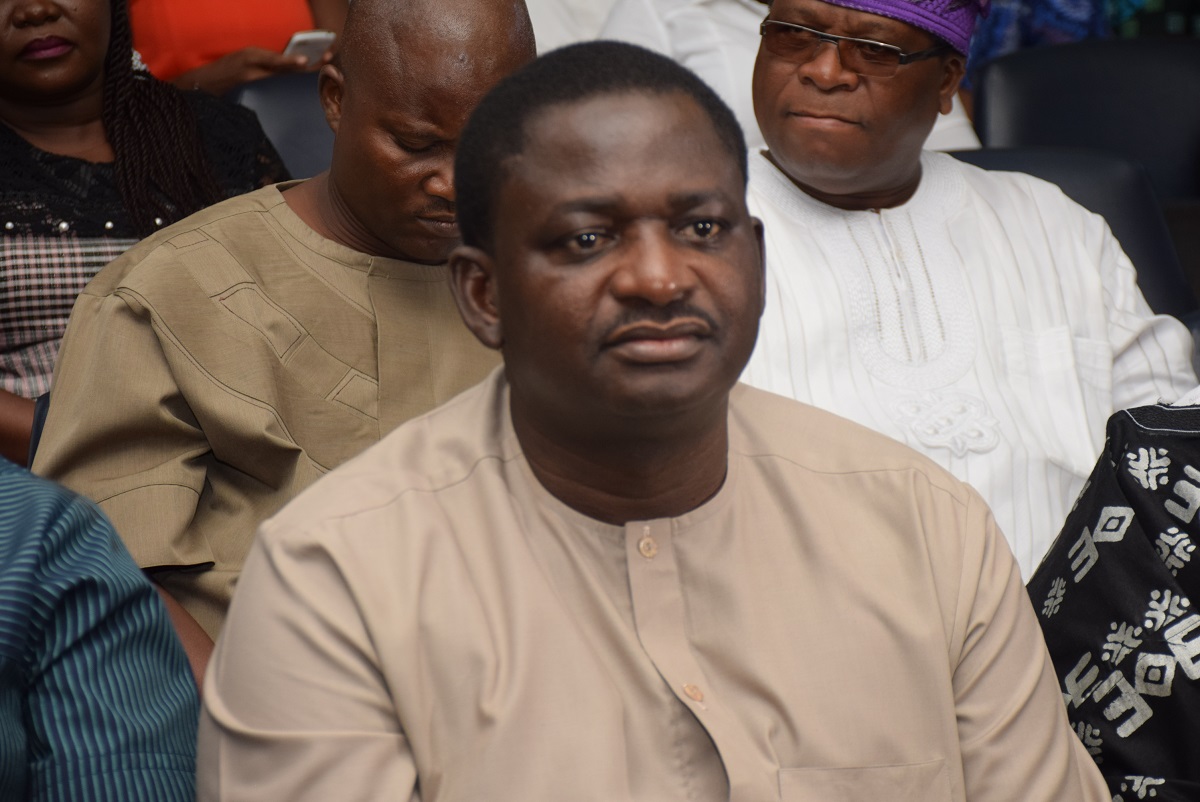

PRESIDENT BUHARI PRESENTS 2020 BUDGET TO JOINT NASS 1A&BL-R; President Muhammadu Buhari during the Presentation of 2020 National Budget to a joint session of the National Assembly. PHOTO; SUNDAY AGHAEZE; SUNDAY AGHAEZE. OCT 8 2019.

The only thing we learn from history is that we learn nothing from history. – Georg Hegel

The ‘Great Lockdown’ of the global economy is taking its toll, and this is the time for deliberating on economic recovery. Charitable individuals and corporations are donating to multilateral agencies and governments. These agencies and governments are supporting individuals and businesses whose operations have been severely affected by the coronavirus pandemic in various ways.

The International Monetary Fund (IMF) projects the combined annual gross domestic product (GDP) of the global economy will reduce by 3 per cent in 2020, compared to last year’s GDP. To put this into perspective, each person in the world will face an income reduction of 4.2 per cent. The impact would be much worse than the ‘Great Recession’ of 2008.

According to the IMF projection, the pandemic will severely impact the growth of annual GDP across all regions. Advanced economies will shrink by 6.1 per cent, emerging economies will shrink by 1 per cent, and Sub-Saharan Africa will shrink by 1.6 per cent. The world’s largest exporter, China’s income will reduce to 1.2 per cent, in comparison to its average growth of 9.9 per cent. Developing countries will be hit most due to falling commodity prices, falling cross-border trade, and the flight of financial markets to safety. There’s no denying the economic impact of this global pandemic and the history books will remember it like they do of the ‘Great Depression’ of 1929.

Advertisement

Nigeria’s economy is projected by the IMF to shrink by 3.4 per cent after seeing a growth of 2.2 per cent in 2019. World Bank data shows Nigeria’s annual GDP fell from $568.5 billion in 2014 to $494.6 billion in 2015, $404.6 billion in 2016, $375.8 billion in 2017, and to $397.3 in 2018. The naira equivalent of these figures is available from the Nigeria Bureau of Statistics (NBS). Economic recovery can only be successful when the country’s GDP surpasses the 2014 peak. COVID-19 has added to the country’s economic problems. These are truly unprecedented times, especially for Nigeria, and the prognosis is grim.

Specifically, the Nigerian economic woe is being exacerbated by three crises: the war against the Islamic extremist in the North-East; the oil price war; and COVID-19 pandemic. Spending on the war means reducing investment in other sectors that will increase economic activities. The two largest oil exporters, Russia and Saudi Arabia are equally playing the game of chicken with oil prices.

Nigeria, a major oil exporter, happens to be at the receiving end, with the loss of oil revenue that helps fund policy promises. The pandemic is changing the behaviour of the global economy. Like every economy, we will have to adapt to the new normal until there is a medication or vaccine for the coronavirus infection. The World Health Organisation has commended the Nigerian government for starting a good job in managing and containing the spread of the coronavirus.

Advertisement

Navigating out of this crisis requires governmental intervention, and it should happen in three phases: the immediate, medium, and long terms. I will discuss the immediate response to the coronavirus disease (COVID-19) presently.

For immediate action, the government should intervene in three ways: protecting the health and social well-being of the public; adjusting monetary and fiscal policies; and supporting businesses to survive. The implementation of these policies should be instantaneous, simultaneous and sequential.

All states of the federation should agree to a collective plan, while the government should work with guidance from experts to protect the health and social well-being of the public. In addition, lessons from devolved economies, such as that of the United Kingdom, should be taken seriously, alongside the avoidance of uncoordinated lockdown rules.

Nigeria, like every other country, should borrow from the bond market to survive this pandemic. It should increase its budget deficit by borrowing from domestic and foreign financial institutions. As long as the long-term government bonds have interest rates lower than the inflation rate, the total cost of the distortion is likely to be small.

Advertisement

The Central Bank of Nigeria (CBN) did a remarkable job by adjusting its monetary plan to accommodate increased emergency spending and in maintaining the stability of the financial system. Still, there is room to cut the interest rate, further, below 5 per cent, to accommodate economic activities. Providing liquidity to solvent banks will boost the financial flow of the economy, with the banks being able to provide soft loans with differed payments of at least twelve months, and a government guarantee of a high percentage of the credit. These loans should be directed towards the micro, small and medium enterprises (MSMEs) to stimulate demand in the economy. The government should encourage the production of essential items.

The MSMEs account for over three-quarters of the country’s businesses. According to Small and Medium Enterprises Development Agency Nigeria (SMEDAN), these businesses offered 59 million jobs in 2019. As of 2017, NBS reported the priority of the MSMEs is financing, and assistance to them needs to be in terms of the provisioning of power, water supply, and a reduction of the tax rate. The government should consider the relief of electricity bills, water bills and taxes relief to this sector for the next three months. The time for discussing how to generate more tax revenue for the economy will come later.

Interventions from banks and government agencies should be available to businesses, including loan forbearance with preconditions. The Central Bank of Nigeria (CBN) and the Bank of Industry intervention fund that supports the agricultural and the manufacturing sectors should be extended to the services sector. The government should relax its policy on protectionism during these times. Equally, these activities should be targeted, timed, time-bound and transparent.

Finally, the Nigerian government should see the financial support it provides during the lockdown as a transfer of resources from one part of the economy to another, rather than a cost. The support will not create any direct costs or benefits to the economy, except the economic distortions that will arise from generating the revenue to service the spending.

Advertisement

As the lockdown continues, Nigerians should have confidence in the government. The government will make mistakes, they will get things wrong, and things will go wrong by themselves. These are unprecedented times and such issues are not uncommon even in normal contexts.

Aminu, PhD, is a senior lecturer in economics and finance at the Cardiff Metropolitan University, UK.

Advertisement

Views expressed by contributors are strictly personal and not of TheCable.

Add a comment