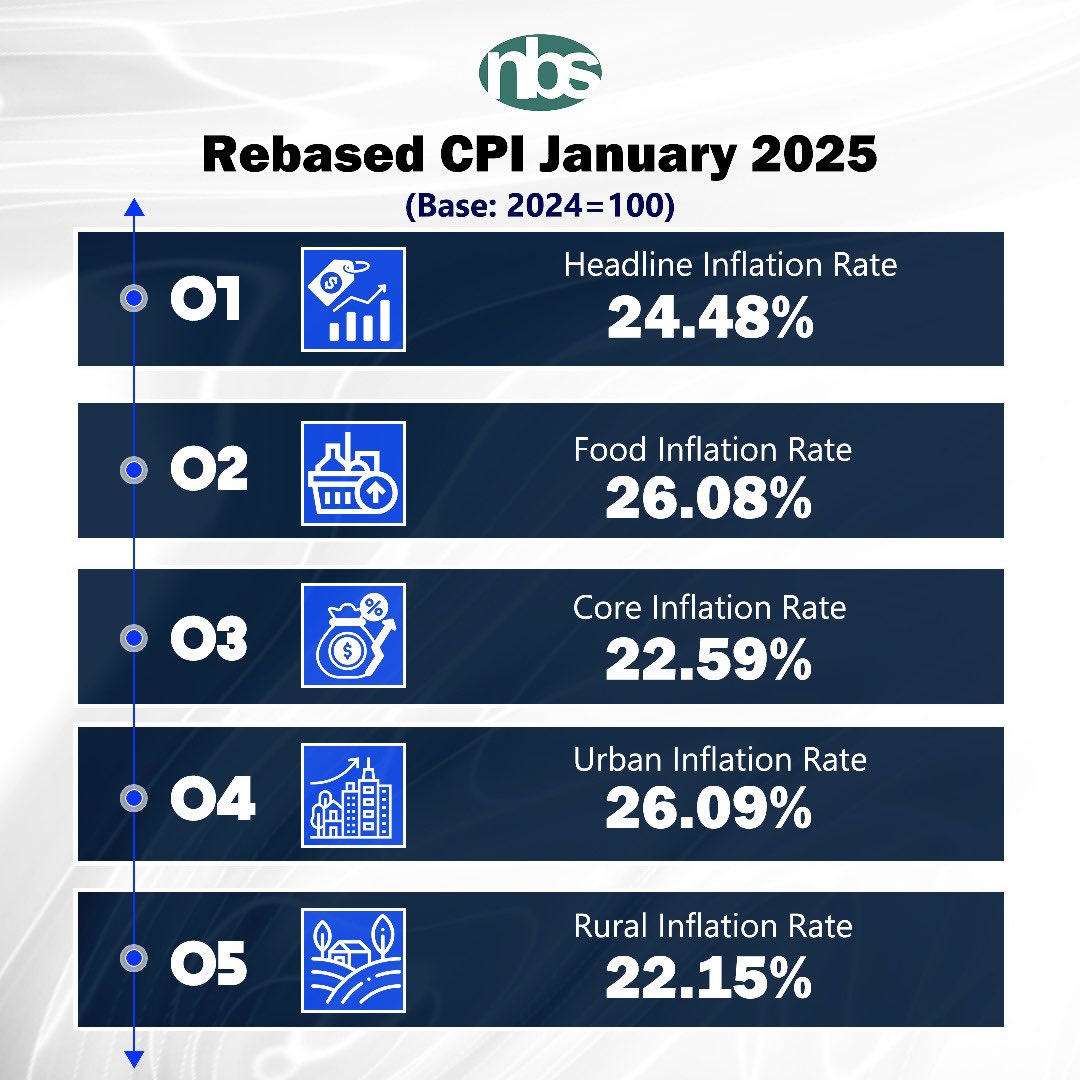

The newly released inflation figures from the National Bureau of Statistics (NBS) confirm precisely this. The headline inflation rate for January 2025 is reported at 24.48%, food inflation at 26.08%, and core inflation at 22.59%. This marks a substantial shift from pre-rebasing figures, where food inflation alone stood at 39.84% in December 2024.

Some might hastily conclude that inflation has eased, but that would be a misinterpretation of the numbers. Instead, this shift aligns exactly with what I projected:

1.Food Inflation Would Appear Lower Due to Reduced Weighting

•In my previous article, I emphasized that food, which traditionally accounted for 51.8% of Nigeria’s CPI basket, would now be weighted at 40.1%.

•This meant that, even if food prices remained high, their relative contribution to overall inflation would shrink, leading to a mathematical reduction in reported food inflation—exactly what we see in the latest figures.

2.Inflation Drivers Beyond Food Would Become More Prominent

•I predicted that the rebasing would reveal other inflationary pressures—particularly in transport, healthcare, housing, and utilities.

•The new data confirms this, as core inflation (which excludes volatile food and energy prices) now stands at 22.59%, reflecting the rising cost of non-food essentials.

•The gap between urban inflation (26.09%) and rural inflation (22.15%) further supports my argument that housing and transportation costs are disproportionately affecting urban dwellers.

3.The Illusion of Lower Inflation

•I warned that the rebasing could create a false sense of inflation moderation, as it does not mean prices have actually decreased.

•The reported 24.48% headline inflation is lower than the previous methodology’s estimates, but in reality, Nigerians continue to face severe cost pressures, especially for food, rent, and transport.

What This Means for Nigeria’s Economy

The rebased CPI provides a more updated and structured way of measuring inflation, but it does not change the lived realities of Nigerians. The cost of living remains high, disposable incomes are shrinking, and essential goods are still unaffordable for many households. If anything, the rebasing highlights a more balanced but equally urgent inflation crisis.

Policy Recommendations: Translating CPI Rebasing into Real Solutions

The government and central bank must move beyond statistical adjustments and focus on real solutions to address inflation:

1.Targeted Food Security Policies

•Even though food’s weight in the CPI has reduced, food inflation remains the highest at 26.08%.

•Urgent interventions in agriculture, logistics, and forex management are needed to stabilize food prices.

2.Addressing Structural Inflation in Housing, Transport, and Energy

•The new CPI confirms that housing, transport, and healthcare costs are major inflation drivers.

•Policies that reduce housing costs, improve mass transit, and stabilize fuel prices must become central to Nigeria’s inflation strategy.

3.Ensuring Policy Measures Reflect the Real Economy

•Policymakers must recognize that the rebasing has changed how inflation is measured, not how inflation is felt.

•Interest rate decisions, government spending, and wage policies must be based on the actual hardship faced by citizens, not just CPI figures.

Conclusion: A Validation, Not a Victory

The January 2025 inflation figures validate the key arguments I made in my earlier article—that rebasing would alter the calculation but not erase the crisis. The challenge now is ensuring that policymakers do not use this rebasing as an excuse to downplay inflation’s impact. Instead, they must acknowledge the broader economic pressures now captured in the CPI and take decisive action.

Nigeria must not fall into the trap of statistical comfort—real inflation relief must come from real economic reforms.

Views expressed by contributors are strictly personal and not of TheCable.

Add a comment