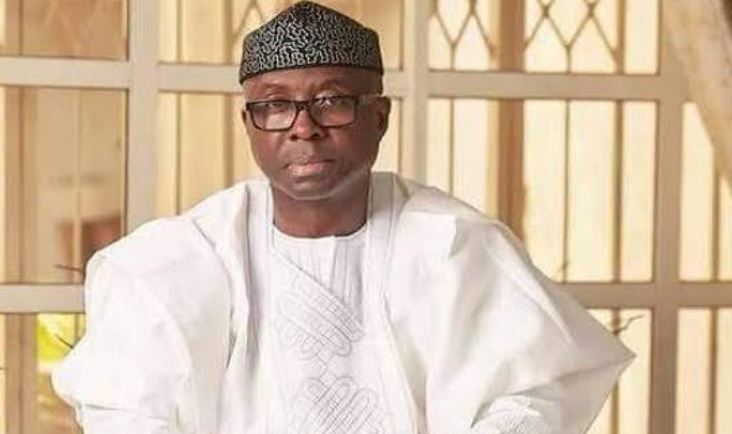

Adeniyi Adebayo, minister of industry, trade and investment, says poor access to credit, especially for small and medium enterprises (SMEs), is contributing to stifling Nigeria’s economic growth.

Adebayo spoke on Thursday, at the national workshop on bankruptcy and debt collection in Nigeria in Abuja.

Speaking on the challenges faced by SMEs, Adebayo said many businesses are confronted with numerous challenges in Nigeria and are unable to access credit facilities due to finance scarcity, high-interest rates and stringent lending conditions often imposed by financial institutions.

“The lack of access to credit has stifled economic growth, leading to a decline in investment and job creation, ” the minister said.

Advertisement

“This is a trend that we have to reverse for the greater interest of the national economy going forward.

“This is critical towards enhancing the overall competitiveness of the national economy, leading to increased productivity, economic growth and employment generation, as well as the promotion of entrepreneurship and increased benefits from the country’s participation in international trade.”

Adebayo also said the outcomes of the workshop must ensure the institutionalisation of a vibrant and sustainable credit system in the country.

Advertisement

He said this should sufficiently incentivise financial institutions to lend to especially micro, small and medium enterprises (MSMEs).

Speaking further, the minister recalled that in March 2022, the federal executive council approved the proposal to establish the Nigerian Bankruptcy Commission (NBC) with debt collection offices in the 36 states of the federation and the federal capital territory (FCT).

According to Adebayo, the commission was established to provide an effective legal and institutional framework to regulate business behaviour and reduce the challenges associated with the enforcement of trade-debt contracts in the regular courts.

He added that the debt collection office would be equipped with the expertise, resources, and specific focus to ensure that customers pay their trade debts on time.

Advertisement

“If successfully implemented, the commission will not only be complementary to the ongoing reforms under the Presidential Enabling Business Environment Council (PEBEC),” he said.

“It will also significantly contribute to the creation of a modern 21st-century credit-oriented economy for the benefit of producers, retailers and consumers in Nigeria.”

Adebayo said the federal government is committed to promoting financial inclusion by ensuring that all Nigerians have access to financial services, regardless of their income level or location.

With this, the minister said, there would be positive financial stability as well as enhanced trade and economic growth.

Advertisement

On his part, Fred Agah, director-general and chief trade negotiator of the Nigerian Office of Trade Negotiations (NOTN), said there was a need for a review of regulatory and institutional framework for bankruptcy and debt collection.

According to Agah, this will help producers get credit for their production and consumers to get goods and pay later.

Advertisement

He said the framework would facilitate definitive procedures for loan recovery and risk management as well.

Advertisement

Add a comment