BY AYO BANKOLE AKINTUJOYE

On Thursday, September 12, 2019, news broke that the Federal Executive Council (FEC) had approved plans to increase Value Added Tax (VAT) from 5% to 7.5%; representing a 50% increase. It is worthy of note that the current 5% VAT regime has been in existence for over 25 years (Since 1994). Although it is still subject to National Assembly Approval which may take several months, it is important to analyze how this new development may impact the livelihood of majority of Nigerians; particularly the over 60% who currently live at the bottom of the pyramid, especially in the face of the disingenuous attempt by government agents to portray VAT as a tax that mainly applies to the rich and to portray it as the only option of government to increase revenue.

On the contrary, VAT is imposed on all goods and services sold in Nigeria, including imports; as stipulated under section 4 of the VAT Act, except for items that are VAT exempt. What this means is that every Nigerian will either directly or indirectly, be affected by a whopping 50% increase in VAT. Another implication of this is that even if you transact only in the informal sector, that is largely outside of the tax net, other items such as clothing, processed food items, shoes, etc. are VAT-able and will be charged.

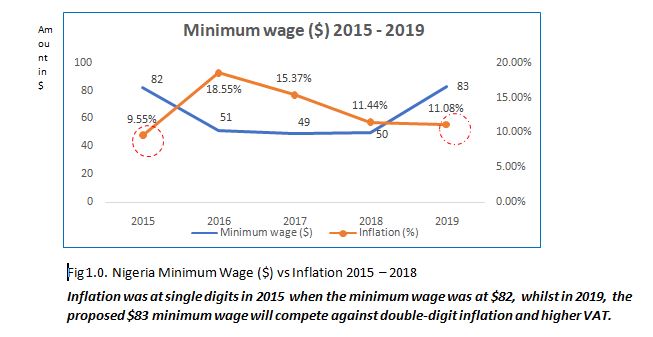

The Nigerian minimum wage had been at a paltry ₦18,000 ($50 – using current exchange rate) since the year 2010, following series of negotiations with the Labour Union, under the then President, Dr. Goodluck Jonathan. Despite the devaluation of the Naira, for a little above nine (9) years the minimum wage remained same while other macroeconomic indices that impacted average cost of living increased. This further negatively impacted the condition of livelihood of the average Nigerian. Below is a graph showing how the minimum wage declined and then flatlined over the last four years, despite increase in inflation rates and naira devaluation.

Advertisement

Following the devaluation of the Nigerian currency in 2016, the minimum wage in dollar terms dropped to $51 and has since flat-lined between 2016 to 2018. The newly approved new minimum wage of $83 (₦30,000) is a 67% increase on the current $50. Although yet to be implemented, this increment is just a dollar higher than what the average Nigerian earned in 2015 (4 years ago) yet has to compete with double-figure inflation.

VAT, on the other hand, had remained at 5% for over 25 years.In Federal Government’s effort to increase its revenue generation and reduce its revenue to debt service ratio, it has introduced a 50% increase in its VAT to 7.5%.This, at the minimum, is a lazy approach to increase government revenue. According to The Urban-Brookings Tax Policy Center, there are at least three ways to increase government revenues:

Advertisement

- Modify Existing Tax Policy:

- The government could scale back or eliminate some of the tax breaks/reliefs that exist in the current laws: A thorough assessment can be done to ascertain the impact of these reliefs on citizens’ willingness to pay taxes. But again, the Nigerian government will rather go the easier route.

- The government could apply existing taxes more broadly:e. expand the tax net. Out of the total VAT received across the Federation, 55% of it comes from Lagos only, 20% comes from the FCT, while the balance of 25 per cent is generated from the remaining 35 states of the federation, according to the data released by the Ministry of Finance.What this means is that the VAT increase will essentially be imposed on a few states, whose citizens/residents will be made to now pay more for others. Devising new ways of increasing VAT collections in other states may also increase government revenue, rather than burdening those already paying with more taxes. It could also devise new ways of incorporating the large informal sector into the formal sector, develop some sort of tripartite agreements between federal, state governments and road transport unions to formalize the huge levies being made from those channels, which are funneled into private pockets, as against the government’s; religious organisations can be taxed on their business-related activities; several of which are done under the guise of religion to evade taxes. This has been done several times in the UK.

- The government could strengthen enforcement:The former Finance Minister, Kemi Adeosun was quoted as saying that VAT compliance rate is about 12%. According to National Bureau of Statistics (NBS), the number of people in the tax net is only 13%, when compared to the labour workforce of about 80 million. Total tax revenue collected in the Federation as at 2018 in Nigeria stood at N5.3trillion ($17billion, using CBN official exchange rate of N306/$1), this is a paltry sum when compared to South Africa’s US$ 88.2 billion for the 2017/18 fiscal year, a country with a smaller economy and only a third of Nigeria’s population. It is also worthy to note that Nigeria’s VAT revenue of about N1.1trillion in 2018 is still about 1% of Nigeria’s GDP of aboutN120trillion, while total tax to GDP ratio is about 4%, showing that a huge gap still exists if government pursues innovative ways to increase enforcement of the current tax regime as opposed to increasing the rates.

- The government could increase the tax rates that apply to selected taxes – the obviously easiest approach which our government has adopted.

- Enact New Taxes

- The government could also boost revenues by introducing new taxes: There are countless social issues bedeviling Nigeria that could be discouraged via new taxes, for example, gas flaring can be taxed at a flat fee of say 80% of the total value of gas flared, etc. This will increase government revenues, have zero impact on the wallet of the ordinary Nigerian, and discourage oil companies from flaring gas.

- Boost Economic Activity

- All things being equal, a bigger economy generates more tax revenue: theGovernment should be spending more time initiating policies that willdrive economic activities and income levels. For example, a transformation of our power sector alone can generate thousands of jobs and change the game for investors in Nigeria. Today, the telecoms sectorwhich was hitherto moribund, now contributes 8% to our GDP and is worth almost N10trillion. The Power sector has the potential to even do better.

- Immigration reform is one way to boost economic activity:Nigeria’s immigration (naturalization) laws are amongst the most rigid in the world. The incursion of new businesses and workers into the country would expand the labor force, attract new capital; and ultimately increase tax revenue for the government. But Nigerian immigration laws make it difficult for foreigners to relocate, the bureaucracies and corruption in the Nigerian Immigration Service even make worse, the frustrations of expatriates looking to do legitimate business in Nigeria, thereby allowing the influx of unauthorized workers.

While the effort of the government to increase revenue is commendable, it is important that the government shies away from adopting lazy approaches that may further impoverish the citizens and ultimately fail to meet its objectives of revenue increase. As it stands, there is no guarantee that the benefits of increasing VAT will be worth the pain on Nigerians. One implication of the Laffer Curve, a principle that defines the hypothetical relationship between rates of taxation and the resulting levels of government revenue, is that reducing or increasing tax rates beyond a certain point is counter-productive for raising further tax revenue.

One implication of this increase thatis certain, however, is that, despite the 67% increase in minimum wage introduced by the Government (which is yet to be implemented), the average Nigerian will now have to pay 50% higher in terms of VAT on every goods or service he/she consumes.

When this is put in context against the devaluation since 2016 and possible rise in inflation, the already poor average Nigerian would have effectively become poorerand may further worsen our standard of living which according to UNDP is ranked 157 among 189 countries on Human Development Index.

A 50% increase in VAT in a poverty ravished economy, is one classic example of a penny-wise, pound-foolish decision.

Advertisement

Ayo Bankole Akintujoye is a Strategist and Business Transformation Expert with a decade experience working with the some of the world’s largest consulting firms and leading Strategy teams in Nigeria’s financial services industry. He tweets from @AyoBankole.

Views expressed by contributors are strictly personal and not of TheCable.

Add a comment