Brent crude, the global oil benchmark, has crossed the $75 mark — highest level since April 2019 — in what is a potential boost to Nigeria’s oil export revenue.

The Brent traded as high as $75.27 per barrel on Tuesday morning.

U.S. West Texas Intermediate (WTI) crude also went up by 0.10 percent to $73.19.

The rally rode on the back of bullish sentiments by investors on a quick recovery in global oil demand and as concerns eased over an early return of Iranian crude.

Advertisement

Since May 21, Brent oil has been on a steady rise from $66.94 per barrel, dropping only marginally on two days before hitting the $75 mark.

This development comes a month after Brent crude topped $70 per barrel on the back of an improved demand outlook.

Oil price has been on a tear since the rise of COVID-19 which dealt a major blow on critical sectors and countries globally.

Advertisement

The rise in crude oil price will result in increased revenue for Nigeria which depends largely on earnings from oil to to finance its N13.588 trillion 2021 budget.

This will boost post-Covid recovery efforts and support government’s fiscal obligations while strengthening the nation’s foreign reserves, currency markets, and economic output.

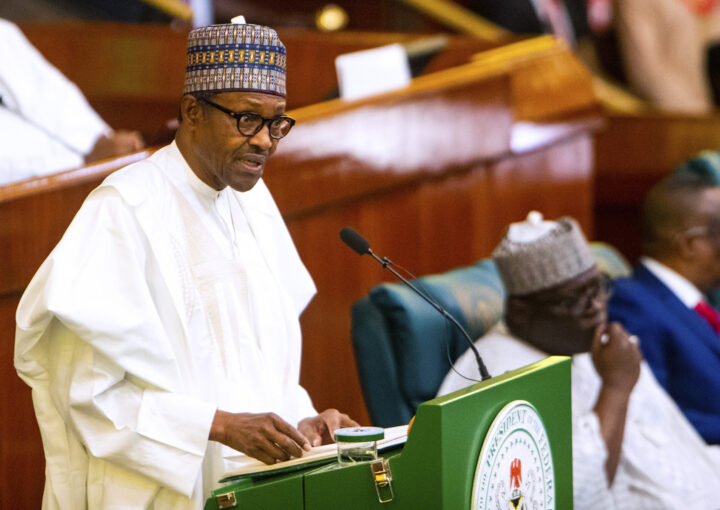

The budget signed into law by President Muhammadu Buhari on December 31, 2020, has a benchmark oil price of $40 per barrel.

Goldman Sachs, a US investment bank and financial services company, had earlier projected that oil prices will rebound to $75 by the third quarter of 2021.

Advertisement

A joint committee of ministers from Organization of the Petroleum Exporting Countries (OPEC) and non-OPEC countries had also projected an increase in global crude oil demand by second half (H2) 2021.

Mohammad Barkindo, secretary-general of OPEC, had said the organisation’s leadership has helped in ensuring growth in oil demand.

He added that the rising COVID-19 cases in some oil producing countries requires more steadfastness from OPEC stakeholders.

Advertisement

Add a comment