Noor Takaful Insurance Limited, the pioneer and leading composite Takaful insurance firm in Nigeria, has distributed a total of Two Hundred and Eight Million, Four Hundred and Ninety-Six Thousand, Eight Hundred Naira (N208,496,800.00) as surplus to an eligible group of policyholders who did not make claims on their insurance during the 2021 financial year.

The surplus distribution was announced on Wednesday, August 2, 2023, during the two-day African Takaful and Non-Interest Finance conference held at Oriental Hotel, Lagos, which was well attended by industry practitioners, relevant stakeholders, international insurance experts, brokers, agents, the media among others.

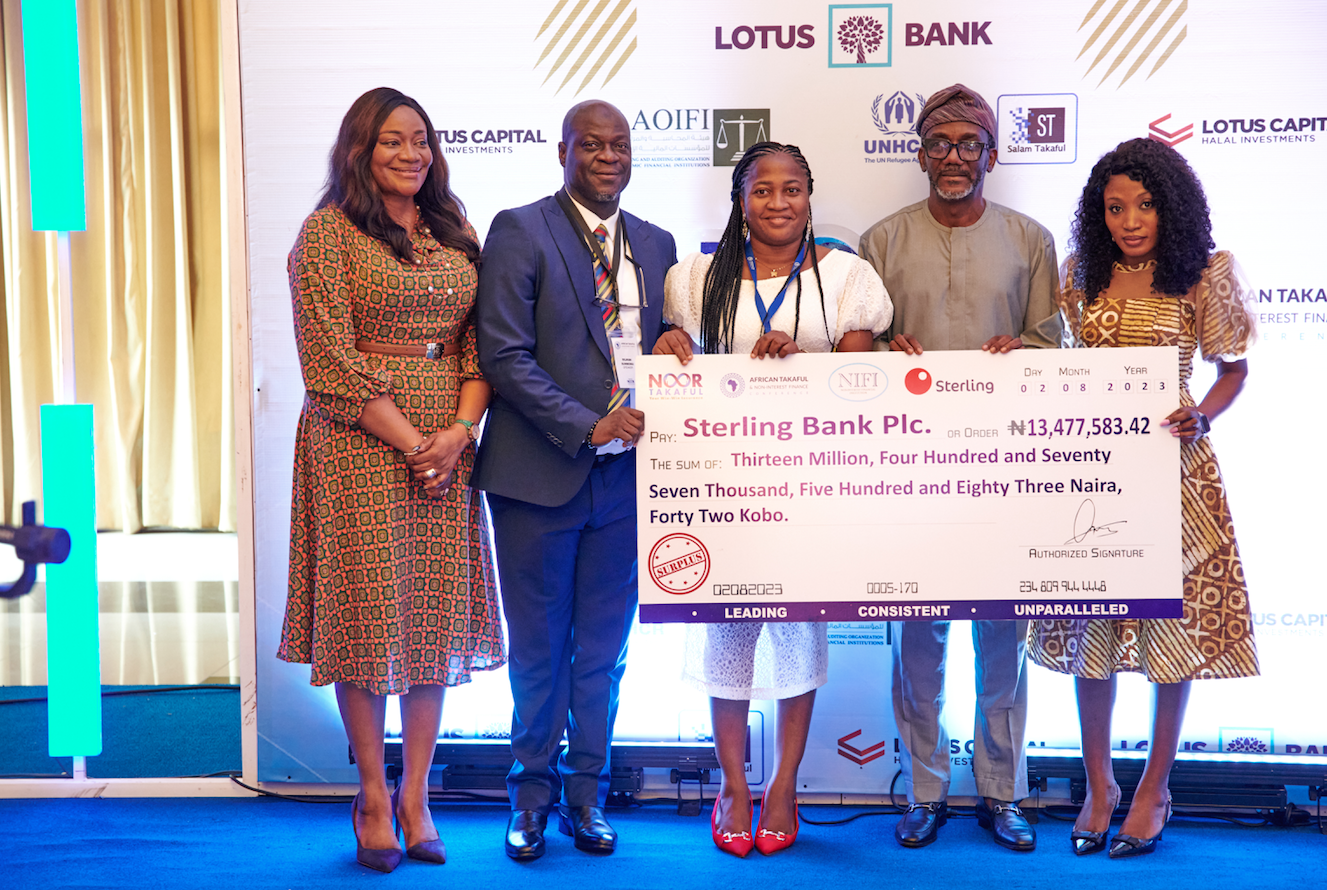

The participants that benefited from the surplus include individuals, private and public organizations, and banks. Some of the customers who received surplus distribution include Lotus Capital Limited, Jaiz Bank Plc, Sterling Bank Plc, Ahmed Zakari & Co, Nasco Group, Istabraraqim Nigeria Limited, and Kings College Old Boys Association, among others.

While the likes of Sterling Bank Plc, Jaiz Bank Plc, and Lotus Bank Limited got N13 477,583.42, N13,151,076.33, and N1,495,559, respectively, Kings College Old Boys(19977-1982 set received N465,957.70.

Delivering his remarks at the event, the Managing Director Noor Takaful Insurance Limited, Rilwan Sunmonu, explained that from the total amount of N208, 496,800.00 to be distributed, Group Family Takaful will distribute N173,994,800 while General Takaful will N34, 502,000.00. The distributable amounts are net of reserves and Jualah / performance incentives due to the Takaful Operator. The surplus amounts have been approved by the National Insurance Commission (NAICOM), which regulates Noor Takaful Insurance Ltd.

Sunmonu stated that the distribution of surplus to participants is in line with the true spirit of the Takaful concepts. He stressed that the payment of surplus by the company is a clear demonstration of its commitment to offering Sharia-compliant solutions to policyholders while reinforcing Takaful as the best alternative insurance. He maintained that Noor Takaful was the first takaful operator to declare profit and remained the only one to distribute surplus yearly since it started operations in 2017.

While assuring Nigerians of the company’s commitment to transparency, Sunmonu expressed profound appreciation to the regulator, NAICOM, for providing the much-needed enabling environment, which has assisted a great deal in deepening the penetration of Islamic finance among Nigerians.

Also speaking, the Vice-Chairman of Noor Takaful Insurance Limited, Aminu Tukur, described the payment of surplus as part of the fulfillment of its pledge to policyholders noting that Takaful insurance has gained huge acceptance among Nigerians over the last few years.

“As a Takaful policy or plan participant, you get better treatment. You also get faster claims payment. More importantly, you also get surplus when you don’t make a claim at the end of your policy year,” he said.

While thanking the stakeholders for their support toward the success of the conference, Tukur assured them that the company would continue to show leadership in the Takaful Insurance industry by devising innovations that would help in deepening the interest and patronage of Nigerians for Takaful products.

About Noor Takaful

Noor Takaful Insurance Ltd., a takaful insurance firm established and duly licensed by NAICOM in April 2016 as the first full-fledge composite takaful insurance operator in Nigeria with a 100 percent indigenous Nigerian shareholding. The company currently plays the pioneering and leading role in unlocking takaful insurance potential for Nigeria. Its operational framework is regulated by NAICOM and is subject to the Insurance Act 2003.

Add a comment