A total of 105 companies are exempted from remitting corporate income tax (CIT) to the government, according to the Nigerian Investment Promotion Commission (NIPC).

NIPC disclosed in the fourth quarter (Q4) 2024 report on the pioneer status incentive application.

The pioneer status incentive is a tax holiday which grants qualifying industries and products relief from payment of CIT for an initial period of three years, extendable for one or two additional years.

The incentive, which is provided with three years of tax relief under the Industrial Development Income Tax Act, is widely recognised as an industrial measure meant to encourage economic investment.

Advertisement

CIT is levied on the profits made by companies operating in Nigeria.

According to the NIPC report, the number of participating firms benefitting from the exemption rose from 104 in the first quarter of 2024 to 105 in Q4 2024.

In the second and third quarters of 2024, NIPC said 88 and 83 companies enjoyed the tax holiday, respectively.

Advertisement

NIPC said all the companies invested over N2.4 trillion collectively.

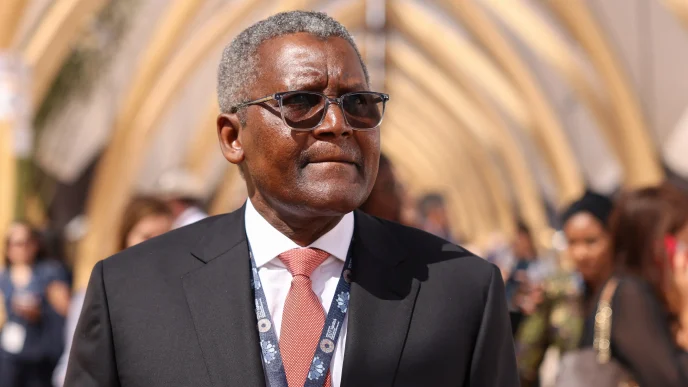

Listed among the 105 companies, spanning several sectors, are Dangote Fertilisers, Mikano International Limited, Dufil Prima Foods, Addmie Nutrition Limited, A.A Rano Limited, Edo Refinery Limited, Johnvents Industries Limited, and Shafa Energy Limited.

‘EIGHT COMPANIES RECEIVED APPROVAL FOR EXTENSION’

According to the commission, as of December 31, 2024, 19 applications were received, eight companies’ requests for extensions were granted, and 13 companies were granted approvals-in-principle.

Advertisement

“Approvals-in-principle are subject to the payment of application fees and only take effect after the payment of such fees,” NIPC said.

The commission said five applications for the extension of the incentive for two years were approved, and 22 new applications were granted.

The new applicants granted the tax holiday are Woodscope Nigeria Limited, Professional Support Property Development Limited, Comterm Nigeria Limited, O’odua Infraco Resources Limited, Von Food and Farms Limited, Mudozangl Nigeria Limited, Koyla Energy Limited, Elite Glass Limited, H & W Rice Company Limited, Segilola Resources Operating Limited, and Sifax Marine Limited.

Others are Ocean & Cargo Terminal Services Limited, Hulhulde Rice Mill Limited, O2O Network Limited, Green Hills Agric Products Limited, Platinum Event Splendour Centre Limited, and Etsako Cement Company Limited.

Advertisement

The commission said Gidan Bailu Cement Company, Auxano Solar Nigeria Limited, AP LPG Limited, Karma Agric Feeds and Foods Limited, and Agrira West Africa Limited also received approval.

In September 2023, Taiwo Oyedele, chairman of the presidential tax reform committee, said the federal government would review tax waivers given to companies operating in Nigeria.

Advertisement

According to Oyedele, the incentives gulp N6 trillion every year.

On April 15, Zacch Adedeji, executive chairman of the Federal Inland Revenue Service (FIRS), said revenue lost to tax expenditure remains difficult to quantify due to poor data availability across relevant government agencies.

Advertisement