Nigeria’s dependence on oil revenue to fund its budget may finally be coming to an end as the federal government expects to earn nearly 63% of its income from non-oil sources in 2018.

However, with the prices of crude oil on the rise — now above $60 a barrel — strict discipline in managing the excess revenue will play a key role.

There are indications that 2018 could be the first time non-oil revenue will outshine petrodollars since the oil boom of 1973.

That was the year oil revenue overtook other sectors of the economy in funding both federal and state budgets.

Advertisement

“It is going to be tough but early indications are strong,” a senior cabinet member told TheCable after the budget presentation by President Muhammadu Buhari on the development on Wednesday.

According to the 2018-2020 Medium Term Expenditure Framework and Fiscal Strategy Paper, oil revenue made up 97% of government’s revenue in 2016.

Advertisement

“Oil revenue was N697.8 billion (97.2% of budget),” the document read.

“Despite the fact that crude oil production was 17% below budget, actual oil revenues closed at 97% of the budget due to slightly higher average price than the benchmark, as well as the adjustment in exchange rate from N197/$ on which the budget was based to N305/$.”

During his 2017 budget presentation speech, President Muhammadu Buhari projected that oil revenue would drop by 40.18%.

“Based on these assumptions, aggregate revenue available to fund the federal budget is N4.94 trillion. This is 28% higher than 2016 full year projections. Oil is projected to contribute N1.985 trillion of this amount,” he had said at the time.

Advertisement

“Non-oil revenues, largely comprising companies income tax, value added tax, customs and excise duties, and federation account levies are estimated to contribute N1.373 trillion.”

This meant that non-oil revenue was projected at 27.79%.

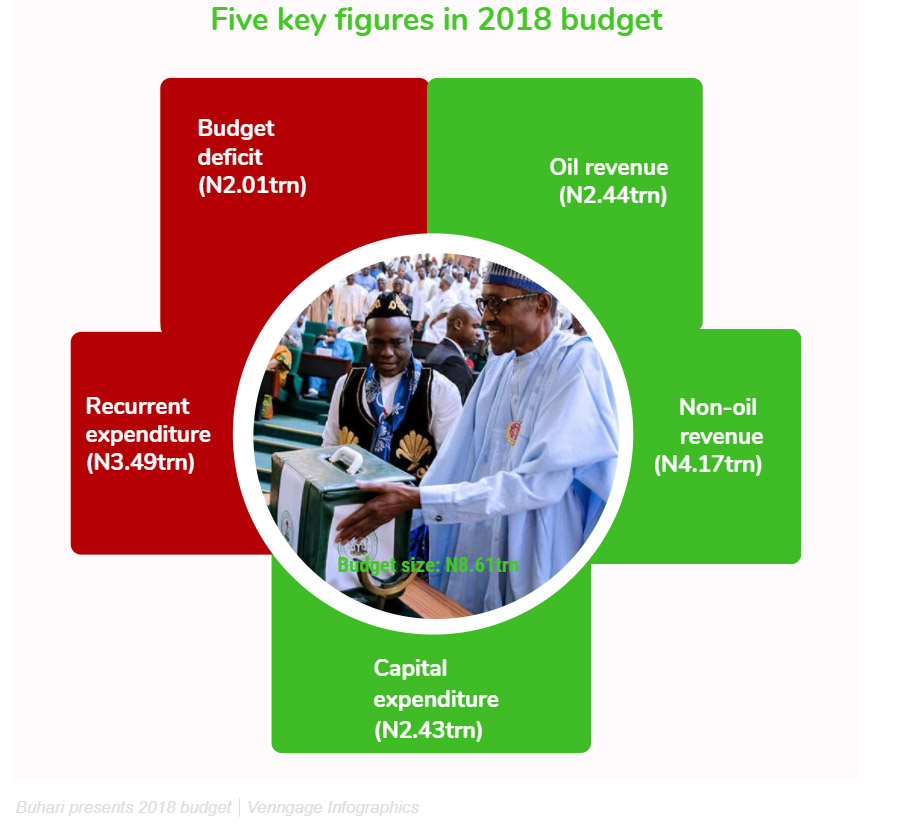

While presenting the 2018 appropriation bill of N8.6 trillion to a joint session of the national assembly, Buhari said oil revenue is projected at N2.442 trillion while non-oil revenue at N4.165 trillion.

The president said the federal government’s estimated total revenue was N6.607 trillion in 2018, about 30 percent more than the 2017 target.

Advertisement

“As we pursue our goal of revenue diversification, non-oil revenues will become a larger share of total revenues. In 2018, we project oil revenues of N2.442 trillion and non-oil as well as other revenues of N4.165 trillion,” he said.

The president said non-oil and other revenue sources of N4.165 trillion would include the share of company income tax (CIT) of N794.7 billion, value-added tax (VAT) of N207.9 billion as well as customs and excise receipts estimated at N324.9 billion.

Advertisement

“Others are independently generated revenues (IGR) of N847.9 billion, federal government’s share of tax amnesty income of N87.8 billion and various recoveries of N512.4 billion,” he said.

“It also includes N710 billion as proceeds from the restructuring of government’s equity in joint ventures and other sundry incomes of N678.4 billion.”

Advertisement

In percentage, this means that oil revenue has been projected to make up 63% of government’s revenue in 2018 and oil revenue, 36.96%.

Kemi Adeosun, minister of finance and Godwin Emefiele, governor of the Central Bank of Nigeria CBN, had previously emphasised the need for policies to diversify government revenue.

Advertisement

The ministry of finance embarked on various programmes to improve tax education and tax compliance, one of which is the voluntary assets and income declaration scheme (VAIDS), which gives tax defaulters a grace period to pay their tax debts without fear of prosecution.

Add a comment