Africa’s largest economy has displayed resilience over the past few months.

From defending against the COVID-19 menace to battling untamed inflation and shouldering domestic risks. Initially, the economic outlook was bleak during 2020 after the economy sunk back into its second recession in less than five years. Lockdown restrictions caused significant disruptions in the value chain, halted most aspects of the economy while crippling the manufacturing sector.

A growing sense of alarm and unease over surging coronavirus cases added to the uncertainty, ultimately fanning fears around Nigeria experiencing a prolonged economic recession.

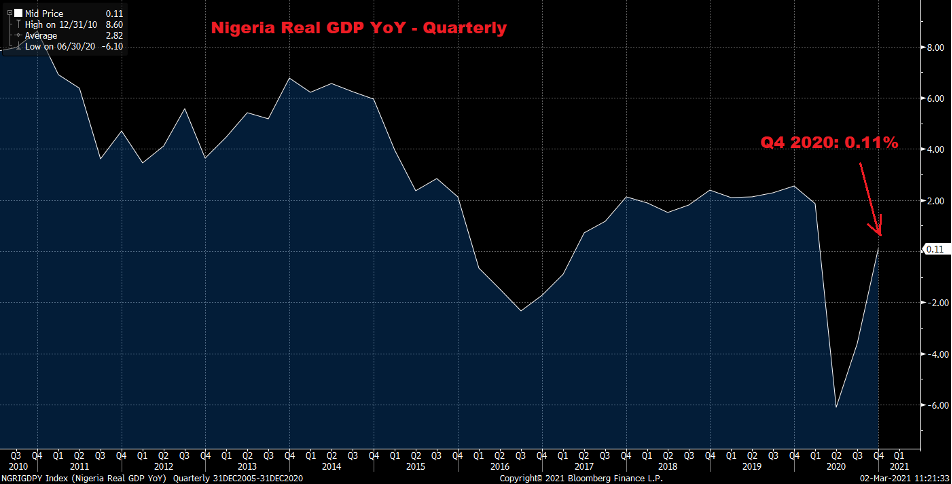

However, the economic expansion of 0.11 percent in Q4 2020 came as a breath of fresh air and offered some light at the end of the tunnel. Although the economy contracted 1.92 percent for the full year, the rebound during the final quarter raised hopes that Africa’s largest economy was exiting from the COVID-19 induced recession.

Advertisement

World Bank projects Nigeria to expand 1.1 percent in 2021

According to the World Bank, economic growth is expected to expand by 1.1 percent this year while Bloomberg forecasts GDP to contract by 1.5 percent in Q1 2021.

Advertisement

Nigeria certainly has the potential to exceed these growth estimates due to rising oil prices and improving global economic conditions. It must be kept in mind that earnings from oil exports account for over half of government revenues and about 90 percent of foreign-exchange earnings.

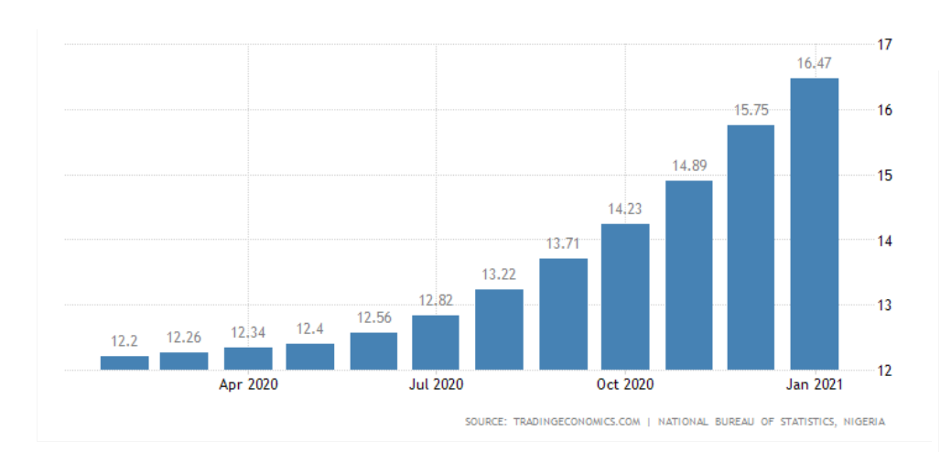

As oil prices appreciate, this provides the government with ammunition to attack domestic risks threatening the country’s fragile economic outlook. In regards to other key metrics, inflation is seen averaging around 14 percent while the Central Bank of Nigeria (CBN) is forecast to hike interest rates at least once this year as economic conditions improve.

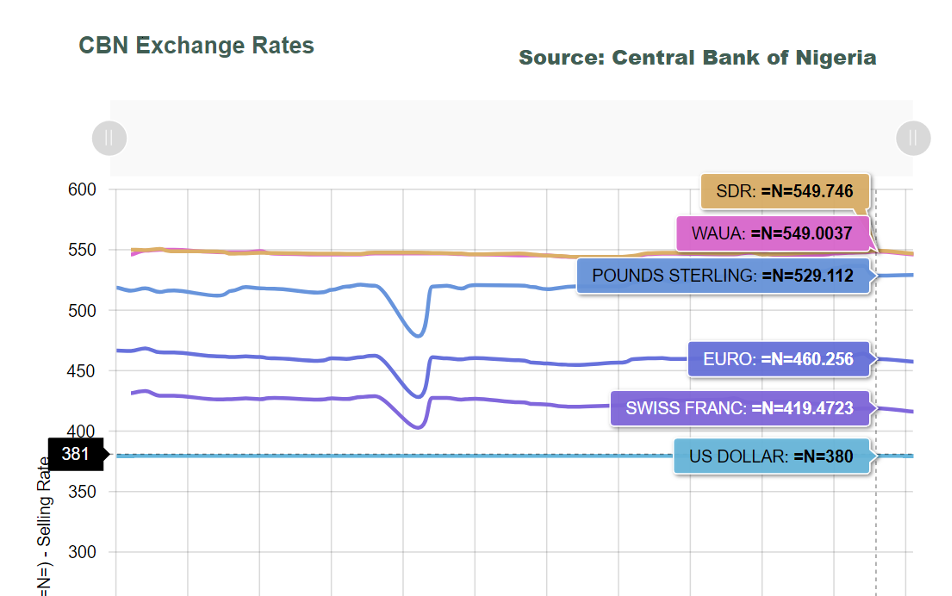

No love for the naira

The past few months have certainly not been kind to the local currency. It has weakened considerably on the black-market exchange, trading around N482 per dollar compared to the N380 official rate. An unappetizing combination of depressed oil prices, dollar shortages, and rising inflationary pressures exposed the emerging market currency to downside risks.

Advertisement

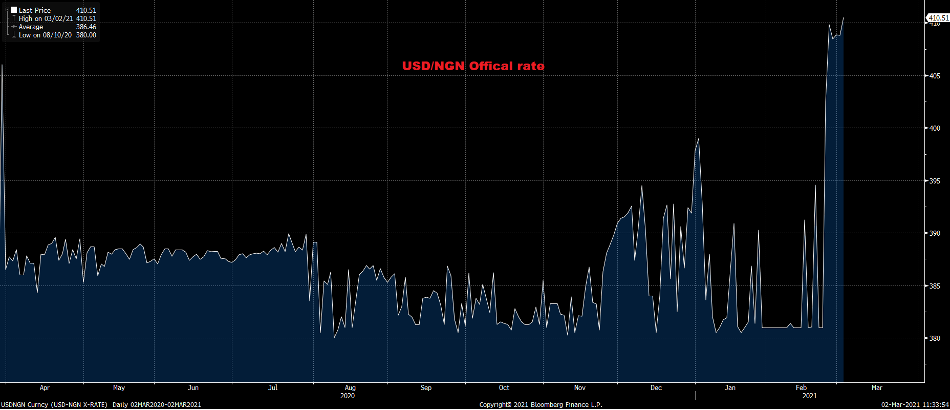

Devaluation third time lucky?

Unfavourable domestic conditions forced the Central Bank of Nigeria (CBN) to devalue the naira twice in 2020 with Godwin Emefiele, the CBN governor, recently confirming another devaluation to N410 against the dollar.

Indeed, a weaker rate would boost government revenue from oil exports – a welcome development for the energy producer. If the naira weakens, this could bolster revenues from crude, which is sold in dollar but converted to naira.

Advertisement

It does not end here. Nigeria’s economic prospects could brighten if the devaluation opens doors to fresh discussions with the World Bank regarding a $1.5 billion loan. Confusion around Nigeria’s multiple exchange rates has hindered investor attraction with major institutions requesting currency reforms to rekindle investment.

Advertisement

Inflation remains a cause for concern

But a weaker naira may lead to untamed inflation.

Advertisement

Inflationary pressures have punished consumers and threatened the country’s fragile recovery. In January, consumer prices jumped to 16.47 percent more than double the target of 7.5 percent thanks to supply disruptions, dollar restrictions, and removal of oil subsidies.

Advertisement

Nigeria is dealing with a cost-push inflation scenario where overall prices have increased due to the rising cost of production and raw materials. The government could pursue deflationary fiscal policy or monetary authorities could increase rates, but this may do more damage than good.

Diversification & oil reliance

It is widely known that diversification has the potential to cure Nigeria’s dependence on oil. However, the country’s economic outlook remains heavily influenced by the commodity’s performance.

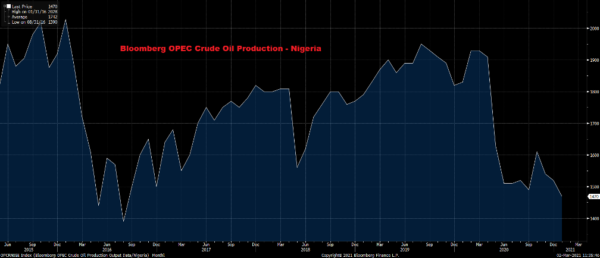

The good news is that oil prices have appreciated over 25 percent since the start of 2021 thanks to OPEC+ cuts, optimism over US stimulus, and robust demand from China. But the bad news is that West Africa’s biggest oil producer has seen its shipments fall in recent months thanks to infrastructure issues with production falling to 1.50 mbpd according to data from Bloomberg.

OPEC+ meeting in focus

The OPEC+ meeting in March may indirectly impact Nigeria’s economic outlook.

While Saudi is publicly urging fellow members to be extremely cautious despite prices rebounding to pre-pandemic levels, Moscow on the other hand is indicating that it still wants to proceed with a supply increase. Another question is whether Saudi Arabia will continue its voluntary production cuts of 1 million barrels per day.

Market expectations are rising over OPEC+ easing supply curbs after April thanks to rising oil prices. But given the nature of OPEC+ and the outcome of previous meetings – anything could be on the table.

Even if oil prices appreciate following the OPEC meeting, gasoline prices will remain unchanged in March indicating that the costly fuel subsidies are back. With inflation at a 12-year high, rising fuel costs could pour fuel into the fire – leading to further uncertainty.

CBN rate hike in 2021?

The million-dollar question is not “if” but “when” the CBN will hike interest rates.

Globally, fiscal policy has been labelled as a more effective weapon against COVID-19. However, a large share of Nigeria’s revenues is spent on repaying debts. This has left little room for critical social and infrastructure spending to shield the economy from the negative impacts of COVID-19.

Monetary policymakers remain in a tricky spot after the COVID-19 menace spread its poisonous tentacles across the economy. The pandemic resulted in lockdowns, reduced activity, a weakened naira, and stagflation.

While a rate hike will increase the cost of borrowing, effectively reducing inflation – this may result in a bigger fall in GDP. However, the options are limited within the monetary policy toolbox with unconventional tools such as loan to deposit ratio, liquidity ratio, and cash reserve ratio in focus.

Add a comment