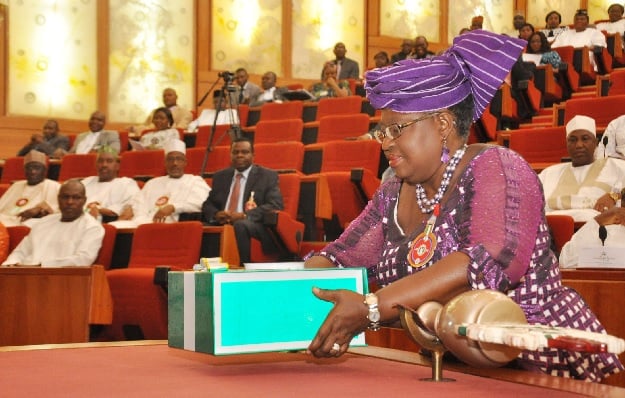

Diezani Alison-Madueke

Under-recognition of NPDC lifting

PwC said liftings by the Nigerian Petroleum Development Company (NPDC) were “under-recognised” to the tune of $0.82billion by the reconciliation committee.

It reported: “The Reconciliation Committee put the value of liftings in favour of NPDC at $6billion. We did not receive any supporting documentation from NPDC to validate this figure other than the submission to the Senate by the former MD of NPDC, Mr Victor Briggs, who disclosed the total value of NPDC liftings from all its assets as $6.82billion.

“While we were unable to verify the $6.82 billion directly at NPDC, we performed a recomputation of the values of liftings using information provided by COMD (NNPC’s Crude Oil Marketing Department) and arrived at a value of $5.65 billion. Discussions with COMD revealed that lifting data captured by COMD for NPDC might not be complete as COMD does not capture liftings done directly by NPDC’s Strategic Alliance Partners. Volumes recorded by DPR for NPDC did not contain the necessary pricing information for valuation.”

PwC said cash payments of $863 million by NPDC to FIRS were not captured by reconciliation committee.

Advertisement

Computation of Crude Oil loss

PwC also raised observations on the computation method adopted by the NNPC to arrive at crude oil loss – a major source of revenue leak in the upstream sector.

“NNPC used a conversion rate of $100/barrel to value differences between the quantity of crude oil pumped at the terminals and quantity received at the refineries. We adopted the monthly average Platts price to value the losses, considering that the revenue generated from Crude oil lifted during the review period had been accounted for using such Platts information instead of a fixed rate. Applying the monthly average Platts price to value the crude oil losses amounted to $73,851,144.93,” PwC said.

TIMELINE

25 September 2013

Sanusi Lamido Sanusi, former CBN Governor, writes a letter to the President stating that from January 2012-July 2013, NNPC had lifted $65bn worth of crude on behalf of the FGN but remitted only $15.2bn, thus $49.8bn was outstanding.

Advertisement

13 December 2013

The former GMD NNPC (Andrew Yakubu) responds that no money is missing. A revenue reconciliation meeting was set up by the FGN to look into the allegations.

18 December 2013

After the reconciliation meeting, a joint press statement was issued by all the parties. Actual value of crude lifted over the period was $67bn which was accounted for as follows: Revenues which directly accrued to NNPC (for the Federation Account) of $14bn. Additional revenues lifted by NNPC on behalf of other parties as follows: FIRS ($15bn), DPR ($2bn), NPDC ($6bn), Other third party financing ($2bn), domestic crude lifted by the NNPC ($28bn).

The Ministry of Finance acknowledged that all crude lifted was remitted apart from domestic crude remittances with a shortfall of $10.8bn, made up of: Unpaid subsidy claims – USD 8.77billion, Holding costs of strategic reserves – $0.46billion, crude oil and product losses – $0.76bn, Pipeline and management costs – $0.91billion. CBN governor stated that the shortfall is $12bn because, of the $28bn due from the domestic crude, NNPC had only remitted $16bn. NNPC insisted that the shortfall is $10.8bn and the difference was due to $1.2bn subsidy payments it claimed to have made between Jan-Mar 2012 (relating to October – December 2011 discharges), and which had been certified by the PPPRA. CBN did not recognize it as no documents were provided by NNPC to support the explanation.

4 February 2014

The CBN Governor appearing before the Senate Committee on Finance stated that NNPC needs to account for $20bn discounting some of the initial explanations provided by NNPC (the lifting in favour of NPDC, other third party financing and certified subsidy claims). The Governor stated that out of the $67billion worth of crude oil lifted by the NNPC, only $47billion had been appropriately accounted for as follows:

Advertisement

- NNPC payment for FGN crude – $14bn FIRS crude – $15bn

- Domestic crude – $16bn

- IOC payment (Royalty) – $2bn

- Total – $47bn

13 February 2014

The NNPC accounted for the $20bn shortfall as follows: NPDC $6bn, Other third party financing $2bn, Jan – Mar 12 certified subsidy $1.2bn, DPK subsidy $3.5bn, PMS subsidy $5.25bn, Crude oil product losses $0.76bn, Maintaining the strategic reserves $0.46bn, Pipeline maintenance and management costs $0.91bn, Total $20.08bn.

The Minister of Finance and Coordinating Minister of the Economy, recommended that there should be an independent forensic audit of the amounts constituting the $10.8bn as stated on 18 December 2013.

7 comments

My fellow Nigerians see how we have been exploited, what a plunder of the people and they wanted to remain in power?

It is difficult to see how Madam Deziani will maintain her claim to innocence in the face of such shameful and damning evidence. It is pertinent that her tenure is properly investigated and she is made to account fully for any illegalities discovered!

THE MINISTER HAS A LOT OF EXPLANATIONS TO OFFER NIGERIANS. THERE SUFFICIENT REASONS TO BELIEVE THAT THE DEAZANI HAS STOLEN SOME MUCH FROM NIGERIA COFFER.

How else was TAN funded?

Thank God we have flush you people out with our vote

The report stated, “We recommend that the NNPC Act be reviewed as the content contradicts the requirement for the NNPC to be run as a commercially viable entity. It appears the Act has given the corporation a blank cheque to spend money without limit or control.

So where was Ngozi, the head of the Economic Team not to have found out this.This is more serious than just the missing money.

Your comment..minister of petroleum should be jail for all this this too much