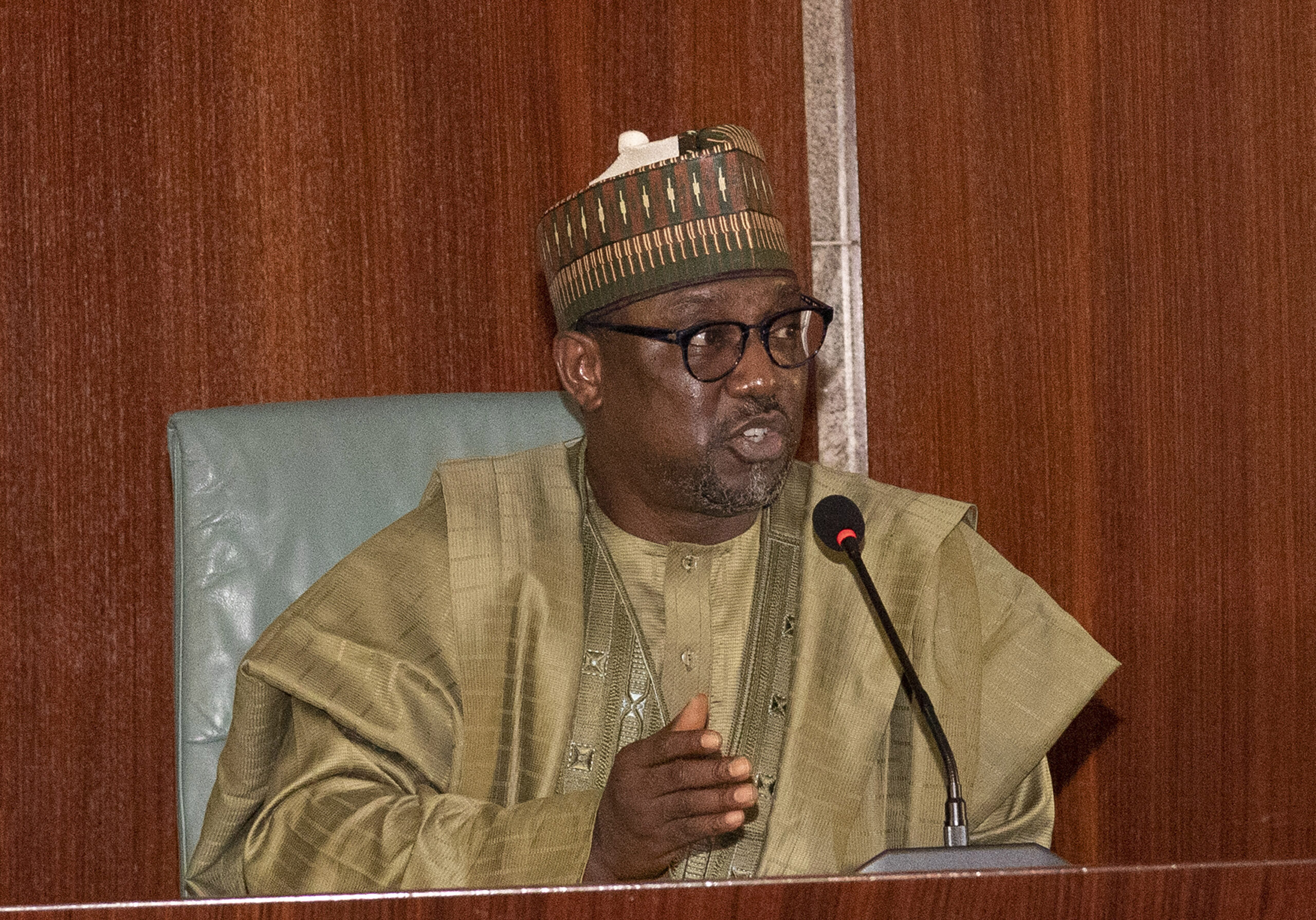

Mele Kyari, group managing director of the Nigerian National Petroleum Corporation (NNPC), says the corporation may issue an initial public offering (IPO) to investors in the next three years.

An initial public offering (IPO) is the first time a company issues shares to the public. This is when a private company decides to go “public”.

In 2019, Saudi Aramco, the state-owned oil firm of the Kingdom of Saudi Arabia, went public with record international initial public offering.

In an interview with Bloomberg TV on Monday, Kyari said the NNPC would not be able to offer its shares to the public by 2022 or 2023 due to certain bottlenecks that had lingered over the years.

Advertisement

Last month, Kyari disclosed that the national oil company would be transformed into a private company that would pay taxes and dividends to its shareholders as specified by the Petroleum Industry Act (PIA).

On the IPO launch, he explained that the books of the NNPC would need to be properly cleaned up, with the proposed NNPC Limited recapitalised, before embarking on such a huge business decision.

“We will be in the position to consider any IPO in three years; that is the provision of the law,” Kyari said.

Advertisement

“But when you want to get ready for IPO, you need to do things differently. You need to get your books correct; you need to recapitalise; you need to shape your portfolio, and many more things that you have to do until you get IPO ready.

“Surely, it is not what we will do in 2022 or 2023; probably the earliest consideration will be in three years’ time.”

Kyari said that the corporation was currently in a good position with the declaration of profit in 2020.

According to him, the IPO will put NNPC in an even better position in the oil and gas space.

Advertisement

“Obviously, this company is changing very fast and on the fast lane. We just declared profit for the fiscal year 2020. We are not getting ready for the IPO tomorrow, that is not exactly the situation,” Kyari said.

“IPO really means this company is going to be profitable, it has a long trajectory; it has a short-term view of how things can be done better to align with the best practices in the industry.

“We are trying to see how we can rework the existing framework for energy transitions that are ongoing all over the world.

“Every country is adjusting its portfolio by doing things differently in a better way and, obviously, in the long run, this is going to be a very great company, and great companies always go for IPO.

Advertisement

“So, this is not something that we are going to do tomorrow, obviously not. Our new law has made the provision that we can sell shares of this company, but in today’s context, I can really say this company is doing great and getting an IPO means that it is going to be better than what it is today.”

Kyari further explained that the corporation’s 20 percent stake in the Dangote refinery, for which it is paying $2.7 billion, was to ensure energy security and tie-down markets for Nigeria’s crude oil.

Advertisement

Add a comment