The management of Nova Merchant Bank says the N31 billion realised from its debut bond issuance will be used to finance loans for customers in agriculture, healthcare, fintech and telecommunications.

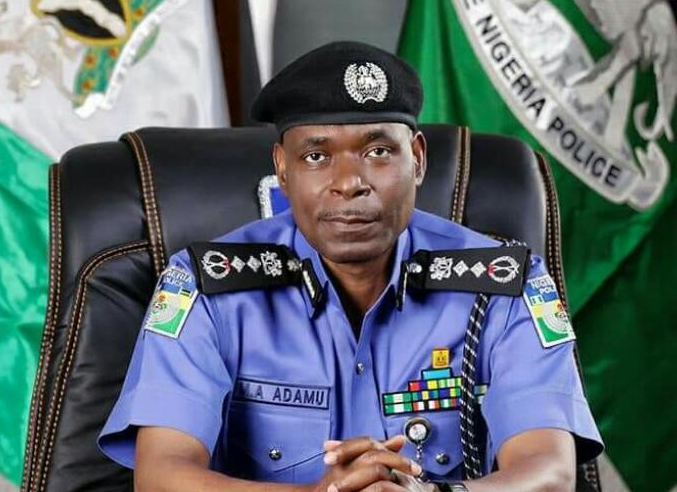

Anya Duroha (pictured), the managing director, told journalists during a virtual call that the bank raised a N10 billion, seven-year tenor bond to mobilise developmental financing to support the country’s economy during the shocks of the COVID-19 pandemic.

According to the MD, the bank has identified opportunities in these areas and “a substantial amount of the money would go into building capacity for export for the country”.

“As part of Nova’s strategy, we knew that at this point we needed to get long-term funds to be able to finance long-term assets. Being a merchant bank, we would like to do a lot more developmental financing and you need long term funds to do that,” Duroha said.

Advertisement

“So, that was why we went to the market to raise that bond. Our plan was to raise N10 billion for seven years tenor, callable after five years and again subordinated bond, such that it would count as tier-2 capital. So, it was oversubscribed by about 300 percent.

“That means we got about N31 billion, whereas we set out to get N10 billion. But the instructive is that the investors were diversified. From individuals to corporate entities, to asset management companies, insurance companies as well as foreign investors. The bond was issued at 12 per cent and it was a good outing for us.

“For Nova Merchant Bank, we are looking at where we have core competence which hovers around advisory services, asset management, and security business.

Advertisement

“We understand that what differentiates a bank from the other is the way they offer their services, and that’s why we are deliberate about the things we want to do, and we actively think through them.”

Speaking on the performance of the bank in its three years of operations, Duroha said earning have grown from N1.2 billion in 2017 to N5.8billion in 2019.

He said the bank’s profit rose from N510 million in the first year to N1.15 billion in 2018 and to N1.65 billion in 2019.

The bank also said it has not recorded any non-performing loans since 2017 which it described as a testament of its risk management framework and how lending is handled in the market.

Advertisement

Add a comment